1 Unstoppable Dividend King Up 3,600% Since 2000 to Add to Your Portfolio for a Lifetime of Passive Income

Key Points

Dividend Kings are the best-of-the-best dividend growth stocks, boasting 50-plus years of consecutive dividend increases.

There's nothing like it if you can find oft-overlooked Dividend Kings with multibagger potential.

One of them is making some business moves that could be significant drivers of its dividend and stock price.

- 10 stocks we like better than Parker-Hannifin ›

If you are familiar with Dividend Kings and even own one or more of them in your portfolio, you're already one step ahead of the income investors who mainly chase dividend yields and pay little attention to dividend growth. But if you haven't heard about the unstoppable Dividend King stock that I'll tell you about next, I don't blame you. It's not a popular name, but it has quietly made investors extremely wealthy over the years.

Before I reveal the name, it's important to reiterate why Dividend Kings are often such powerful wealth compounders. Although many stocks within the S&P 500 and elsewhere pay dividends, some also regularly increase their dividend payments. Among these dividend growth stocks, there's a small, elite group of stocks, known as the Dividend Kings, that have increased their dividend payouts every year for at least 50 consecutive years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

It's hard to imagine the magnitude of a difference those 50-plus years of dividend growth can make to a stock's total returns over the years until you own a stock that does just that. Case in point: Parker-Hannifin (NYSE: PH).

The chart I'm about to show you regarding this little-known Dividend King might blow your mind.

Image source: Getty Images.

An astounding multibagger dividend stock

Only around 56 stocks currently qualify as Dividend Kings. Parker-Hannifin is among the best in terms of dividend track record, boasting an impressive streak of 69 consecutive dividend raises.

That's not all.

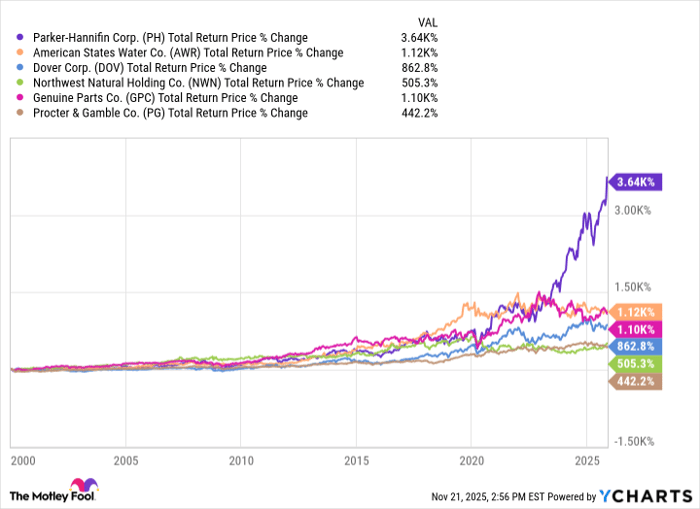

If we compare Parker-Hannifin stock's performance, including reinvested dividends, over the past couple of decades or so with that of the only five other Dividend Kings that have also raised their dividends for at least 69 years, none even come close.

Parker-Hannifin stock has generated returns of more than 2,300% since the beginning of 2000. With reinvested dividends, the stock's return totals a staggering 3,600% over the time period.

PH Total Return Price data by YCharts.

I have been bullish about Parker-Hannifin for years now, and while I couldn't have predicted the magnitude of the stock's run-up over the years, I'm not surprised to see it turn into a multibagger. Parker-Hannifin remains a no-brainer stock to add to your portfolio if you want decades of passive income. Here are three reasons why.

1. Dominance in a growing industry

With annual sales of $19 billion in fiscal year 2025, Parker-Hannifin is the leader in motion and control technologies. These are primarily products and systems that make things move, such as hydraulics, filtration, pneumatics, fluid and gas handling, and climate control. The aerospace and defense sector is the largest market for Parker-Hannifin, accounting for 35% of its revenue. Industrial equipment, transportation, off-highway machinery, and energy are other major markets.

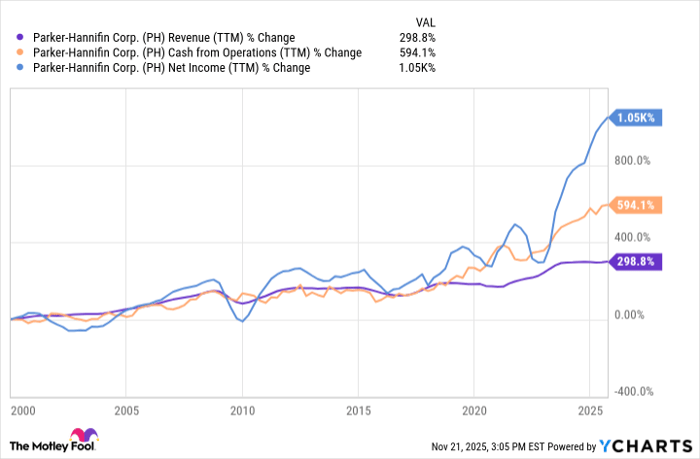

It's a powerful business model overall, with interconnected products and verticals. Customers driving nearly two-thirds of Parker-Hannifin's revenues are buyers of at least four of its technologies. Cross-selling and customer stickiness are expected to continue driving the industrials giant's sales, profits, and cash flows higher.

PH Revenue (TTM) data by YCharts. TTM = trailing 12 months.

2. Record backlog, a visible growth path

Parker-Hannifin exited its fiscal year, which ended June 30, 2025, with a record backlog of $11 billion. Aerospace backlog reached a new high of $7.4 billion. The company's cash from operations grew 12% to $3.8 billion during the year.

Parker-Hannifin is off to a strong start in fiscal 2026, generating record sales, operating margin, and earnings per share in the first quarter. It is guiding for 4% to 7% growth in sales for fiscal 2026, including organic sales growth of up to 4% at the midpoint. Aerospace and defense remains the top performer, with organic sales expected to grow by nearly 9.5%.

3. Aftermarket: a key growth driver

Parker-Hannifin's focus on aftermarket, or the sale of repair and replacement parts and accessories, is unmistakable. Aftermarket is a high-margin business with recurring revenue. Last fiscal year, aftermarket generated 51% of Parker-Hannifin's total sales. Its latest acquisition target is also a big move into the aftermarket industry.

Parker-Hannifin hasn't shied away from acquisitions to drive growth. Its latest deal is an agreement to acquire Filtration Group for $9.25 billion in cash in the coming months. While the acquisition will significantly expand its filtration portfolio, the most crucial point is that aftermarket drives 85% of Filtration Group's sales. The bigger the aftermarket segment grows, the more resilient Parker-Hannifin's business will be.

Buy this Dividend King and sleep well at night

An elite dividend track record with a strong cash-flow profile makes a dividend stock highly bankable and safe. Parker-Hannifin offers more than just that, given its robust business model and growth potential in aftermarket, especially in the aerospace and defense industries.

You may find Parker-Hannifin's dividend yield of below 1% very unappealing, but that's where the beauty of dividend growth comes to light. Parker-Hannifin's steady dividend growth could yield handsome returns in the long term, both in the form of passive income and share price appreciation.

Should you invest $1,000 in Parker-Hannifin right now?

Before you buy stock in Parker-Hannifin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Parker-Hannifin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $562,536!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,096,510!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 187% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool recommends Genuine Parts. The Motley Fool has a disclosure policy.