Gold slips as markets brace for Fed’s decision, Powell’s presser

- Traders price a 90% probability of a Fed rate cut despite hawkish risks.

- Powell may push back on aggressive easing bets amid a divided FOMC outlook.

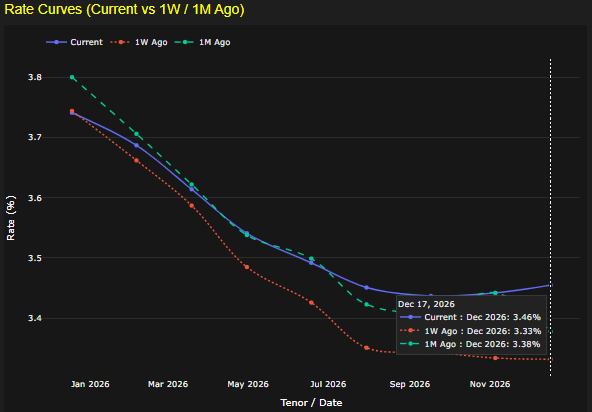

- Markets eye the new dot plot for clues on 2026 rate trajectory.

Gold (XAU/USD) posts modest losses on Wednesday with traders bracing for the Federal Reserve’s (Fed) monetary policy decision, along with Fed Chair Jerome Powell's press conference. At the time of writing, XAU/USD trades at $4,197 after reaching a daily peak of $4,218.

Bullion eases toward $4,200 as traders await the Fed’s rate call and economic projections for 2026

The markets are on pause, with US equities virtually flat, while US Treasury bond yields fall and the US Dollar remains sold. Market players have priced in a 90% probability that the Fed will cut rates, but it would push back against expectations for further easing towards 2026.

Two weeks ago, Fed Governor Christopher Waller and New York Fed President John Williams were the proxies for Powell and paved the way for Wednesday’s decision. Nevertheless, the division within the Federal Open Market Committee (FOMC) could force him to adopt a 'mildly hawkish' stance at the press conference.

Traders will also be looking for the Summary of Economic Projections (SEP), specifically the dot plot, which could delineate the interest rate path for 2026.

Speculation is growing that for next year markets are pricing 50 basis points of easing, instead of three cuts, revealed a Bloomberg article. This is because Fed officials lack recent economic data, which was delayed due to the US government shutdown. The November Nonfarm Payrolls is set to be released on December 16, and the November Consumer Price Index (CPI) on December 18.

Daily digest market movers: Gold treads water amid weaker US Dollar

- US Treasury yields are diving, with the 10-year benchmark note rate down two basis points at 4.162%. US real yields, which correlate inversely with Gold prices, are falling nearly three basis points to 1.902%, a tailwind for Bullion.

- The US Dollar Index (DXY), which tracks the Greenbacks’ performance against a basket of six peers, is down 0.22% to 99.01.

- The latest US Job Openings and Labor Turnover Survey (JOLTS) indicated that the labor market remains more resilient than anticipated, as vacancies unexpectedly rose by 7.67 million in October from 7.658 million, according to the Bureau of Labor Statistics (BLS), signaling firmer labor demand.

- Separately, ADP reported that private employers added an average of 4,750 jobs per week in the four weeks ending November 22, improving from the prior period’s 13,500 decline, suggesting an increasing demand for workers towards the year’s end.

Technical Analysis: Gold hovers around $4,200 amid dull session

Gold’s technical picture suggests that the uptrend might continue, but a slightly hawkish Fed could prompt traders to sell the yellow metal below the $4,200 milestone. Although momentum remains bullish, as shown by the Relative Strength Index (RSI), Bullion’s downside risks remain.

If XAU/USD drops below $4,200, the next support would be the 20-day Simple Moving Average (SMA) at $4,153, followed by the 50-day SMA at $4,090 and the $4,000 mark. On the flip side, if the Fed is dovish, Bullion could skyrocket towards $4,300 ahead of the record high of $4,381.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.