Want to Start the New Investing Year Off Right? 3 Warren Buffett-Inspired Moves to Make Before 2026

Key Points

These moves should favor positive performance in any market environment.

Buffett has made all of the following moves repeatedly throughout his career.

- 10 stocks we like better than S&P 500 Index ›

The past three years have been fantastic ones for investors. The bull market marched on, with the S&P 500 advancing more than 20% in both 2023 and 2024, and the famous benchmark is on track for another spectacular gain. This is thanks to the performance of artificial intelligence (AI) stocks, players such as chip giant Nvidia, software maker Palantir Technologies, and cloud companies like Alphabet and Oracle.

We can make predictions about what's to come in 2026, but of course, it's impossible to guarantee any particular outcome. So, what's an investor to do? Well, we could make a few moves, inspired by Warren Buffett's investment style, that might help us succeed in 2026, and more importantly, score a win over the long term. Investors often turn to Buffett due to his decades of market-beating performance.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Let's check out three Buffett-inspired moves to make now to start the new year off right.

Image source: The Motley Fool.

1. Look for value

Buffett, chairman and chief executive of Berkshire Hathaway, is known for value investing -- he looks for quality companies trading at bargain prices. These companies are worth a lot more, and Buffett knows that eventually others will recognize this, get in on these players, and as a result, stock performance will take off.

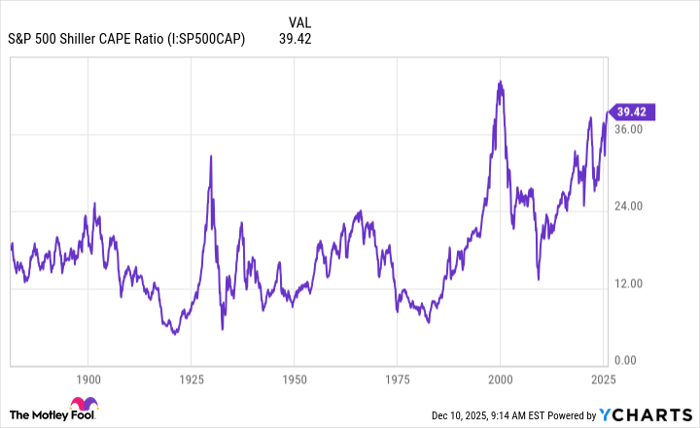

The market hasn't exactly been overflowing with bargains in recent times, as overall valuations have reached record levels. The S&P 500 Shiller CAPE ratio, an inflation-adjusted view of stock price in relation to earnings, reached 39 recently -- a level it only surpassed during the dot-com bubble.

S&P 500 Shiller CAPE Ratio data by YCharts

But, even in such an environment, Buffett shows us that deals exist if you look carefully. An example: Buffett increased his stake in Pool Corp., the world's biggest distributor of pool equipment, in the second quarter, as its valuation declined.

As we approach the new year, be on the lookout for any dip in quality players, as this may offer you valuable buying opportunities.

2. Buy dividend stocks

Buffett loves dividend stocks and has sung the praises of Coca-Cola and American Express in recent years, as they've added significantly to the wealth of Berkshire Hathaway shareholders and Buffett himself. Buffett, in his 2022 letter to shareholders, said his dividend from Coca-Cola had climbed to $704 million from $75 million in 1994.

Of course, most of us don't have the ability to buy millions of shares and collect passive income at that level -- but don't despair. Even a modest investment can generate impressive returns over time as the passive income adds up.

What I like about dividend stocks is that, when your portfolio is increasing in value, they add to those gains -- and when you're having a difficult investing year, they insulate your portfolio from extreme declines. This makes dividend stocks great investments to own during bull and bear markets.

3. Try something new

Buffett always follows his investing principles, from buying stocks at reasonable prices to holding on for the long term, but he's also been known to try something new from time to time. And even if these choices are sparked by his investment managers, Buffett, at the helm, still must be on board.

One recent move along these lines is the purchase of Alphabet shares in the third quarter of this year. Alphabet, as owner of Google Search and Google Cloud, is a tech giant -- and Buffett doesn't invest in many tech companies. But Buffett and his team may have noticed Alphabet's valuation, lower than that of many peers, and considered the company's strong moat, or competitive advantage -- it's steadily held 90% of the internet search market.

All of this should inspire us to broaden our investment range into new industries, a move that boosts diversification in our portfolios. Diversification is positive because it makes us less reliant on just one stock or one industry -- and that lowers risk.

Of course, it's key to research these industries and companies so that we understand their businesses and challenges -- but once we're comfortable with that, we're ready to go. And your new move before the new year could translate into gains in 2026 and over the long term.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

American Express is an advertising partner of Motley Fool Money. Adria Cimino has positions in American Express and Oracle. The Motley Fool has positions in and recommends Alphabet, Berkshire Hathaway, Nvidia, Oracle, and Palantir Technologies. The Motley Fool has a disclosure policy.