Don't Buy Unity Software Stock Until It Stops Doing This 1 Thing

Key Points

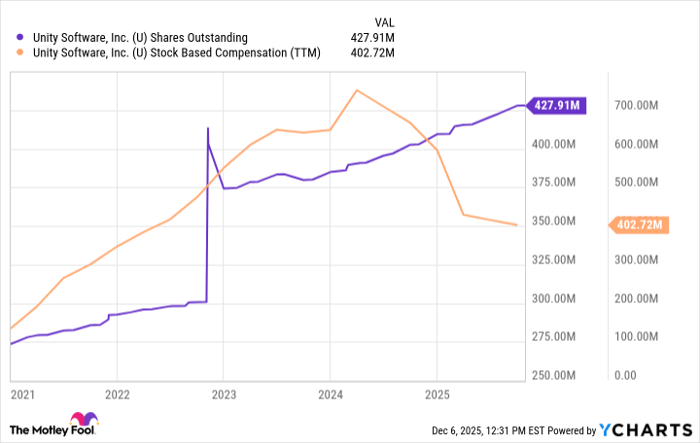

Unity Software's share count has risen dramatically since its IPO in 2020.

Share dilution is a significant factor contributing to the stock's poor returns.

Poor management decisions have also not helped the stock.

- 10 stocks we like better than Unity Software ›

Unity Software (NYSE: U) was one of Wall Street's most exciting IPO stocks in 2020. But after soaring in its market debut, the stock has languished. Years later, Unity's stock traded more than 30% below its debut share price, and has plunged nearly 80% from its all-time high in 2021.

The company remains a leading platform for game developers. Unity's ecosystem enables developers to create, manage, and monetize games across console, computer, and mobile systems. It's a compelling story, considering some researchers estimate that the global gaming market could reach $600 billion by 2030.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

However, investors may want to continue to steer clear of Unity stock. Or, at the very least, avoid buying the stock until Unity Software stops doing such a disservice to its shareholders.

What am I talking about? Here is what you need to know.

Image source: Getty Images.

Don't buy Unity Software until the excessive dilution stops

Part of going public is the duty companies have to their shareholders, those who own their stock. Ideally, companies operate in the best interests of their shareholders, but not every company does. I don't think Unity Software has intentionally mistreated its shareholders, but it seems fair to say that the shareholders have received a lousy deal over the past five years.

The number of outstanding shares has increased by a whopping 62% since Unity's IPO. That has come from the company funding a significant acquisition with stock in late 2022, as well as hundreds of millions of dollars paid to employees as stock-based compensation over the years.

U Shares Outstanding data by YCharts

Companies can utilize stock-based compensation to aid free cash flow, but it can result in share dilution. As the share count rises, revenue and profits spread across a larger shareholder base, ultimately hampering the stock's investment returns.

Over the past year, Unity has paid out more than 20% of its total revenue as stock-based compensation. That's very high, and helps explain the stock's poor performance.

Poor management decisions haven't helped

It's not the company's only problem. Unity received backlash from customers after attempting to implement a controversial Runtime Fee structure that essentially charged developers for each installation after products hit certain milestones.

Unity's revenue has declined since its peak in early 2024, and the company remains deeply unprofitable, reporting net losses of $434 million over the past year. Unity has since reverted to a more traditional subscription-based billing model.

But even if Unity's business execution tightens up and the company can grow and make money at the same time, it's hard to justify putting your hard-earned capital into a stock that continues to flood the market with shares.

At this point, there has been so much shareholder dilution that it's probably wise to avoid the stock altogether until the share count stops growing entirely. That likely means profitability, lower stock-based compensation, and share repurchases, so it could be a while.

Should you invest $1,000 in Unity Software right now?

Before you buy stock in Unity Software, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Unity Software wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,982!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,459!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Unity Software. The Motley Fool has a disclosure policy.