Billionaires Are Piling Into This Nasdaq Stock Down 72% and Yielding a Healthy 5% Dividend

Key Points

SiriusXM has a low P/E ratio and high dividend yield.

The company is slowly losing subscribers and seeing declining revenue.

Investors should avoid buying this stock because of its high debt levels.

- 10 stocks we like better than Sirius XM ›

Billionaires have loaded up on this ailing consumer internet business in recent years: SiriusXM (NASDAQ: SIRI). Warren Buffett's Berkshire Hathaway owns over a third of the business. Steve Cohen's Point72 owns close to $100 million in shares and so does D.E. Shaw. As of Oct. 27, SiriusXM stock has fallen 72% from highs set back in mid-2023 as the satellite music streaming service struggles to compete with modern competitors.

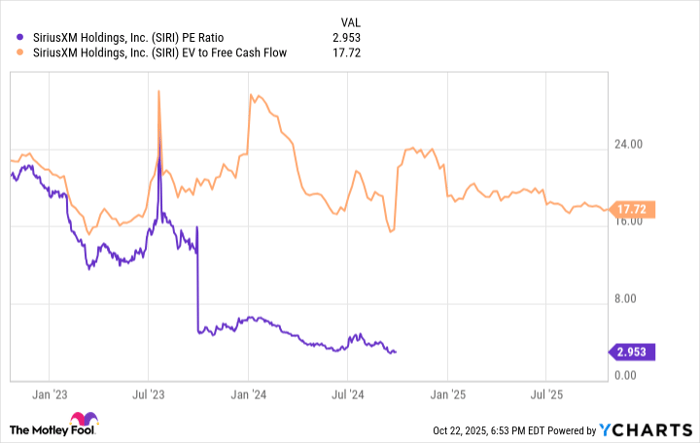

The stock currently has a dividend yield of 5% and a dirt-cheap, price-to-earnings ratio (P/E) of just 3. Does that mean you should load up on this beleaguered stock alongside Warren Buffett and these hedge fund managers?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Churning subscribers, declining revenue

At the beginning of the 21st century, SiriusXM disrupted the car radio market with its satellite internet service. With better connectivity and tons of music, talk radio, and sports, SiriusXM was a huge improvement over the legacy AM/FM local stations, leading the company to see huge subscriber growth. It worked with automotive dealers to bundle SiriusXM with car purchases, locking in drivers as customers for many years.

Then, along came modern music streaming with YouTube, and Apple and Alphabet's Google CarPlay. In recent years, SiriusXM has struggled mightily to grow its subscribers, which have declined every year since the end of 2022. People are adopting music streaming services such as Spotify or YouTube Music and connecting them to modern vehicles with Bluetooth or digital CarPlay connectivity on their dashboards, which usurps the need for a SiriusXM subscription. Why pay extra for car radio when you have a global library of music, podcasts, and audiobooks at your fingertips?

Last quarter, SiriusXM self-pay subscribers declined by 68,000, and while the company claims a low monthly churn rate of just 1.5%, it is in a tough spot trying to grow the business. Revenue has begun to decline sharply in the last few years, hitting $8.565 billion over the last 12 months compared to $9 billion in 2023. The company is seeing rising content costs as it signs new talent such as Stephen A. Smith, Alex Cooper, and Conan O'Brien. Operating margin has begun to decline, down 22% over the last 12 months compared to 30% in 2018.

Image source: Getty Images.

A looming pile of debt

To make matters worse, SiriusXM has a balance sheet loaded with debt. At the end of last quarter, the company had less than $100 million in cash on the balance sheet and over $10 billion in long-term debt.

That is a large liability for a company currently generating just around $1 billion in free cash flow. SiriusXM pays over $100 million in quarterly interest payments. It paid $183 million in dividends through the first six months of 2024 and currently has this large debt pile it will have to eventually pay off or refinance. The company can barely cover its annual interest payments and dividend with its current free cash flow. If the business keeps heading in the wrong direction and doesn't improve its low cash balance, then SiriusXM could be in big trouble in the coming years and may have to cut its dividend altogether.

Data by YCharts.

Should you buy SiriusXM stock?

SiriusXM stock may look cheap because of its low P/E ratio. But a P/E ratio does not take into account debt on the balance sheet, which this company has loads of. SiriusXM's market cap is $7.25 billion, but its enterprise value is over $17 billion. That means it trades at a free-cash-flow multiple of close to 17x its trailing free cash flow.

This does not look cheap when you consider SiriusXM's declining subscribers, revenue, and the increased competition from Spotify and others that is only getting worse every year. Do not be influenced by Buffett, the stock's high dividend yield, or the cheap-looking P/E ratio. Avoid adding SiriusXM stock to your portfolio right now.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Brett Schafer has positions in Alphabet and Spotify Technology. The Motley Fool has positions in and recommends Alphabet, Apple, Berkshire Hathaway, and Spotify Technology. The Motley Fool has a disclosure policy.