The Smartest Nuclear Stock to Buy With $100 Right Now

Key Points

NuScale Power has an SMR design that's been approved by the NRC.

The company has not yet built an SMR for commercial purposes.

NuScale is bleeding cash, but its first deal might be close at hand.

- These 10 stocks could mint the next wave of millionaires ›

After decades of dormancy and stagnation, nuclear energy is roaring back to life. It's not hard to understand why. As a source of clean energy, nuclear can help companies and nations meet climate objectives. And as a source of reliable, round-the-clock power, nuclear can give artificial intelligence (AI) data centers the juice they need to support ever-growing computational demand.

Not all nuclear energy stocks, however, will have the same growth trajectory, nor will every nuclear start-up stick around long enough to generate meaningful revenue. On that note, one nuclear energy stock that's worth a closer look is NuScale Power (NYSE: SMR). Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Regulatory approval could be a competitive moat

NuScale Power is designing a small modular reactor (SMR). While it's not the only U.S. company using this novel technology, it is currently the only one with an SMR design approved by the Nuclear Regulatory Commission (NRC). That puts it in front of other advanced nuclear technology companies like Oklo and Nano Nuclear Energy.

NuScale obtained its design license back in May 2025. And while it hasn't yet inked a major deal with a paying customer, the company has been "inundated" with requests, according to CEO and President John Hopkins.

That said, NuScale is involved in two projects that could lead to deployment: an SMR power plant in Romania, led by Romanian utilities company RoPower, and an SMR project with the Tennessee Valley Authority (TVA). Both projects are still under planning, but they're plausible paths to a first deal.

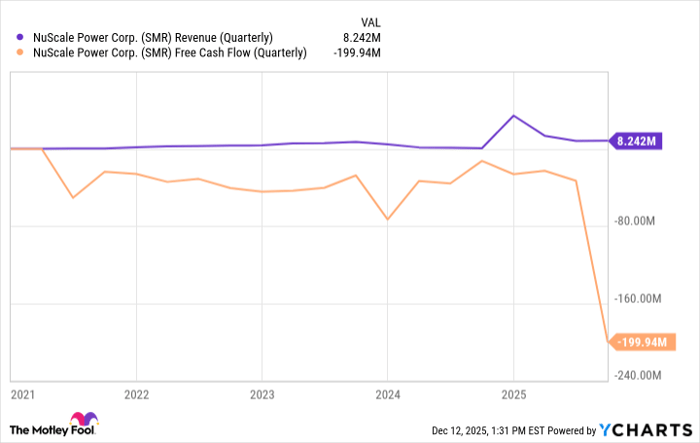

At the same time, investors should take note of risks. The company is burning cash and has yet to scale its nuclear technology commercially. It's unclear, for example, how much SMRs will cost, or whether they will, in the end, become the preferred energy source for AI data centers.

SMR Revenue (Quarterly) data by YCharts

As such, NuScale is still a speculative play on the future of energy. For aggressive investors with $100 to invest, a small position could be a high-risk, high-reward way to gain exposure to advanced nuclear technology.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 968%* — a market-crushing outperformance compared to 193% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of December 17, 2025.

Steven Porrello has positions in NuScale Power and Oklo. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.