Should You Buy Nuclear Energy Stocks in 2026?

Key Points

Nuclear energy is making a comeback to help power the AI revolution.

Nuclear stocks like Oklo and NuScale Power are soaring, even if they barely generate revenue.

The stocks look overvalued right now and should be avoided in 2026.

- 10 stocks we like better than Oklo ›

Artificial intelligence (AI) has changed the global economy in more ways than one. It has indirectly impacted the energy markets due to the substantial electricity needs at data centers used to train and run AI models. In order to keep the electricity supply growing with demand, different methods for energy production are being evaluated.

One energy source seeing a renaissance is nuclear power. Shunned for decades due to concerns over waste contamination, the renewable energy source is now being considered as a solution for AI data centers. Two stocks have soared on the back of this nuclear energy shift: Oklo (NYSE: OKLO) and NuScale Power (NYSE: SMR).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Should you consider adding nuclear energy stocks like Oklo and NuScale Power to your portfolio in 2026?

AI and growing electricity needs

The United States is growing its demand for electricity generation for the first time in a long while, driven by AI. Analysts expect upwards of $1 trillion spent on capital investments from now until 2029 to match this demand.

Nuclear start-ups like Oklo and NuScale Power are looking to capture this opportunity. Oklo is designing a small nuclear reactor that will use recycled nuclear waste, along with its own recycling facilities, to produce radioisotopes. These small reactors are being proposed for direct-generation needs, such as military applications or data centers.

NuScale Power is also building a small modular reactor (SMR), with formal approval for its design from the Nuclear Regulatory Commission (NRC). Oklo hasn't submitted its final design for approval, as of this writing.

The standard SMR from NuScale Power will generate 77 megawatts of electricity. With estimates for 50 gigawatts (approximately 50,000 megawatts) of new electricity generation needed between now and 2030, there could be room for hundreds of SMRs to be deployed around the country to power data centers.

Image source: Getty Images.

Rising stock prices, but not much business progress

Stocks of both Oklo and NuScale Power have risen on the back of the AI trade. Oklo stock is up 733%, while NuScale Power's is up 65.6% in the last three years. Oklo has a market cap of $12.9 billion, while NuScale Power has a market cap of $5.3 billion.

Investors are clearly bullish on these two companies. The problem is, neither of them has ever built or even licensed a nuclear power plant design in real life. NuScale Power has an approved design by the NRC, but the only historical project it ever had in Utah was cancelled because of cost overruns. It just signed a new agreement with the Tennessee Valley Authority, but no reactors have been made, as of today.

Oklo has never generated any revenue and doesn't have an approved reactor design. NuScale Power generates $64 million in revenue, but that mainly comes from contracts on construction developments and studies on whether nuclear power would be feasible for a utility, such as one it has in Romania.

Both companies are highly unprofitable. Oklo had negative $68 million in free cash flow over the last 12 months, while NuScale Power had negative $283 million.

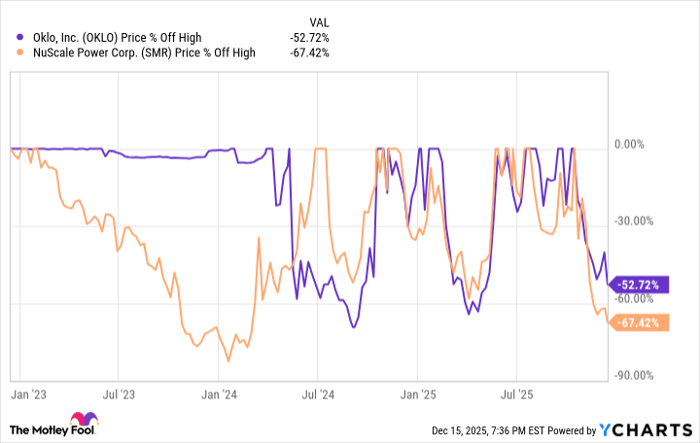

OKLO data by YCharts.

Should you buy nuclear energy stocks?

The only reason an investor would buy nuclear energy stocks today is based on hopes for the future of the industry. When examining the underlying business fundamentals of both Oklo and NuScale Power, there's much to be desired with minimal or zero revenue, minimal contracts (or no contracts at all), and heavy cash burn.

As of this writing, on Dec. 15th, 2025, both stocks are down from their highs -- down 50% in less than three months. The air is coming out of the nuclear energy trade, with zero underlying earnings to support these stock prices.

Expect more pain in 2026. It may not be a good idea to buy nuclear energy stocks like Oklo or NuScale Power next year for your portfolio.

Should you buy stock in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,955!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,460!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 17, 2025.

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.