Where Will Rivian Stock Be in Three Years?

Key Points

Major automakers are pointing out that demand for EV's is weakening.

One EV maker feeling the effects is Rivian, which is losing billions annually.

With production of new models in the works, Rivian's costs might increase.

- 10 stocks we like better than Rivian Automotive ›

This is a loaded question, and the answer isn't an exact science. Rivian Automotive (NASDAQ: RIVN) held some serious traction in 2022 and 2023, but stalled out in 2024 -- it dropped from 167% revenue growth to 12%. So what happened? And what's Rivian to do?

As I see it, Rivian faces two major challenges over the next three years: Getting more affordable car models to market, and handling the loss of the tax credits that electric vehicle (EV) companies enjoyed.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Other automakers have been sounding the alarm on EV demand. Stellantis (NYSE: STLA), maker of the popular RAM pickup trucks, cancelled its REV pickup due to weakening North American demand. General Motors announced last week that it will be cutting back its EV production due to the loss of tax credits, and subsequent weaker demand.

These are clear indicators of a potentially major problem for a company attempting to solely sell electric SUVs and trucks in the United States.

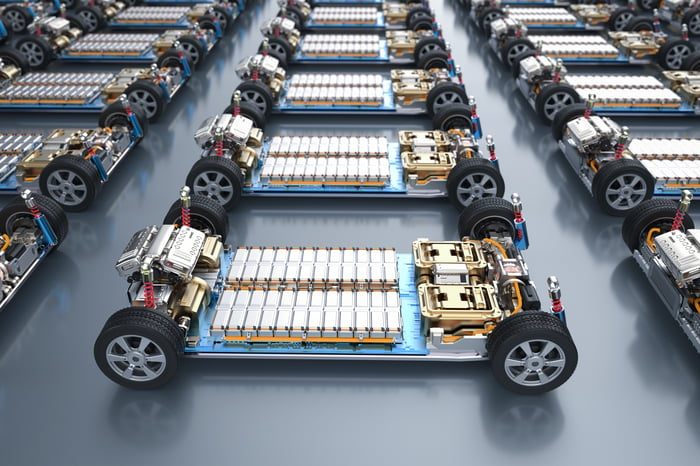

Image source: Getty Images.

An expensive stock

Rivian stock has lost 90% of its value since going public. Even after that decline, the company remains at over $16 billion in market value, but is losing billions annually and is seeing slower top-line growth.

One of the often overlooked, but very important things to keep in mind here is the actual valuation trends for auto stocks. The established players, most of which all have their own EV lineups, trade at around 10 times earnings. A few might trade slightly higher, such as Ford Motor Company, which trades at 15 times earnings.

But as a whole, investors just aren't overly enthused about giving high valuations to most car stocks. Admittedly there's a differentiation between the traditional names and the new guys. These new players are getting traded on different metrics, such as price-to-sales, speculation, and so on, but I don't see them maintaining this momentum for the long term.

After a certain point, earnings are what matter, and EV companies like Rivian and Tesla are all going to answer to it eventually. Because of that, I see eventual downward pressure on the valuations given to names like Rivian.

Back to gross losses

Last quarter, gross results shifted back to losses of $206 million after two quarters of gross profits. In all, Rivian is reporting net losses of billions annually, with a loss of $4.75 billion last year. Given that its working on adding new and more affordable models, expenses don't seem likely to lessen in the coming months.

Perhaps the one big differentiator here is the partnership, and $1 billion in equity gained from Volkswagen back in July. This clear partnership is the redeeming indicator for this stock. Volkwagen is a global company, and a partnership with it has some significant potential in terms of Rivian being able to provide its software for use.

This is just a piece of the $5.8 billion agreement between the two companies. Still, this is a long path forward, and as stated, without tax credits for EVs, I think the industry will struggle to create the same momentum it has enjoyed in the United States, which is one of the prime auto markets.

The next three years

When trying to figure out Rivian's potential over the next three years, one has to consider the costs and time it'll take for Rivian to ramp up its cheaper models, as well as how it's going to manage what could become a tougher market. In its most recent quarter, production, deliveries, and total auto revenues were down year over year. Total revenue expanded thanks to increased software revenue, which reached $376 million last quarter.

Rivian is working to bring lower-priced options to market, such as the R2 SUV, which will theoretically help attract more customers to the table, but it is still priced at $45,000. That's not so cheap when you consider the number of traditional options available, like cars that you don't need to charge, and that have better maintenance and repair infrastructure.

While electric vehicles certainly have their place, the current environment doesn't seem primed to create huge increases in demand for EVs right now. As long as the Trump administration is in the White House, it doesn't seem likely that tax credits for EVs are coming back.

Because of that, the next three years don't seem overly bullish for automakers that only produce electric vehicles. Even though Rivian stock is up this year, I don't think overall momentum is going to last if we do see U.S. demand for electric vehicles weaken in the short term.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

David Butler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and Stellantis. The Motley Fool has a disclosure policy.