Is AppLovin Stock a Bad-News Buy?

Key Points

Multiple short-seller reports have come out within the past year about AppLovin.

The SEC has recently begun a probe into the company's data collection practices.

The stock has been declining in the past month, although it's still up over 70% this year.

- 10 stocks we like better than AppLovin ›

When a company faces adversity and there is plenty of bad news around its business, that can seem like a troubling time to invest in it. But if nothing comes of the developments and the company proves to be in fine shape, then it could end up rallying and generating fantastic returns for investors who bought on the dip.

Billionaire investor Warren Buffett has famously said he likes to buy great companies "when they're on the operating table" and facing some temporary challenges. The key thing, of course, is knowing whether a company is in temporary trouble, or if it's facing an existential threat.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

One stock that has been in the news for all the wrong reasons of late is AppLovin (NASDAQ: APP), an advertising technology, or adtech, company that has been growing at a feverish pace in recent years. Short-seller reports and concerns about its data collection practices have weighed on the stock. It's down 15% in the past month, and it has fallen 26% from its 52-week high.

Could it be a good stock to buy on weakness right now, or are you better off steering clear of it?

Image source: Getty Images.

There's smoke, but is there fire?

It's one thing for a company to be the target of one short-seller report, but there have been three prominent short-sellers that have questioned AppLovin's practices recently: Muddy Waters, Fuzzy Panda, and Culper Research. The central issue has been around the company's data collection practices and whether the tech company is helping advertisers target users without consent, which would be a violation of app store policies.

The company has denied the allegations. However, the Securities and Exchange Commission (SEC) has also begun looking into the company, to see if there is any merit to a recent whistleblower complaint and the short reports.

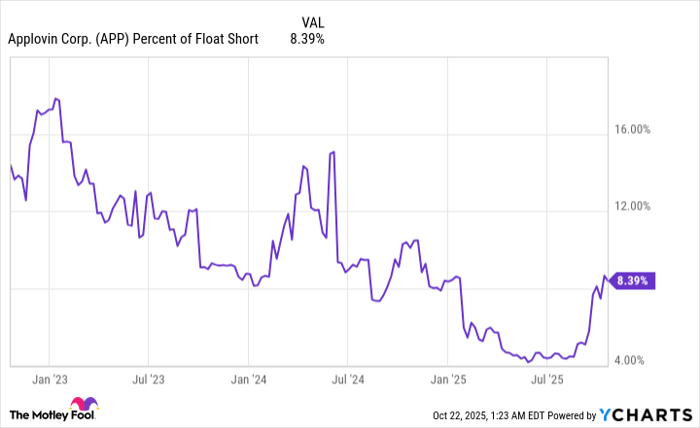

Meanwhile, short interest in the stock had been declining in recent years, but amid these recent developments, there has been an uptick in the number of people betting against the company.

APP Percent of Float Short data by YCharts.

AppLovin's stock may be down, but its valuation remains high

Although AppLovin has come under pressure of late, this recent dip in price is still minimal in relation to how well it has done in recent years; it's up over 3,000% in three years, even when including this recent decline in value.

At more than $200 billion in market cap, this is a highly valuable company, and investors are paying close to 80 times earnings for a piece of the business. By comparison, the average stock on the S&P 500 trades at just 25 times its profits.

The problem with a high valuation such as this is that it offers investors virtually no margin of safety should the SEC find any issues with the company's data collection practices, which could impact both its earnings and growth prospects.

AppLovin's stock is just too expensive and too risky to buy right now

AppLovin isn't a stock that's on an operating table, not yet anyway. Right now, there are just a lot of question marks around the business, which may or may not amount to anything significant or derail its growth. However, the SEC probe is nonetheless a risk investors need to consider when deciding whether to buy the stock or not. And when you combine that with an inflated valuation, there's simply not much of an incentive to take a chance on AppLovin today.

At the very least, investors may be better off taking a wait-and-see approach with the stock to see if anything comes of the investigation. But there's no rush to buy the stock today as it still trades at an extremely high valuation, which effectively assumes a best-case scenario for the business, and that means there's plenty of downside risk.

Should you invest $1,000 in AppLovin right now?

Before you buy stock in AppLovin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AppLovin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.