Does Billionaire Philippe Laffont Know Something Wall Street Doesn't? His Hedge Fund Is Backing a Stock That Jumped 211% in Just 5 Days.

Key Points

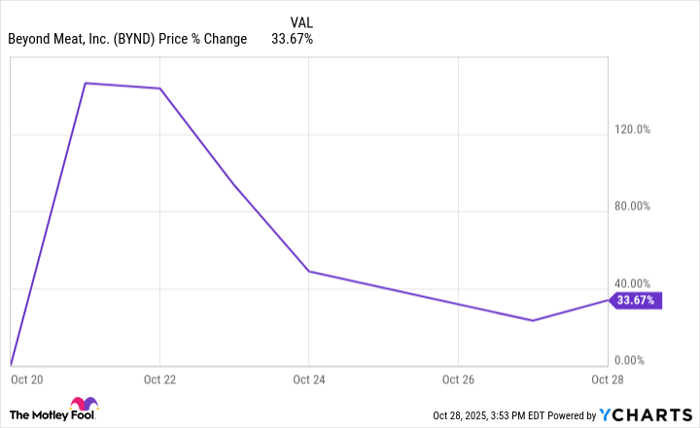

Beyond Meat stock popped over 200% before pulling back in the last few trading sessions.

Although the stock was temporarily parabolic, Beyond Meat's core business is in decline.

Coatue is also invested in Beyond Meat's top rival, Impossible Foods.

- 10 stocks we like better than Beyond Meat ›

Hedge funds are some of the most fascinating institutions on Wall Street. One firm that I analyze closely is Coatue Management, founded by billionaire investor Philippe Laffont. Coatue is primarily known to invest in growth stocks, particularly in the technology and healthcare sectors.

According to its latest 13F filing, some of Coatue's largest positions include CoreWeave, Meta Platforms, Amazon, GE Vernova, and Microsoft. If the names above are any indication, I think it's safe to say that Laffont is bullish on artificial intelligence (AI). Beyond AI, Coatue also holds positions in companies such as Intuitive Surgical, Caris Life Sciences, and Hinge Health.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

It would appear that Coatue is invested in top-notch businesses -- deliberately avoiding abnormal levels of risk. This begs the question: Why in the world does Coatue hold Beyond Meat (NASDAQ: BYND) stock?

Over the last few trading sessions, shares of Beyond Meat skyrocketed by more than 200% seemingly out of nowhere, before collapsing again.

BYND data by YCharts

Does Laffont know something the rest of us don't? Let's dig into what's fueled the rally in Beyond Meat stock.

Why did Beyond Meat stock move higher?

The volatility in Beyond Meat stock was kicked off following an 8-K filing in mid-October. In the filing, the company disclosed the completion of a convertible note offering -- effectively swapping the securities to augment liquidity needs. Per the structure of the deal, a total of 316,150,176 new shares were added to Beyond Meat's outstanding share count.

Initially, the news was not met with much fanfare. After all, the company basically telegraphed that it is not generating enough cash flow organically to bolster the cash position on its balance sheet. Nevertheless, retail traders swiftly changed the negative sentiment surrounding Beyond Meat.

Thanks to buzz on social media platforms, a choreographed short squeeze was orchestrated -- sending shares of Beyond Meat parabolic. These types of events happen from time to time. Remember GameStop and AMC Entertainment?

Broadly speaking, though, short squeezes tend to be fleeting -- maybe lasting a couple of days at most. Seldom are they prolonged events that go on for no real reason. This isn't exactly what's going on with Beyond Meat, though.

Shortly following the convertible debt transaction, the company announced a major distribution deal with Walmart. Admittedly, this could be perceived as a positive tailwind. In theory, selling into Walmart could lead to new customer acquisition and represent part of a turnaround that Beyond Meat so desperately needs (more on that below).

Image source: Beyond Meat.

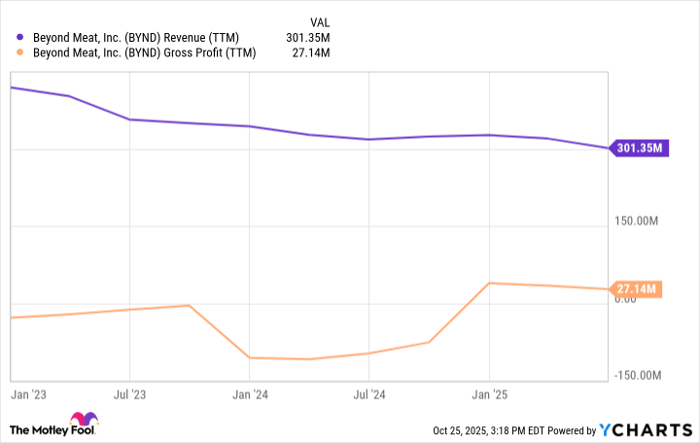

Beyond Meat is a business in decline

The snapshot below illustrates Beyond Meat's revenue and gross profit over the last 12 months. Not only are sales in decline, but the company's gross margin profile is razor thin -- hovering around 9%. With this type of trajectory, it's no wonder the company is desperate for cash and resorted to the debt offering.

BYND Revenue (TTM) data by YCharts

To me, Beyond Meat's business is in trouble and there aren't many -- if any -- prudent reasons to buy the stock.

Against that backdrop, I'm confident that the outsized volatility and abnormal gains investors have witnessed over the last week can be summed up by the following idea: day traders found their newest meme stock.

Why might Laffont like Beyond Meat stock?

Given Beyond Meat's poor operational performance, it's curious why Coatue would hold a position in the company at all. I have a few theories.

First, Coatue has been an investor in another plant-based meat company, Impossible Foods, for several years. It's possible that the firm saw Beyond Meat as an opportunity to gain more exposure at the intersection of health, wellness, and the trillion-dollar food market. Simply put, owning Beyond Meat stock could be a form of hedging the investment in Impossible Foods.

Another idea is that Coatue might be willing to roll the dice on an unusually high beta stock. Given its core positions are diversified blue-chip companies disrupting multiple industries poised for long-term growth, perhaps Coatue is allocating a portion of its portfolio to a more speculative asset.

My last theory -- and the one that seems most plausible -- is that Beyond Meat represents an incredibly small position within Coatue's broader portfolio. The fund only owns 343,393 Beyond Meat shares, accounting for less than 0.1% of its total holdings -- suggesting it may be a peripheral investment rather than a core focus area.

It's important to note that the short squeeze may see a crash landing. Shares of Beyond Meat fell sharply from their peak, although they still show a gain of more than 30%. Chasing momentum now is risky. It's best to sit this one out and avoid being a bag holder.

All told, I do not think that Laffont knows something the rest of Wall Street doesn't.

Should you invest $1,000 in Beyond Meat right now?

Before you buy stock in Beyond Meat, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Beyond Meat wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,287!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,173,807!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Adam Spatacco has positions in Amazon, Meta Platforms, and Microsoft. The Motley Fool has positions in and recommends Amazon, Beyond Meat, Intuitive Surgical, Meta Platforms, Microsoft, and Walmart. The Motley Fool recommends Ge Vernova and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.