Got $5,000? 5 Top Growth Stocks to Buy That Could Double Your Money.

Key Points

The AI infrastructure build-out isn't expected to slow down next year.

Meta Platforms and The Trade Desk should bounce back over the next few years.

- 10 stocks we like better than Broadcom ›

Looking for stocks that can double your money in a reasonable time frame is a great goal for investors. The U.S. market, as represented by the broad S&P 500 index, tends to double every seven years or so. So, if investors want to outperform the market, they should be searching for stocks that can do it in five years or less.

In my view, these five stocks have that potential, making them excellent picks to buy now.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Nvidia

I know what you're thinking: How can Nvidia (NASDAQ: NVDA) double yet again when it's already the world's largest company? The problem with that statement is that it anchors to past performance, not to where the tech sector is heading. Nvidia makes the world's leading graphics processing units (GPUs), and those chips are being heavily used to power artificial intelligence (AI) workloads. While there are some fears that the AI market is in a bubble, Nvidia's results don't support that conclusion.

CEO and founder Jensen Huang noted recently that the company is "sold out" of its cloud GPUs, and management expects the market for them to get a lot bigger. By 2030, it expects global data center capital expenditures to be in the $3 trillion to $4 trillion range, up from $600 billion in 2025. If that projection turns out to be accurate, the market Nvidia is operating in will be at least five times larger in value in five years, making it entirely reasonable for its market cap to double in that time (although I bet it happens even faster).

Broadcom

Riding the same wave as Nvidia, Broadcom (NASDAQ: AVGO) is growing in popularity as an AI investment. Instead of making its own high-end parallel processing units to challenge Nvidia directly, it's partnering with AI hyperscalers to develop computing units that are tailored to the workloads the buyer expects them to handle. These custom AI accelerators, called application-specific integrated circuits (ASICs), are less flexible than general-purpose GPUs, but can be purchased at lower prices and provide better performance on the tasks they are made for.

Recently, news broke that Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is reportedly considering selling some of its Tensor Processing Units (TPUs) to Meta Platforms (NASDAQ: META). While most investors took this news as bullish for Alphabet (which it is), Broadcom would also benefit from such a deal because it partnered with Alphabet to design these AISCs. As custom AI accelerator units become more common, Broadcom will further benefit, which is why I anticipate that its stock will double in a relatively short time frame.

Taiwan Semiconductor Manufacturing

Nvidia, Broadcom, and most of their peers in the high-end chip space are fabless -- they don't own their own chip manufacturing plants. Instead, they outsource that part of the operation to third-party foundries, and the best and most popular of these is Taiwan Semiconductor Manufacturing (NYSE: TSM). It's the world's largest chip foundry by revenue, and has maintained that spot in part due to its constant innovation and excellent delivery.

As long as spending for AI computing infrastructure and hardware continues to rise, Taiwan Semiconductor's stock will continue to do well. If the AI buildout follows the trajectory that Nvidia projects that it will, the world will need a lot more high-end chips, and TSMC is well positioned to benefit.

Meta Platforms

The market is currently bearish on Meta Platforms. Investors are concerned that it is spending too much on building out its AI computing capacity, and that it could get overextended. Furthermore, they're worried that there will be little to no payoff for that spending spree.

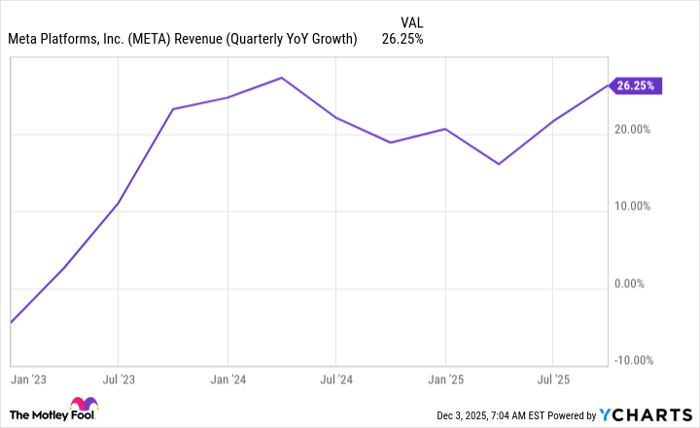

While these are valid concerns, Meta is already seeing some benefits from its various AI implementations, such as higher ad conversions and more time spent on its social media platforms. In Q3, its revenue rose 26% year over year -- an incredible performance.

META Revenue (Quarterly YoY Growth) data by YCharts.

It will take some time for the market to warm up to Meta's stock again, but when it does, it will be a great one to be holding.

The Trade Desk

The Trade Desk (NASDAQ: TTD) is in a similar boat to Meta. Its stock is among the worst performers in the S&P 500 so far this year, down by more than 60%. That weak performance stemmed in part from its transition to a new AI-focussed advertising platform, which hasn't gone as smoothly as management hoped. However, the company is pivoting and making improvements that customers have asked for.

Despite this, its Q3 results were strong, with revenue rising 18% year over year. This growth rate is lower than what most investors would have expected, but it reflects the fact that in Q3 2024, there was naturally a massive amount of political ad spending that wasn't there in 2025. The Trade Desk's year-over-year comparisons should improve over the next few quarters, which could boost the stock.

The Trade Desk trades for about 19 times next year's expected earnings, making it one of the cheapest stocks on this list and an excellent buy heading into the new year.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Keithen Drury has positions in Alphabet, Broadcom, Meta Platforms, Nvidia, Taiwan Semiconductor Manufacturing, and The Trade Desk. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Nvidia, Taiwan Semiconductor Manufacturing, and The Trade Desk. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.