A Once-in-a-Decade Opportunity to Buy This Aerospace Stock

Key Points

All the leading industry players have confirmed that the aerospace supply chain is healing and aircraft production is set to ramp significantly in the coming years.

GE Aeropace and RTX have both raised guidance recently, partly on the back of improved parts availability, which is helping boost engine and component production.

Prospects for aerospace supplier Hexcel are closely tied to aircraft production and the increasing use of composites in newer-generation aircraft.

- 10 stocks we like better than Hexcel ›

It's been a difficult few years for advanced composites company Hexcel (NYSE: HXL), with its key end market, aircraft manufacturing, suffering as Boeing and Airbus production has fallen short of expectations.

However, there's a growing body of evidence to suggest that's about to change, and it's highly likely to drive a dramatic improvement in Hexcel's profitability, making it an outstanding stock to buy now. Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Hexcel is the future of the aerospace industry

The company is a leader in advanced lightweight carbon fiber composite materials that offer weight and strength advantages over traditional materials such as aluminum. Management claims its carbon fiber composites are five times stronger and 30% lighter than aluminum.

That's a big deal in the commercial aerospace industry as it helps deliver increased fuel efficiency and lower emissions, particularly for larger, wide-body aircraft. It also helps reduce weight and enhance performance in the defense industry (fighters, helicopters, etc.). As such, there are three, closely connected, key drivers of long-term profitability for Hexcel:

- Increasing aircraft production overall.

- The increasing penetration rate of advanced composites in each new generation of aircraft.

- The increase in output of composite-rich aircraft, such as the Airbus A350 widebody, Boeing 787 widebody, and Boeing 777X (due for first delivery in 2027) widebody.

Boeing and Airbus dominate its end market, as 63% of Hexcel's sales in 2024 came from commercial aerospace. Airbus and its commercial aerospace subcontractors accounted for 37% of total sales, and Boeing and its commercial aerospace subcontractors accounted for 13% of total sales.

Hexcel's other end market, "Defense, Space & Other," accounted for 37% of total sales, with Boeing and Airbus, and their subcontractors, together accounting for 5% of total sales. Lockheed Martin is a key defense customer, notably on the F-35 fighter program.

Here's an example of how each new generation of aircraft has tended to contain more composites and therefore more "shipset value" (monetary value per aircraft or rotorcraft) for Hexcel. Consider that the newer narrowbody Boeing 737MAX and Airbus A320neo family of aircraft have about 15% of their weight in composites (shipset value of $0.2 million to $0.5 million), compared to just 5% and 10% of weight for the respective older variants. In addition, the widebody Airbus A350 has a whopping $4.5 million to $5 million of shipset value.

Hexcel's business is about to turn around

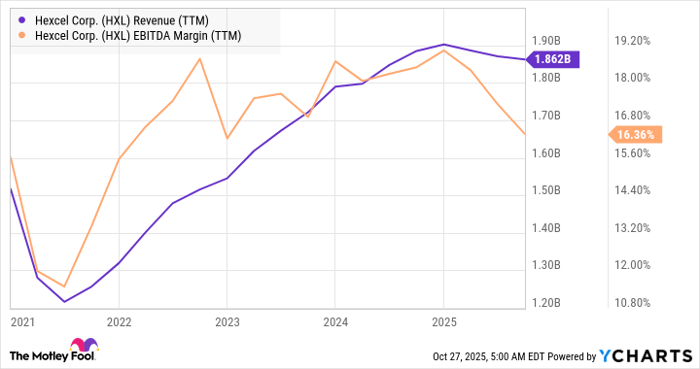

While the long-term outlook is bright, Hexcel has suffered in recent years as its management prepared for growth in aircraft production that didn't materialize as expected, resulting in sluggish revenue growth and declining profit margins.

HXL Revenue (TTM) data by YCharts

However, what's never been in doubt is the multi-year backlog at Airbus and Boeing, and don't forget that it includes aircraft such as the Boeing 777X, which contain more shipset value for Hexcel.

|

Backlogs |

Commercial Aerospace Backlog (units) |

Estimated Years of Production at Current Rates |

|---|---|---|

|

Airbus |

8,754 |

>10 years |

|

Boeing |

~5,900 |

>7 years |

Data source: Company presentations. Correct as of the first half of 2025.

In addition, the supply chain issues that caused a lack of material availability and, consequently, sluggish aircraft production growth are being resolved. Moreover, Boeing has stabilized its 737 MAX production rate and recently received Federal Aviation Administration approval to increase the monthly rate from 38 to 42.

What the industry has been saying

In a nutshell, a healing supply chain is making more parts available, and that's enabling aerospace suppliers like GE Aerospace and RTX (both key customers of Hexcel) to ramp production of engines and components for Boeing and Airbus.

It's clearly the way Hexcel's management sees it, too, with CEO Tom Gentile recently expressing "growing confidence" in the "improving production system stability," such that he considers Hexcel approaching "the margin levels we enjoyed in the past as production rates increase and drive operating leverage for Hexcel," and $1 billion in free cash flow (FCF) over the next four years.

Image source: Getty Images.

Is Hexcel stock a buy?

The company had an 18% operating profit margin and a 12.2% FCF margin in its last "normal" year, 2019, and if the Wall Street consensus is right, it will generate $344 million in operating profit (with a 14.5% margin) and $276 million in FCF in 2027.

Those figures would put Hexcel on a 2027 price-to-FCF multiple of 21 in 2027. That's far too cheap for a business set for mid-teens revenue growth and underlying margin expansion as it works back to at least 18% operating profit margins.

Throw in the super-growth prospects of a new generation of narrowbody aircraft in the 2030s (which Hexcel management believes could contain 60% composites by weight), growth in widebody production (not least the 777X) and Hexcel looks like a significantly undervalued growth stock.

Should you invest $1,000 in Hexcel right now?

Before you buy stock in Hexcel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Hexcel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends GE Aerospace, Hexcel, Lockheed Martin, and RTX. The Motley Fool has a disclosure policy.