A Once-in-a-Decade Investment Opportunity: 1 Artificial Intelligence (AI) Semiconductor Stock to Buy Hand Over Fist and Hold for Years (Hint: It's Not Nvidia)

Key Points

Taiwan Semiconductor manufactures microchips for nearly all the major AI components.

Taiwan Semiconductor has a new technology that could drive increased demand.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

The artificial intelligence (AI) race is really just getting started. While there have been substantial buildout announcements over the past month, these are just announcements. The actual building of data centers will occur over the next few years, so chip demand from companies like Nvidia hasn't reached peak capacity yet.

While Nvidia is still the leader in AI computing hardware, there are a few companies starting to challenge that notion. Advanced Micro Devices and Broadcom have been building strong momentum over the past few weeks, making investors question whether Nvidia is still the gold standard of AI investing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

While I think all three companies have merit, there's one stock that will benefit no matter who the perceived leader in AI computing is: Taiwan Semiconductor (NYSE: TSM). None of these companies can manufacture their own microchips, so they farm it out to foundries like TSMC. This makes Taiwan Semiconductor the ultimate neutral party to capitalize on this once-in-a-decade buildout opportunity, and I think it's an excellent stock to buy right now.

Image source: Getty Images.

Taiwan Semiconductor is best-in-class

There aren't a ton of options for companies to use to have their chip designs manufactured. Among the few possibilities, Taiwan Semiconductor is by far the most popular option, having earned that title by offering innovative technology and strong manufacturing yields. As a result, Taiwan Semiconductor is the go-to company to have chips made, which is why it has captured the three dominant AI companies above, alongside other tech companies like Tesla and Apple.

Taiwan Semiconductor has always been innovative, and its latest product launch backs up that notion. While the current most powerful chip technology is 3nm (nanometer) chips, 2nm chips are entering production this quarter. While that may not sound like a huge jump, it is. These chips are incredibly energy-efficient, consuming 25% to 30% less power than the 3nm varieties when configured to run at the same speed. Since AI data center energy consumption is a huge focus right now, and could be a limiting factor in artificial intelligence proliferation in the future, Taiwan Semiconductor's pioneering of this incredible technology is a big deal.

This new technology could prompt its customers to design new computing hardware that harnesses the power of 2nm chips, which AI hyperscalers will buy because they can deliver higher computing capacity with less energy consumption. The upgrade from a 2nm to a 3nm won't be cheap, and this will drive increased revenue on top of rising chip demand in general.

Taiwan Semiconductor is slated to cash in on this trend, but it's already putting up impressive growth figures.

Taiwan Semiconductor is growing rapidly

During the third quarter, Taiwan Semiconductor's revenue rose 41% year over year in U.S. dollars. That's incredible growth, and it outpaces many of the big tech companies. Taiwan Semiconductor is also incredibly efficient, with a 46% profit margin for the quarter.

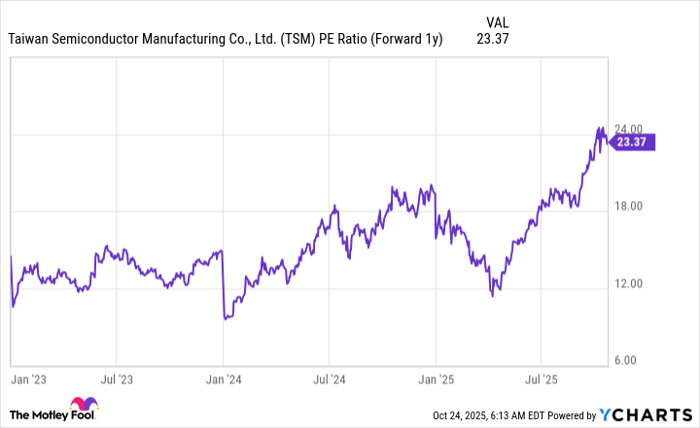

This all combines to show how impressive a company Taiwan Semiconductor is, but it's also a reasonably priced investment option. Taiwan Semiconductor trades for 23 times 2026 earnings, which isn't too bad a price to pay compared to some of its big tech peers.

TSM PE Ratio (Forward 1y) data by YCharts. PE = price-to-earnings.

Furthermore, these projections are based on Wall Street analysts' estimates, not the company's estimates. Over the course of the AI race, Wall Street analysts have consistently guided for lower growth rates than many of these companies ended up delivering, making the stocks actually higher than they appear. The same thing might happen in 2026, as analysts expect 20% revenue growth from TSMC.

If Taiwan Semiconductor outperforms expectations, this could make the stock cheaper than it appears, making it a no-brainer buy now. Even if it does deliver the growth that Wall Street expects, it still has a massive opportunity in front of it, making it a great stock to buy and hold throughout the buildout of AI computing capacity.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,287!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,173,807!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Keithen Drury has positions in Broadcom, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.