FedEx (FDX) Earnings Preview: Will FedEx Deliver Good Results the way they Deliver Parcels

TradingKey - FedEx Corporation is reporting first-quarter fiscal 2026 earnings this coming Thursday, after the market session. It has been a tough year for FedEx, and this is also reflected in the stock market. FDX price is down 16% in 2025 due to factors such as tariffs, softening macro picture and intense industry competition.

Lackluster Guidance

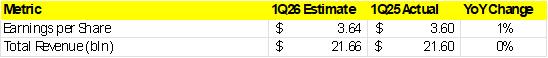

For both Q1 2026 and full-year 2026, the management is guiding a flat top-line growth, mostly due to the trade situation and the slowing down of the economy. FedEx Express and FedEx Ground segments, both representing more than 85% of the total revenue, are expected to remain flat, while the FedEx Freight business (15% of the total revenue) will experience a low single-digit decline.

However, the EPS would be the more important number to look at, due to the company being in the middle of business optimization with the Network 2.0 and One FedEx projects, which are supposed to drive the profitability up. Adjusted EPS for Q1 guided by the management stands at $3.40–$4.00 and for the full-year of 2026 - at $20–$21. Any upward or downward revision will impact the stock price, and this will eventually dependent on how well the above-mentioned business restructuring will work out.

Trade Troubles

The parcel industry was severely hit by the termination of a century-old "de minimis" exemption, which previously allowed goods valued below $800 to enter the U.S. without incurring customs fees and onerous filing requirements. The change took full effect last Friday, August 29. Importantly, the exemption had already been eliminated for China/Hong Kong back in May 2025, which represents around 75% of all de minimis shipments to the U.S.

It is estimated that the headwind in the profit from this will be around $170 to $200 million in Q1 and roughly $50 million in Q2.

However, the recent trade woes may have a positive side effect on FDX and UPS as well, as over 30 international postal operators have stopped delivering to the U.S. This could generate a near-term market share opportunity for the domestic parcel giants, as they fill this gap. But eventually, this may not be enough to offset the effect of the de minimis rule.

Intensified Competition

The competitive landscape in parcel delivery is complex and dynamic. The situation with the major competitor UPS is quite identical, as both UPS and FDX are pressured by new entrants, primarily Amazon and some big retailers who aim to develop their own logistics capabilities (such as Walmart, Target, Best Buy). The large scale of these chains, combined with their desire to take control of the whole delivery chain, does pose a significant threat to FedEx, as their market share will be eroded and they will be forced to cut prices. However, this will take some time, as companies like Amazon still rely on FedEx for fulfilling orders. The recent agreement between the two firms is such an example. We estimate the new Amazon contract could be a revenue opportunity for FedEx.

On the positive side, FedEx still has options to counter the intensified competition. The company has a large fleet (including aircraft), which brings a certain moat. Further to this, venturing into health verticals can bring high-margin business for them.

Expectations Remain Low

All these negative processes related to the economy, the tariffs and the competition are perhaps priced in, considering the current unassuming valuation of just less than 12x forward PE. Low expectation often means limited downside. And this is quite relevant in the case of FedEx.

Any upside in the stock price may come from the freight spin-off, which is expected next year, lifting the PE multiple, and the Network 2.0 integration may add more to the bottom line. However, we continue to expect the near-term will remain challenging.

Get Started