This Is the Social Security COLA Retirees Say Is Required to Keep Up With Inflation

Key Points

With inflation continuing to increase, Social Security recipients will receive a slightly higher-than-expected raise.

However, the majority of retirees say they'd need a significantly higher COLA to keep up with surging costs.

The COLA has a long history of falling short, and there's some not-so-good news about its future, too.

- The $23,760 Social Security bonus most retirees completely overlook ›

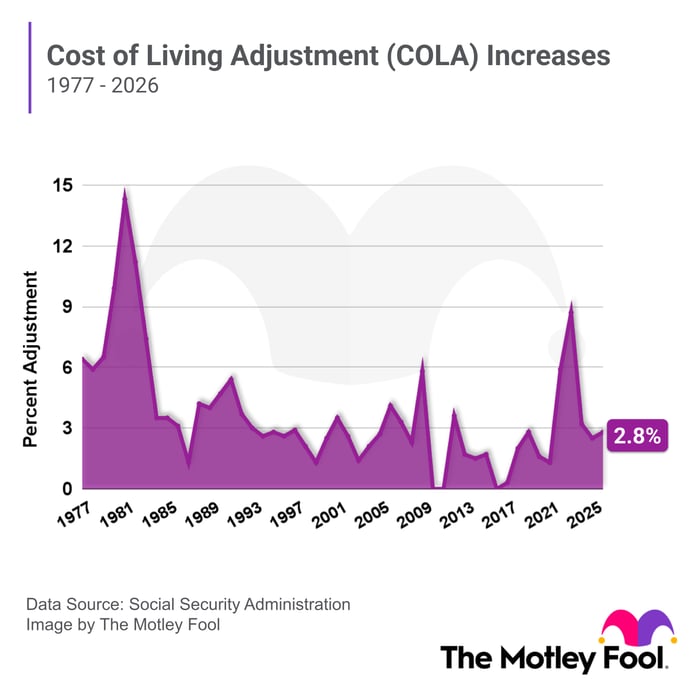

It's official: Social Security recipients can expect a 2.8% cost-of-living adjustment (COLA) in 2026.

The announcement came after the Bureau of Labor Statistics revealed that inflation increased again in September, resulting in an adjustment slightly higher than the 2.7% forecast from experts.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

While next year's COLA will be higher than initially expected, most retirees say it won't be nearly enough. Here's what the average retiree expects to need from the COLA in order for it to effectively keep up with rising costs, as well as some not-so-good news about the future of Social Security.

Image source: The Motley Fool.

Retirees expect to need record-breaking COLAs

According to The Motley Fool's annual Social Security COLA survey, 54% of retirees say that next year's 2.8% adjustment will be insufficient, with 30% of that group strongly believing it won't be enough to cover costs.

That's a fair concern, considering inflation has been stubbornly high all year. Medicare Part B premiums are also projected to increase from $185 per month to $206.50 per month, according to the 2025 Medicare Trustees Report.

The average retired worker collects around $2,008 per month in Social Security benefits, as of August 2025, and a 2.8% COLA would add up to around $56 per month. Meanwhile, the estimated Medicare premium increase could take a $21.50 bite out of that raise, as Part B premiums are generally deducted from Social Security payments.

So what does the average retiree think a sufficient COLA would look like? According to The Motley Fool's survey, roughly one-third of current retirees ideally expect a raise of at least 10%, while 64% want a COLA of 6% or more. Only 5% of retirees are happy with a COLA of less than 3%.

Image source: The Motley Fool.

Over the last half-century, there have been only two years with a COLA of more than 10%, compared to 24 years with an adjustment of less than 3%. Over the past couple of decades, in particular, the COLA has been low -- averaging 2.3% since 2009.

Seniors often get shortchanged by the COLAs

In some ways, a lower COLA is actually a good sign. Because the adjustment is directly tied to changes in inflation, a lower COLA means that inflation has slowed over the past year. The last time retirees received a record-breaking raise was in 2023, with an 8.7% adjustment after inflation soared throughout 2022.

That said, even higher-than-average COLAs have struggled to maintain buying power amid rising costs. A 2024 study from nonpartisan advocacy group The Senior Citizens League found that Social Security has lost around 20% of its purchasing power since 2010, and in most of those years, the inflation rate outpaced the COLA.

The COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which may play a role in why it often falls short for retirees. The CPI-W tracks changes in workers' spending habits, but retirees often have different spending patterns. Older adults are often disproportionately affected by inflation, yet the COLA doesn't always reflect that.

Will COLAs increase going forward?

The COLA is a complicated beast, so there's not necessarily an easy fix. Unless the program changes significantly, it's probably wise to avoid getting your hopes up about a 10% raise.

It's no secret that Social Security is facing financial challenges, which are becoming more serious by the year. While the program isn't going bankrupt or collapsing entirely, the trust funds are expected to run out by 2034, according to the most recent estimates from the Social Security Administration Board of Trustees.

When or if the trust funds are depleted, the program will need to rely on its income sources -- primarily payroll taxes -- to continue paying out benefits. Without the trust funds, though, those income sources will only be enough to cover around 81% of scheduled benefits.

Larger COLAs will be beneficial in the short term, but they will also drain the trust funds faster -- resulting in potential benefit cuts sooner than expected. Again, many factors go into Social Security's COLA decisions. But considering the program is already in a shaky financial situation, it's unlikely that it will increase its spending until its cash shortfall is resolved.

Next year's COLA could provide some much-needed relief for retirees who are feeling the burden of inflation on their budgets. At the same time, though, it's wise to keep your expectations in check when it comes to adjustments going forward.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.