XRP vs. Dogecoin: Which Is the Better Cryptocurrency Heading Into 2026?

Key Points

Many major cryptocurrencies have faced heavy selling pressure during 2025.

Dogecoin's main catalyst of hype-driven narratives make the token's movements incredibly unpredictable.

XRP has legitimate potential to upend the financial services market in the long run.

- 10 stocks we like better than Dogecoin ›

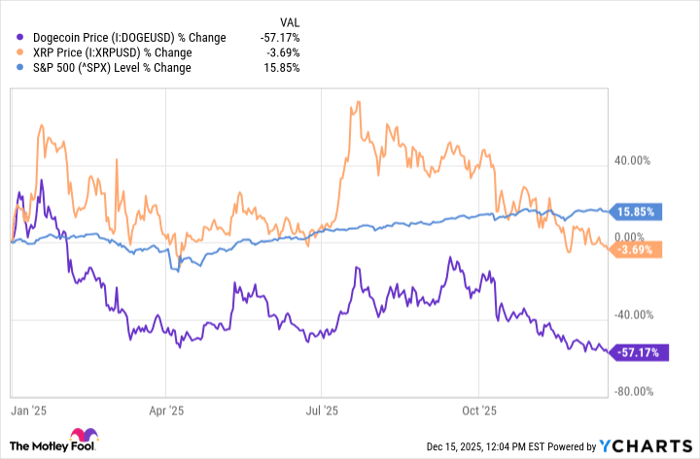

With just a couple of weeks left in the calendar year, it's looking like 2025 will feature double-digit gains in the S&P 500 (SNPINDEX: ^GSPC) and Nasdaq Composite (NASDAQINDEX: ^IXIC) for the third year in a row. Although that's great news for stocks, investors in cryptocurrency haven't exactly enjoyed similarly robust gains this year.

In particular, speculative tokens like Dogecoin (CRYPTO: DOGE) and XRP (CRYPTO: XRP) have each underperformed the stock market this year -- both are trading well below past highs.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Dogecoin Price data by YCharts

As we head into 2026, is now a good time to buy the dip in XRP or Dogecoin?

Where is Dogecoin headed in 2026?

Dogecoin was created in 2013 by a pair of engineers from IBM and Adobe named Billy Markus and Jackson Palmer. The token's origins are rooted more in satire than in building actual utility in the world of digital currency.

One of the key aspects about Dogecoin that smart investors should understand is that the token boasts an unlimited supply base. This feature makes it difficult for Dogecoin to actually sustain meaningful price appreciation. On top of that, Dogecoin has very limited use cases in the real world -- making it incredibly niche.

This raises the question: What makes Dogecoin's price actually move?

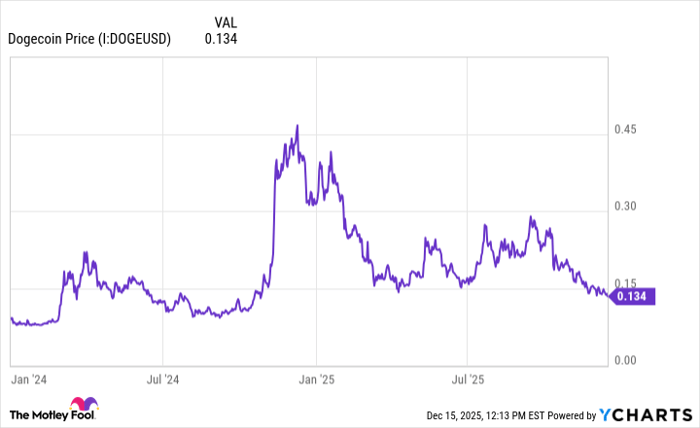

Dogecoin Price data by YCharts

The chart above illustrates Dogecoin's price fluctuations since the beginning of last year. As investors can see, pronounced volatility is no stranger to the fan favorite meme coin.

In particular, Dogecoin experienced a significant run-up during the final months of 2024. This was mostly driven by the planned creation of the Department of Government Efficiency (DOGE), which was previously led by Elon Musk -- a known public supporter of Dogecoin.

Since its run-up this time last year, however, Dogecoin's price has plummeted, and the token has largely traded sideways ever since. Against this backdrop, it's fair to say that Dogecoin's movements largely hinge on narratives rather than on concrete fundamentals or broader macroeconomic factors.

Given the outsize nature of its unpredictable patterns, Dogecoin's price throughout 2026 is anyone's guess.

Image source: Getty Images.

Is now a good time to buy XRP?

Large corporations generally have employees, customers, and vendors all over the world. One of the biggest pain points in corporate treasury operations is sending funds across borders in a timely fashion.

Sending money internationally usually requires moving funds around numerous bank accounts that are denominated in different currencies. During this process, businesses incur hefty transaction and processing fees at each intermediary bank. Moreover, sometimes these transactions take several days to settle.

Ripple's payments network is seeking to solve these problems. Through Ripple's infrastructure, companies can send money overseas in a much faster and cost-efficient way compared to incumbent payments systems.

Within the Ripple network, businesses have the option to denominate their transactions in XRP as opposed to fiat currency. The value proposition of using XRP is that it serves as a bridge for currencies that may not be as liquid in certain regions.

While XRP carries legitimate utility in the financial services world, its price movements are almost as unpredictable as Dogecoin. Earlier this year, XRP soared above $3 for the first time since 2018. The spike came after a long, drawn-out legal battle between Ripple and the Securities and Exchange Commission (SEC) came to an end, with results that were partly in Ripple's favor.

During the past six months, however, XRP has experienced heavy selling pressure. I think one reason for this is that investors are slowly realizing that Ripple's success does not necessarily imply growth for XRP. In other words, banks and businesses can use Ripple's solution without using XRP if they so choose.

With that in mind, XRP could be in store for further price declines in the near term. In the long run, however, I see XRP as a wiser crypto investment than Dogecoin given its applications in the cross-border transactions market.

Although XRP may not be a bargain right now, it could be worth monitoring as 2026 approaches. For the right price, XRP could be worth a small allocation in your portfolio if you plan to hold onto it for the long run.

Should you buy stock in Dogecoin right now?

Before you buy stock in Dogecoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dogecoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,955!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,460!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 18, 2025.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe, International Business Machines, and XRP. The Motley Fool recommends the following options: long January 2028 $330 calls on Adobe and short January 2028 $340 calls on Adobe. The Motley Fool has a disclosure policy.