This Unstoppable Stock Is Crushing the S&P 500, and Wall Street Says It's a Screaming Buy Heading Into 2026

Key Points

Sea Limited has a growing presence in areas like e-commerce, digital financial services, and digital entertainment around the world.

Sea's revenue growth has accelerated for two consecutive quarters, and its profits are soaring.

The stock is still attractively valued, and Wall Street thinks it's a buy as we head into 2026.

- 10 stocks we like better than Sea Limited ›

Sea Limited (NYSE: SE) is a technology conglomerate based in Singapore. It operates the largest e-commerce platform in Southeast Asia, a globally recognized game development studio, and a booming digital financial-services business. In fact, many Wall Street analysts refer to the company as the "Amazon of Asia" because of its diverse presence in the digital economy.

Sea Limited stock has soared by 40% this year, crushing the S&P 500, which is up just 12%. Investors have rewarded the company's accelerating revenue growth and its soaring profits. Fortunately, according to Wall Street, there could be even more upside on the table in 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The Wall Street Journal tracks 36 analysts who cover Sea stock, and the overwhelming majority have given it a buy rating, with none recommending selling. Here's why their bullish consensus might be justified.

Image source: Getty Images.

A powerhouse in the digital economy

Shopee is Sea's hybrid consumer-to-consumer and business-to-consumer e-commerce platform. It's popular in countries including Indonesia, Singapore, and Thailand, and it's also expanding quickly into Latin American markets like Brazil. Through the first three quarters of 2025 (ended Sept. 30), it processed 10 billion orders worth $90.6 billion, making it the largest platform of its kind in Southeast Asia.

Then there is Monee, Sea's digital financial-services platform. It has several synergies with Shopee, because it writes loans to merchants to help them grow their businesses, and it offers buy now, pay later loans to consumers to increase their spending power. The platform had a record 34 million users at the end of the third quarter, growing 45% year over year. Outstanding loan balances also soared by 71% to a record $7.9 billion during the quarter.

Lastly, Sea's third segment is digital entertainment, which is home to its Garena game development studio. It's responsible for Call of Duty: Mobile, Arena of Valor, and the global smash-hit Free Fire, which is consistently one of the most downloaded games worldwide.

Garena had a total of 670.8 million quarterly active users across all titles during the third quarter, which was the most in four years, dating back to the third quarter of 2021, when pandemic-related lockdowns and social restrictions drove a boom in the gaming industry.

Accelerating revenue growth and soaring profits

Sea Limited generated $6 billion in total revenue during the third quarter of 2025, which was a 38.3% increase from the year-ago period. It was the second consecutive quarter in which that growth rate accelerated, highlighting the significant momentum across Sea's portfolio of businesses. Here's how the third-quarter number was broken down:

|

Segment |

Q3 Revenue |

Year-Over-Year Growth |

|---|---|---|

|

E-commerce (Shopee) |

$4.3 billion |

34.9% |

|

Digital financial services (Monee) |

$989.9 million |

60.8% |

|

Digital entertainment (Garena) |

$653 million |

31.2% |

Data source: Sea Limited.

Although the e-commerce segment is Sea's largest source of revenue by a wide margin, it operates on very thin profit margins. It still generated $186.1 million in adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) during the third quarter, which is Sea's preferred measure of profitability, but the digital financial services and digital entertainment segments generated $724.2 million in adjusted EBITDA combined, on significantly less revenue.

Sea's total adjusted EBITDA of $874.3 million represented a 67.7% jump compared to the year-ago period.

This highlights the benefits of having a diversified business; while e-commerce powered Sea's top-line results, digital entertainment and digital financial services drove the bottom line.

Wall Street is very bullish on Sea stock

The Wall Street Journal tracks 36 analysts who cover Sea stock, and 26 have given it a buy rating. Six others are in the overweight (bullish) camp, and the remaining four recommend holding. None of the analysts recommend selling.

The analysts have an average price target of $192.51, suggesting Sea stock could climb by 30% over the next 12 to 18 months. The Street-high target of $226 implies an even juicer potential upside of 53% instead.

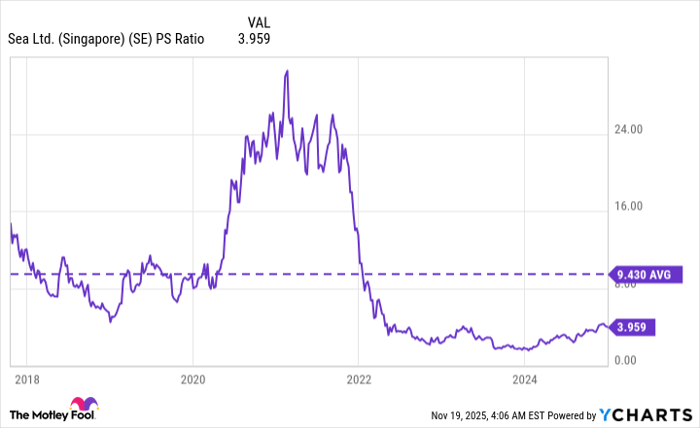

Despite the 40% gain in Sea stock this year, it's still attractively valued, which leaves room for upside in 2026. It's trading at a price-to-sales ratio (P/S) of just 3.9, which is a 58% discount to its long-term average of 9.4 dating back to when the stock went public in 2017.

SE PS Ratio data by YCharts.

To cap things off, Sea is in a great financial position. It had a $10.5 billion in cash and equivalents on hand at the end of the third quarter, and since the company is consistently profitable, management now has the flexibility to invest more aggressively in growth-focused projects to acquire more customers and potentially generate even faster revenue growth.

As a result, Wall Street analysts are probably right to predict further upside in Sea stock as we head into the new year. I think their price targets are reasonable, and they might even prove to be conservative in the longer term.

Should you invest $1,000 in Sea Limited right now?

Before you buy stock in Sea Limited, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sea Limited wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,222!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,342!*

Now, it’s worth noting Stock Advisor’s total average return is 1,013% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Sea Limited. The Motley Fool has a disclosure policy.