Could Investing $10,000 in Rigetti Computing Make You a Millionaire?

Key Points

Rigetti possesses two important components of a millionaire-maker stock.

The company has several competitive advantages versus its quantum computing rivals.

However, growing $10,000 into $1 million is a steep hill to climb.

- 10 stocks we like better than Rigetti Computing ›

Over $320,000. That's how much a $10,000 investment in Rigetti Computing (NASDAQ: RGTI) 12 months ago would be worth now. If you had invested the same amount on Oct. 9, 2024, your position in Rigetti would have been worth $615,000 exactly one year later.

Such results might excite many investors seeking to strike it rich with the right stock. Could investing $10,000 in Rigetti Computing make you a millionaire?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Two important components of a millionaire-maker stock

If you look at stocks that have been millionaire makers in the past, they tend to share two key features. First, the companies were early leaders in their fields. Second, they operated in nascent industries that had explosive growth potential. Rigetti Computing checks off both of these important components of a millionaire-maker stock.

Rigetti is one of a handful of rising stars in the quantum computing industry. Sure, several deep-pocketed tech giants are investing heavily in quantum computing. Rigetti, though, is a pure play that focuses only on the promising technology.

Quantum computing definitely has explosive growth potential. Boston Consulting Group predicts that it could create up to $850 billion of economic value by 2040, with a hardware and software market of as much as $170 billion. The entire quantum computing market today is less than $2 billion.

Such astronomical growth isn't far-fetched when you consider what quantum computing might achieve. The technology could dramatically accelerate the training of artificial intelligence (AI) models. It could revolutionize drug discovery and development by simulating the interactions between drug compounds and biological targets. Quantum computing could greatly improve climate modeling and weather forecasting. It could pave the way for new approaches in materials science and design. And those are just a few examples of how the technology could be applied.

Rigetti's advantages

Although quantum computing remains in its infancy, Rigetti has already deployed 18 quantum systems so far. The company has 112 issued patents on its technology, with another 140 patents pending.

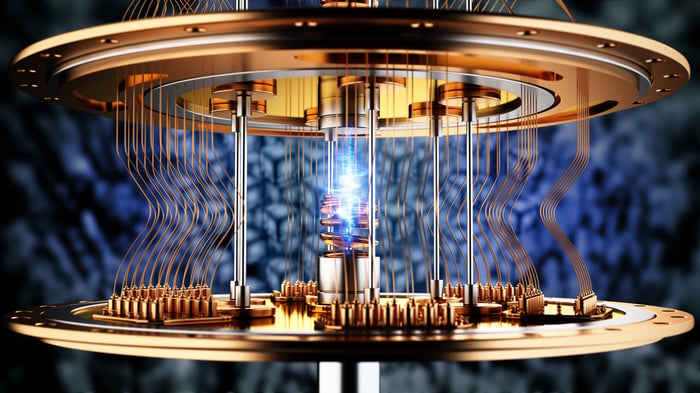

Image source: Getty Images.

One of Rigetti's biggest competitive advantages is its manufacturing expertise. The company built the world's first foundry dedicated to manufacturing quantum integrated circuits. This foundry supports the precise fabrication of quantum chips.

Rigetti makes the industry's largest multichip quantum processing unit (QPU) -- the Cepheus-1-36Q. This QPU contains four nine-qubit chips and halved the error rate of its predecessor. The company plans to unveil a 100+ qubit system by the end of 2025.

It also has the most cost-effective control system in the industry. Rival control systems can cost around $35,000 per qubit. Rigetti's cost is only $10,000 per qubit.

Unsurprisingly, Rigetti has attracted quite a few big customers. They include government agencies such as DARPA, NASA, and the Lawrence Livermore National Laboratory. Financial services giants Moody's and HSBC also use Rigetti's quantum technology. The company's quantum systems can be accessed via Amazon Web Services (AWS) and Microsoft Azure as well.

A steep hill to climb

Could investing $10,000 in Rigetti make you a millionaire? It's possible, but there's a steep hill to climb.

Rigetti's market cap currently stands at around $13.7 billion. To grow $10,000 to $1 million would require the company's valuation to skyrocket by 100x to $1.37 trillion.

Sure, Rigetti's performance over the last 12 months might seem to bode well for its chances of being a millionaire maker. However, many more investors are aware of the stock today than knew about it a year ago.

I think buying shares of Rigetti Computing could pay off handsomely over the long term if the company's technology fulfills its potential. But I wouldn't bet the farm on the quantum computing stock making you a millionaire.

Should you invest $1,000 in Rigetti Computing right now?

Before you buy stock in Rigetti Computing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rigetti Computing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

HSBC Holdings is an advertising partner of Motley Fool Money. Keith Speights has positions in Amazon and Microsoft. The Motley Fool has positions in and recommends Amazon, Microsoft, and Moody's. The Motley Fool recommends HSBC Holdings and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.