Ripple Price Forecast: XRP retakes $3 as bullish signals hint at record high breakout

- XRP returns above $3.00, marking a significant step toward the $3.66 record high.

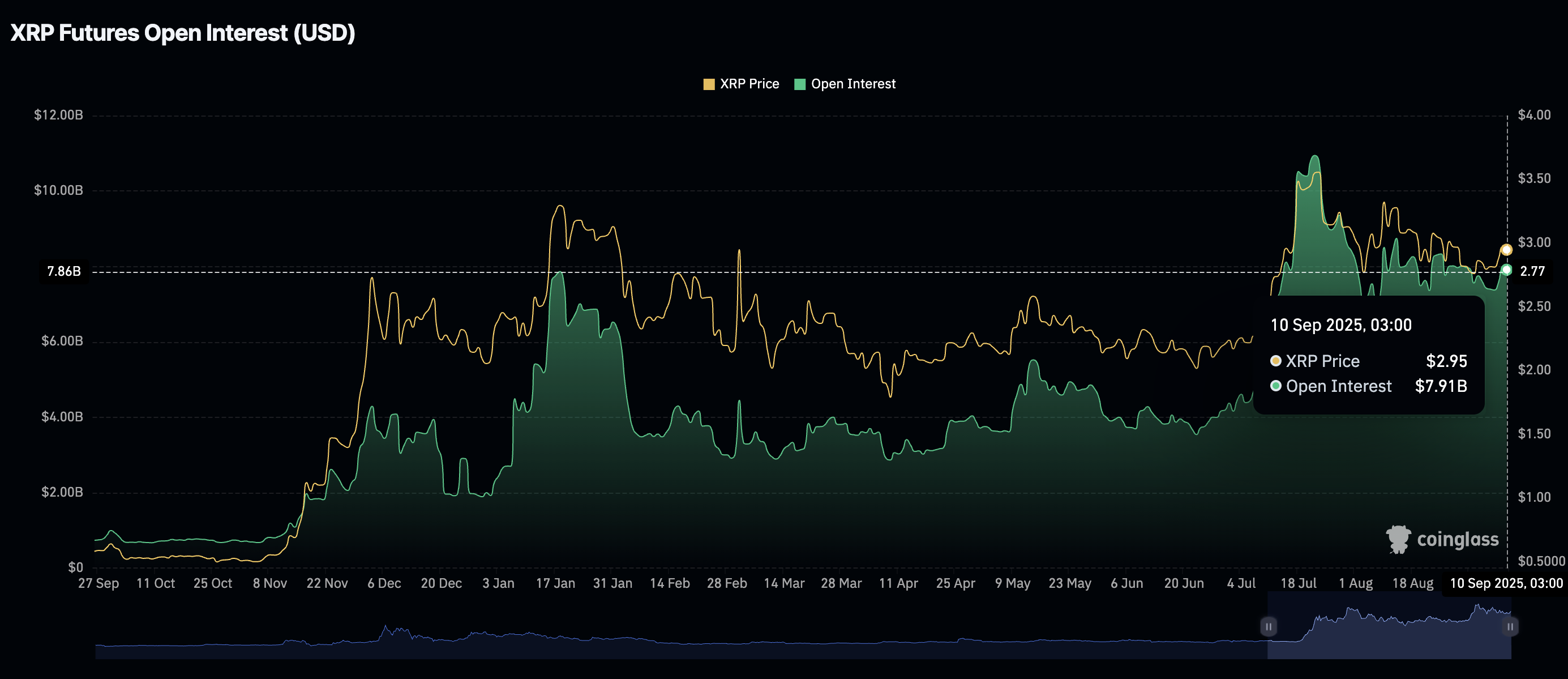

- XRP futures Open Interest nears the $8 billion mark as retail interest grows.

- XRP futures weighted funding rate remains steady near 0.0103% as traders pile into long positions.

Ripple (XRP) bulls are teasing a breakout above the critical $3.00 level on Wednesday, as Bitcoin (BTC) leads the crypto market in a mid-week recovery. Interest in the cross-border money remittance token has been rising this week, following an extended risk-off period that saw XRP’s derivatives market wobble.

A daily close above the $3.00 level is anticipated, which would affirm the short-term bullish outlook and target the hurdle at $3.35.

Traders generally expect the United States (US) Federal Reserve (Fed) to cut interest rates on September 17, following a series of weak economic data, including the Nonfarm Payrolls benchmark revision, which suggests that the US has been grappling with a weakening labor market, stressing the need for rate cuts heading into the fourth quarter.

XRP builds bullish momentum as retail demand swells

The uptick in XRP price is in tandem with the steady increase in the futures Open Interest (OI). CoinGlass data shows that OI, referring to the notional value of outstanding futures contracts, is approaching the $8 billion mark, up from $7.37 billion posted on Sunday.

As the OI increases, XRP price gains bullish momentum, underpinning investor confidence in the uptrend. Similarly, a higher OI reading as volume rises implies heightened trading activity.

XRP Futures Open Interest | Source: CoinGlass

A steady weighted funding rate of 0.0103%, as shown in the chart below, supports the positive sentiment surrounding XRP. This implies that traders are piling into long positions, expecting the rebound above $3.00 to continue in the short term.

XRP Futures Weighted Funding Rate | Source: CoinGlass

Technical outlook: XRP bulls set eyes on record high

XRP holds above several key levels, including the resistance-turned-support at $3.00, a descending trendline and the 50-day Exponential Moving Average (EMA) at $2.91 on the daily chart.

The Moving Average Convergence Divergence (MACD) indicator reinforces the short-term bullish outlook, sustaining a buy signal triggered on Monday. Investors will likely continue to seek exposure as long as the blue MACD line holds above the orange signal line.

Based on the Relative Strength Index (RSI), positioned at 55, bearish momentum is gradually fading, paving the way for bulls to regain control of the trend. Higher RSI readings, approaching overbought territory, would underpin the steady increase in buying pressure backing retail demand for XRP.

XRP/USDT daily chart

Still, traders should be cautious and watch out for sustained pullbacks below the 50-day EMA support at $2.91. The 100-day EMA at $2.78 and the 200-day EMA at $2.53 would serve as tentative support levels in that case. Profit-taking amid changing market dynamics could result in risk-off sentiment overwhelming buying pressure.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.