Should You Buy Amazon After Its Deal With OpenAI?

Key Points

OpenAI just signed a multibillion-dollar deal with Amazon’s cloud business for access to AI chips.

Amazon Web Services is the world’s biggest cloud provider and has been investing massively in AI.

- 10 stocks we like better than Amazon ›

You may think of Amazon (NASDAQ: AMZN) primarily as an e-commerce giant -- and it is -- but the company also has become a major player in artificial intelligence (AI) in recent years. And just this week, it scored a new win that reinforces its position in this high-growth market.

OpenAI, the owner of chatbot ChatGPT, inked a $38 billion deal with Amazon's cloud business for access to high-powered compute. This is significant because it's the first direct contract between OpenAI and Amazon -- and OpenAI is considered one of the leaders in the development of AI.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Investors clearly liked this news as Amazon's shares rose in Monday's trading session and closed at a record high. Now the question is: Should you buy Amazon after its deal with the top AI research lab? Let's find out.

Image source: Getty Images.

Amazon's cloud business

We'll get started by taking a look at Amazon's cloud business and its focus on AI. Amazon Web Services (AWS) is the world's No. 1 cloud services provider and offers its customers a broad variety of AI products and services -- from its own in-house developed Trainium AI chip to top chips from Nvidia and a fully managed AI service called Amazon Bedrock. Basically, customers of any type -- small start-ups and market giants alike -- may find anything they need for their AI projects at AWS.

All of this has helped drive growth in recent quarters, and in the latest one -- the third quarter -- AWS reported a 20% increase in revenue, and its annual revenue run rate climbed to $132 billion thanks to the company's focus on AI. The company has spent billions of dollars -- more than $89 billion so far this year -- to expand its data centers in response to demand from AI customers, and Amazon said it expects AI to be "a massive opportunity with the potential for strong return on invested capital (ROIC) over the long term."

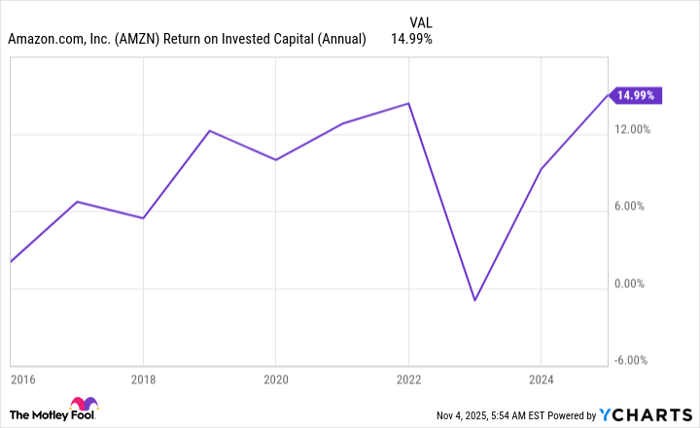

Amazon has a solid track record when it comes to ROIC, with periods of investment resulting in progressive gains over time.

AMZN Return on Invested Capital (Annual) data by YCharts

The biggest profit driver

It's also important to note that, though Amazon is well known for its e-commerce business, AWS actually drives the company's profit. In the recent quarter, AWS operating income totaled more than $11 billion -- that's about 64% of the company's total operating income.

Now, let's consider the OpenAI deal. The agreement offers the research lab access to AWS' fleet of Nvidia graphics processing units (GPUs), the world's highest-performance AI chip. Right now, OpenAI will use AWS' current infrastructure, but as part of the plan, AWS eventually will build additional infrastructure for this AI customer.

Originally, OpenAI had an exclusive cloud deal with a major AWS cloud competitor, Microsoft, but that exclusivity ended earlier this year. And in recent times, the research lab has made a variety of AI deals, from one for cloud capacity with Oracle to direct agreements with chip designers including Nvidia and Broadcom.

A key customer for AWS

OpenAI, as a major user of compute for the training and inferencing of models today and as the AI boom progresses, represents a key customer for chip designers and cloud providers -- so this deal clearly is positive for AWS and secures its position as a significant player in the market. Right now, the deal involves access to Nvidia chips, but it's possible that in the future it could broaden to include AWS' own Trainium chips -- that could represent another big win for AWS as margins on its own low-cost chips should be higher than those on chips from other providers.

Now, let's return to our question: Should you buy Amazon now, after the OpenAI deal? As mentioned, Amazon already has been winning in the AI market -- now this deal broadens its revenue growth opportunity and reinforces its position as a key AI player. Today, the stock looks reasonably priced, trading at 36x forward earnings estimates -- that's not a high price to pay for a highly profitable e-commerce and cloud leader that also is excelling in AI.

So, the bottom line is Amazon already was a smart buy before the OpenAI deal -- but this news is the cherry on the cake.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,269!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,268,146!*

Now, it’s worth noting Stock Advisor’s total average return is 1,076% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Adria Cimino has positions in Amazon and Oracle. The Motley Fool has positions in and recommends Amazon, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.