Dow Jones Industrial Average hesitates as government shutdown looms

- The Dow Jones struggled to maintain bullish momentum on Monday.

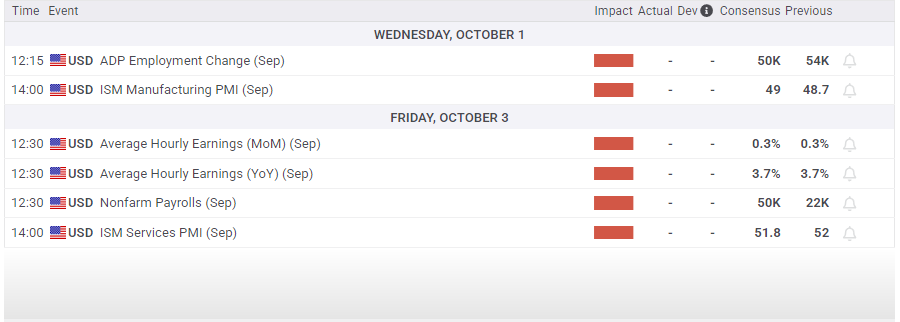

- The AI tech rally continues to face fresh headwinds, and a key US NFP jobs report is due this week.

- Labor data may wind up delayed if the US government fails to pass a funding resolution in time.

The Dow Jones Industrial Average (DJIA) hit a fresh patch of bearishness on Monday, easing back slightly from the week’s early highs near 46,500. Equities remain apprehensive as a looming government shutdown throws a wrench in the works for investors awaiting this week’s latest Nonfarm Payrolls (NFP) report.

The ongoing AI tech rally continues to wobble, but cracks are beginning to spread across the surface. Huge partnerships and investment announcements continue to pump record volumes of investment cash into the AI tech space as infrastructure spend skyrockets. However, questions about how revenues will overtake building and upkeep costs continue to mount with few answers in sight.

Investors brace for an NFP that may not come

Markets are closely watching the US government to see if Republican and Democrat lawmakers can meet in the middle on accelerating funding costs to keep the federal government operating. US President Donald Trump threatened sweeping federal worker firings if the US government can’t cut itself a cheque for the pace of outsized spending that has struck federal coffers since the Trump administration took office in January.

The US Labor Department is preparing to delay the latest NFP jobs report, currently slated for this Friday. If the federal government shuts down this week, investors will have to wait a while to see the latest employment figures. A raft of bitter labor data markdowns has left a sour taste in the mouths of many market watchers, including President Trump, who terminated the head of the Bureau of Labor Statistics (BLS) recently following a disastrous NFP print that showed the pace of US job creation has slowed to a crawl during his second term. A follow-up write down of job creation from March 2024 to March of 2025 showed the US economy has overall added far fewer jobs than many had priced in.

Dow Jones Daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.