Why I'm Never Buying Strategy Stock

Key Points

Strategy prioritizes buying Bitcoin and repaying its institutional investors.

The company just funded cash reserves by diluting shareholders, and it will likely keep diluting shareholders.

- 10 stocks we like better than Strategy ›

It's been five years since Strategy (NASDAQ: MSTR) shocked the world with a new internal treasury policy -- it's using every dollar it can access to buy cryptocurrency Bitcoin (CRYPTO: BTC). Since its first Bitcoin purchase on Aug. 11, 2020, Strategy stock is up more than 1,000%.

Despite that performance, I'm glad I've never owned a single share, and I don't plan to ever buy from here.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

To be clear, my aversion to Strategy stock has nothing to do with my opinion of Bitcoin. In fact, I believe that the world's largest cryptocurrency will continue to appreciate in value over the long term. Investors, businesses, and even governments want to diversify into this new asset class, and Bitcoin is the "gold standard" of cryptocurrency, so to speak.

My aversion to Strategy stock has everything to do with how it's buying Bitcoin.

Image source: Getty Images.

Stock investors are at the back of the line

Strategy owns roughly 650,000 Bitcoins at the moment, which are worth roughly $55 billion as of this writing. To acquire this much of the cryptocurrency, the company has invested over $48 billion. These funds were primarily supplied by investors -- both public and private -- rather than from its operations.

Strategy has creatively raised cash from investors. It's taken on traditional debt, issued convertible notes, created new classes of shares, and issued new Class A shares. But regardless of the method, the money ultimately comes from investors. And some of the money needs to be repaid.

So far, Strategy is winning because the price of Bitcoin and its stock price keep going up. This allows it to access enough capital to buy more Bitcoin while still satisfying all of its obligations. But in a bear market, things become more difficult. And the company clearly believes a bear market is coming.

For evidence, consider that Strategy just created a $1.4 billion cash reserve fund so that it can keep paying its dividends for at least two years -- different share classes are entitled to different payouts. Creating reserves now indicates that management believes it will be harder to get funded by investors in the future.

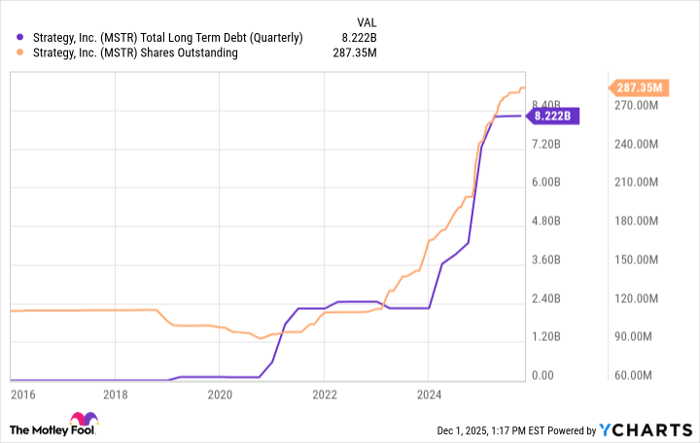

To be clear, Strategy didn't sell Bitcoin to increase its cash reserves -- that's something it's said it's unwilling to do. Rather, the company issued more shares, further diluting shareholders. The chart below shows that the share count is skyrocketing right along with its debt.

Data by YCharts.

In conclusion, Strategy's first commitment is to buy Bitcoin. Its second-highest priority is ensuring it delivers returns for institutional investors through its dividend. At the end of the line are common shareholders. And the company is demonstrating a willingness to dilute common shareholders if necessary. This reality could become exacerbated in a prolonged bear market.

In my view, buying a Bitcoin ETF or buying Bitcoin directly are better long-term options for investors thinking about Strategy stock. Buying Strategy comes with a heavy debt load and a management team that's demonstrated its lowest priority is the common shareholder. And it's why I'll never own it.

Should you invest $1,000 in Strategy right now?

Before you buy stock in Strategy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Strategy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $589,717!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,111,405!*

Now, it’s worth noting Stock Advisor’s total average return is 1,018% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.