If You'd Invested $100 in the Invesco Semiconductors ETF (PSI) 10 Years Ago, Here's How Much You'd Have Today

Key Points

A semiconductor ETF can provide exposure to the AI industry with increased diversification.

This ETF has significantly outpaced the S&P 500 over the past 10 years.

However, there are important risks to consider before you buy.

- 10 stocks we like better than Invesco Exchange-Traded Fund Trust - Invesco Semiconductors ETF ›

Semiconductor stocks have been thriving over the past few years, primarily because of their pivotal role in the artificial intelligence (AI) sector.

Investing in a semiconductor ETF -- like the Invesco Semiconductors ETF (NYSEMKT: PSI) -- can be a smart way to buy into this slice of the market with some added diversification. This ETF contains 30 stocks, all of which are linked to the semiconductor sector. Investing in dozens of stocks at once can hedge against volatility, limiting risk during market downturns.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

How much can you earn with a semiconductor ETF?

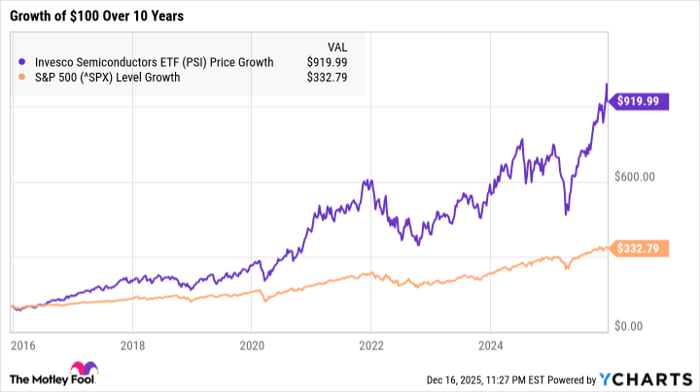

The Invesco Semiconductors ETF has skyrocketed over the past decade. Since December 2015, it's earned a staggering total return of 820%. For context, the S&P 500's (SNPINDEX: ^GSPC) total return in that time is around 233%.

If you had invested $100 in this ETF 10 years ago, you'd have around $920 today. By going a little bigger and investing $500 back then, you'd have around $4,600 today.

PSI data by YCharts

Just keep in mind that a narrow ETF like the Invesco Semiconductors ETF does carry more risk than, say, an S&P 500 ETF or similar broad market fund. While this ETF does contain 30 stocks, which adds some diversification, it's still highly targeted to one niche subsector of the market.

Higher-risk investments can sometimes lead to lucrative earnings over time, but it's crucial to take steps to protect your portfolio. Double-check that the rest of your investments are well diversified, and be prepared to keep a long-term outlook despite short-term volatility.

Should you buy stock in Invesco Exchange-Traded Fund Trust - Invesco Semiconductors ETF right now?

Before you buy stock in Invesco Exchange-Traded Fund Trust - Invesco Semiconductors ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco Exchange-Traded Fund Trust - Invesco Semiconductors ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,955!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,460!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 18, 2025.

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.