Is Nvidia Still a Top AI Stock Pick? 4 Reasons Why It Is

Key Points

Nvidia has better foresight into impending AI spending than most investors.

Nvidia may receive positive news regarding exports to China soon.

The stock isn't as expensive as you may think.

- 10 stocks we like better than Nvidia ›

Nvidia (NASDAQ: NVDA) has been one of the best artificial intelligence (AI) stocks to own since the AI arms race kicked off in 2023. Its technology has powered most of the AI we experience today, and that's unlikely to change much in the future.

However, many investors are worried that there could be an AI bubble forming or that Nvidia has already run up too much to continue increasing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

I think both of those notions are false, and I've got four reasons to believe Nvidia is still a top artificial intelligence stock pick today.

Image source: Getty images.

1. Massive AI spending is still coming

While some are worried about an AI bubble forming, I'm not that concerned. Most of this discourse stemmed from OpenAI's deals with various computing providers to pay for computing power with something other than cash or debt. More experienced investors saw this occur during the dot-com crash, and it looks as if history may be repeating itself.

However, I don't think that's the case. While OpenAI may be getting a bit overvalued and could cause an issue, most of the spending is still coming from other AI hyperscalers like Meta Platforms and Alphabet. These companies have legitimate businesses that are funding their AI investments. While they may be spending a ton of money on AI computing capacity, the reality is that they have the funds to do it. As a result, there still could be more spending to come from these businesses.

Nvidia expects global data center capital expenditures to rise from $600 billion in 2026 to $3 trillion to $4 trillion by 2030. That's huge growth, and Nvidia may also be a bit more informed on this subject than the average investor.

Data centers take a long time to build, and GPUs are still in heavy demand, which outstrips supply. As a result, clients are likely in talks years in advance of when they're planning on installing the GPUs so they are available by the time the data center is ready to operate. This gives Nvidia a better view into the future than most investors have, and investors should give Nvidia the benefit of the doubt for predicting what future demand will look like.

2. Hyperscalers are mostly locked into the Nvidia ecosystem

Another factor investors may be forgetting is the lifespan of a GPU. These computing devices are run aggressively and don't last forever. One estimate pegs the lifespan of a data center GPU tasked with AI training or inference at one to three years. We're coming up on three years of the ongoing AI trend, so many of the installed computing units will need to be replaced as they wear out.

Switching to a competitor would incur more costs, as there are multiple changes that would need to be made to switch away from Nvidia's chips. This isn't ideal, and could wipe out the cost savings reaped by switching to a cheaper alternative. As a result, Nvidia isn't at risk of being replaced because it established a first-mover advantage by capturing nearly all of the AI computing market share in the first few years.

3. Chinese business could return

Another topic investors may have forgotten about is that Nvidia isn't currently allowed to sell its chips in China. The Trump administration revoked its export license earlier this year, and while Nvidia has reapplied for the license with assurances that it would be renewed, it still hasn't been approved. This is a massive market, and being allowed to sell there again could boost the company's results significantly.

Investors may be getting positive news on this subject soon, as U.S. and China trade negotiations could include some provision for cutting-edge AI chips for China. This is a massive bargaining chip for the U.S., and once the trade disputes are resolved, it could add significant growth for Nvidia.

4. The stock isn't as expensive as you think

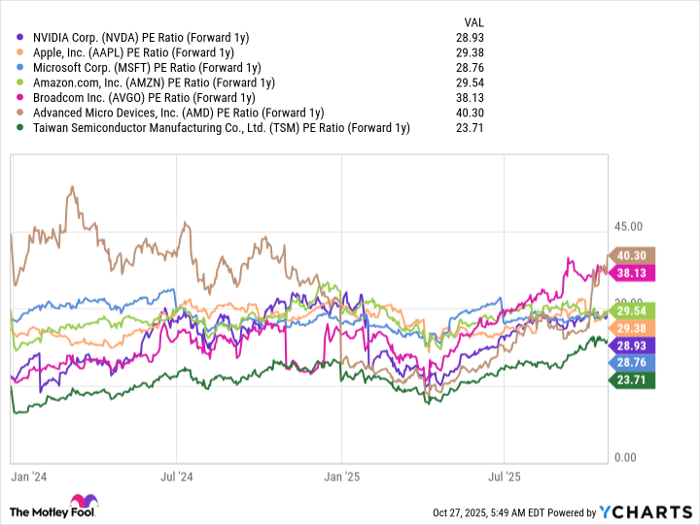

Lastly, Nvidia's stock has somehow received a sentiment that it's extremely overvalued. I don't think this is true at all. It may look a tad expensive, but that's because investors forget to factor in growth. When you look at how the company is valued using next year's earnings, Nvidia is indistinguishable from its peers.

NVDA PE Ratio (Forward 1y) data by YCharts

While trading for 29 times next year's earnings isn't necessarily a cheap valuation, it's right next to many of its big tech peers (and far cheaper than some of the companies that are supposedly slated to dethrone Nvidia).

Nvidia still has plenty of room to run, and I think it's still one of the best AI stocks investors can buy right now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Keithen Drury has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.