The Smartest AI Stock to Buy With $1,000 Right Now

Key Points

Taiwan Semiconductor is the primary chip supplier to the major AI computing hardware players.

TSMC is launching a new chip technology.

The stock trades at a discount to its peers.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

The artificial intelligence arms race is alive and well, and hyperscalers are still planning to spend billions of dollars constructing data centers in 2026. Deciding what computing units to fill these data centers with used to be an easy decision, as Nvidia was the default choice.

However, Advanced Micro Devices stepped up its game in recent months, and custom AI accelerators from Broadcom are also a growing option, as evidenced by the recent news from Alphabet and Meta Platforms regarding Alphabet's tensor processing units (TPUs).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Regardless of the outcome of this battle for AI computing hardware supremacy, there will be one ultimate winner. Taiwan Semiconductor (NYSE: TSM) is poised to benefit from whichever company offers the best product at any given time, as all major computing hardware providers obtain their chips from them.

Image source: Getty Images.

Being the arms dealer in an arms race is a great business

Taiwan Semiconductor supplies the majority of the high-powered computing chips in the AI arms race. It is the largest semiconductor foundry in the world by revenue. It has risen to that position by constantly innovating, having impressive manufacturing yields, and being a great partner to work with.

From a technological standpoint, TSMC has always been the first to launch new chip nodes. That isn't changing with the latest generation, as its 2nm (nanometer) chips are already entering production. The benefits of this next-generation technology are incredible, as it consumes 25% to 30% less power than the previous 3nm generation when configured to run at the same speed. Energy consumption could become a huge bottleneck in the next few years, and utilizing more efficient computing hardware is one way to address the challenge.

One fear some investors have about TSMC is its proximity to mainland China. There are growing concerns that China could attempt to take over Taiwan, which would likely send the stock plummeting. However, with TSMC a key supplier to major tech companies worldwide, this would also crash the entire market. To alleviate this risk, TSMC has increased its international footprint, including a $160 billion investment in multiple facilities in the U.S. Nvidia is already getting all of its components for its cutting-edge Blackwell chips in the U.S., which also helps TSMC circumvent tariffs.

Taiwan Semiconductor is bound to benefit from whichever computing unit is the most popular at the time. The real focus for TSMC investors should be whether there is increased spending by AI hyperscalers. While this cohort spent a record amount in 2025 on data center buildouts, 2026 looks to be a year of even greater spending. This supports a bold projection from Nvidia, which estimates that global annual data center capital expenditures could reach $3 trillion to $4 trillion by 2030.

If that's true, Taiwan Semiconductor will be a monster winner along the way, making it a strong buy now.

Taiwan Semiconductor doesn't carry the same premium as other AI investment picks

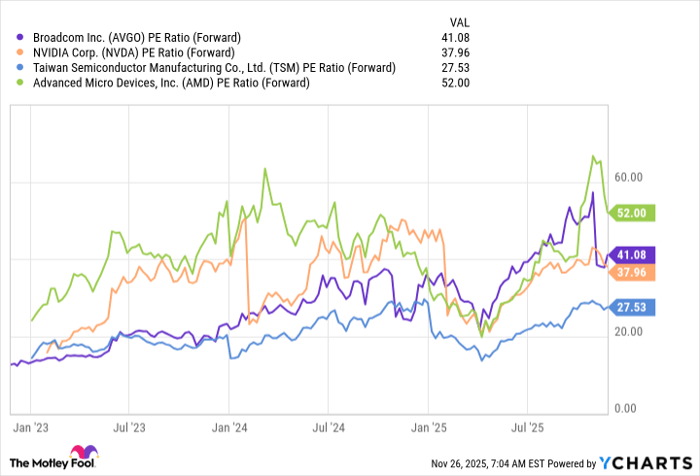

Despite TSMC being well-positioned to benefit from the massive AI buildout, it doesn't carry the same premium as stocks like Nvidia, AMD, or Broadcom.

AVGO PE Ratio (Forward) data by YCharts

At 27.5 times forward earnings, Taiwan Semiconductor appears to be a bargain compared to the other three. Additionally, while one or two of those businesses may work out, the third could lose market share. That means all three of these stocks are significantly riskier than TSMC. Normally, risk reduces a stock's premium, but that's not the case here.

Taiwan Semiconductor is a safer stock pick than these other three and can be purchased for a lower price. That's a no-brainer, in my opinion, and investors should load up on Taiwan Semiconductor while it trades at a discount to its peers.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $580,171!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,084,986!*

Now, it’s worth noting Stock Advisor’s total average return is 1,004% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Keithen Drury has positions in Alphabet, Broadcom, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.