Is BigBear.ai Stock a Buy Now?

Key Points

BigBear.ai's stock is up considerably over the past year, even though its sales have declined.

Federal spending cuts have shrunk the company's revenue, but management expects its top line to head back up next year.

BigBear.ai's balance sheet is solid, but it still isn't profitable.

- 10 stocks we like better than BigBear.ai ›

Businesses involved in the artificial intelligence (AI) trend saw their share prices rise for much of 2025 as a host of factors drove heavy spending on the technology. Among the companies propelled by that tailwind was BigBear.ai (NYSE: BBAI); with its government-focused AI solutions, it appeared particularly well positioned to benefit.

As of Friday, the company's shares were trading in the neighborhood of $5.40 -- up nearly 160% over the past 12 months. However, the stock is also well off the 52-week high of $10.36 it reached in February, and down by almost 40% from where it peaked in October.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Does this selloff present a buying opportunity? Or are the issues that drove the shares down solid reasons to stay away from BigBear.ai?

Image source: Getty Images.

BigBear.ai's year of ups and downs

The federal government's pledge early this year to support domestic tech growth helped boost BigBear.ai shares to their 52-week high in February, but the stock price has suffered since President Donald Trump made significant cuts to federal spending. As a result of those cutbacks, BigBear.ai's revenue plunged by 18% year over year to $32.5 million in the second quarter, then dropped by 20% year over year in Q3 to $33.1 million.

Now, though, there are hopes for a top-line rebound. In November, BigBear.ai announced it was acquiring Ask Sage, a generative AI platform built for national security agencies and customers in other highly regulated industries. That deal is expected to close by early 2026.

Ask Sage supports 160,000 government teams, allowing them a secure way to use AI on their sensitive data. It's on track to reach $25 million in annual recurring revenue this year, which will be a sixfold increase over 2024. BigBear.ai plans to sell Ask Sage solutions to its existing customer base and offer its own solutions to Ask Sage's clientele.

Management also sees opportunities to use this acquisition to help it pull ahead of the competition.

"With unprecedented government AI investments expected in 2026 and 2027, Ask Sage's existing accreditations and operational platform will give us a key competitive advantage," explained BigBear.ai CEO Kevin McAleenan.

The pros and cons of BigBear.ai's business

McAleenan also expects more government spending "to materialize into contracts next year" based on Trump's "big, beautiful bill." That legislation provided massive funding increases to the Department of Homeland Security, which is a BigBear.ai customer.

However, investors need to consider that BigBear.ai is not profitable. Its loss from operations in Q3 totaled $21.9 million, more than double its loss of $10.5 million in Q3 2024. Rising operating losses and declining sales are a concerning combination.

The company's balance sheet is solid, though. It exited Q3 with total assets of $919.8 million compared to total liabilities of $309.7 million. It had $715 million in cash, cash equivalents, and investments on its books, a record high for the company, while its total debt was $142 million -- its lowest level in years.

Weighing an investment in BigBear.ai

With its solid balance sheet and the pending acquisition of Ask Sage, BigBear.ai's fortunes are looking up. The company has projected full-year sales of between $125 million and $140 million. It's on track to meet this forecast, with revenue through the first three quarters totaling $100.4 million.

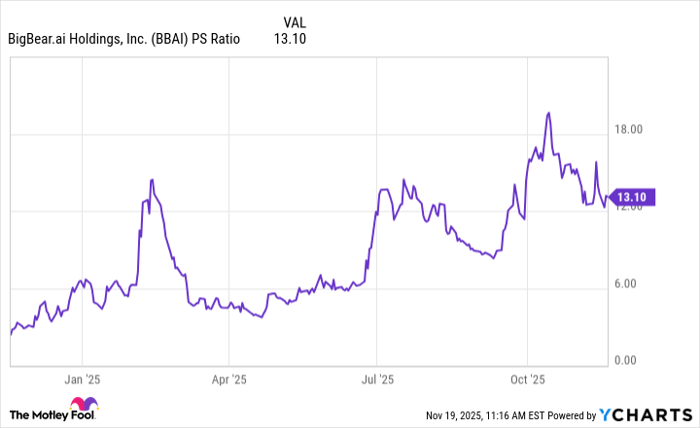

Given the positive signs for the business, one might think BigBear.ai's stock looks like a good investment candidate, but now is not an opportune time to buy. Even after its share price slump, its price-to-sales (P/S) valuation is still elevated.

Data by YCharts.

While BigBear.ai's sales multiple has dropped from its recent peak, it remains significantly higher than it has been for most of the past year, suggesting the stock is on the pricey side. Notably, in 2025 alone, its P/S ratio has fallen on multiple occasions to more reasonable levels, so it's reasonable to think another drop could occur.

Given its lack of sales growth and its increasing operational losses, paying a premium for BigBear.ai stock doesn't make sense. For those who are interested in this company, it would be better to wait to buy until shares are more reasonably priced, or for the company to deliver a few quarterly reports that do more to justify its valuation.

Should you invest $1,000 in BigBear.ai right now?

Before you buy stock in BigBear.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and BigBear.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $562,536!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,096,510!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 187% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Robert Izquierdo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.