Following Nvidia's $5B and SoftBank's $2B, Intel seeks investment from Apple: A Path to Recovery?

TradingKey - According to sources familiar with the matter, chipmaker Intel is in talks with Apple to seek investment support for its turnaround plan and to explore deeper collaboration. Although discussions remain in an early stage and a final agreement is far from certain, the news has swiftly boosted market sentiment, driving Intel’s shares up 6.4% on Wednesday to close at $31.22.

This potential deal would extend Intel’s recent momentum in fundraising. Just last week, NVIDIA announced a $5 billion investment in Intel, aiming to deepen cooperation in PC and data center chips. Meanwhile, Japan’s SoftBank Group revealed a $2 billion investment in Intel last month.

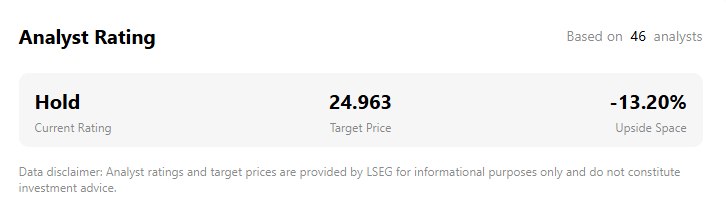

Despite NVIDIA’s investment already providing a lift to Intel’s stock, shares remain well below their historical highs. According to TradingKey Stock Score, Intel currently holds an overall score of 5.97. Wall Street analysts largely maintain a “hold” rating on the stock. Analysts are closely watching whether Intel’s foundry business — producing chips for other companies — can show tangible signs of growth. The current consensus price target is actually 13.2% below the current share price.

Intel’s Dilemma

Intel’s current transformation hinges on the development and commercialization of its next-generation 14A process node (equivalent to 1.4 nanometers), but this technology roadmap faces a severe challenge: a lack of anchor customers. In its 10-Q filing submitted in July, the company explicitly warned that without securing “significant external customers and meeting key milestones,” the development and production of the 14A node and subsequent advanced nodes would “not be economically viable.”

Hendi Susanto, a portfolio manager at Gabelli Funds, told MarketWatch that it’s crucial for Intel to secure customers and design commitments for the 14A process node, “not only to prove its ability to advance its technology roadmap, but also to attract major foundry clients and build the manufacturing scale needed to reach economic viability.”

“Securing Apple as an investor and, hopefully, a major customer would mark a significant breakthrough,” Susanto said in emailed comments.

Apple’s Considerations

For Apple, any potential investment or partnership would be more than just a financial move. Since 2020, Apple has fully transitioned to its own in-house chip designs, with its most advanced processors manufactured by TSMC. Market consensus holds that Apple is unlikely to return to Intel’s x86 architecture chips.

However, analysts note that Apple could be interested in Intel’s foundry services as a “second manufacturing source” to reduce reliance on a single supplier, especially amid heightened geopolitical risks. The potential collaboration also carries significant political weight: Apple has publicly pledged to invest approximately $600 billion in U.S.-based initiatives over the next four years.

"This move can be seen as political, where Apple made a big commitment to invest in U.S. manufacturing," said Ryuta Makino, research analyst at Gabelli Funds. The move would undoubtedly strengthen Apple’s relationship with the Trump administration as well.

Brian Mulberry, senior portfolio manager at Zacks Investment Management, said Apple also could benefit “from onshoring production of components that would avoid tariffs.”