Cardano Price Analysis: Hoskinson's optimism clashes with bearish technical outlook

- Charles Hoskinson shared the possibility that Cardano could outperform Bitcoin and potentially become its yield layer.

- The derivative data signals a decline in optimism as open interest and bullish bets decrease.

- The technical outlook highlights a bearish path of least resistance, targeting the 50-day EMA.

Cardano (ADA) edges lower by 1% at press time on Tuesday, extending the nearly 5% drop from Monday. Despite the short-term bearishness, Charles Hoskinson, the co-founder of Cardano, shared an optimistic note in a recent podcast, suggesting that Cardano could outperform Bitcoin while potentially becoming Bitcoin’s (BTC) yield layer.

Still, both the derivative and technical data point to an extended pullback in ADA, potentially towards its 50-day Exponential Moving Average (EMA).

Charles Hoskinson shares optimistic comments for Cardano and ADA holders

In a podcast with Jason Yanowitz, the co-founder of Blockworks, Charles Hoskinson highlighted the limitations of Bitcoin's performance over the next few years, potentially reaching $1 million, a 10-fold increase. Cardano, on the other hand, Charles believes it will outperform BTC with a 100-fold or possibly a 1000-fold jump.

Based on the current market capitalization, Bitcoin would reach $23 trillion in the said scenario, while Cardano’s ballpark figure ranges from $2.7 trillion to $27 trillion. However, the case of 1000-fold, where Cardano overtakes Bitcoin, seems unlikely given the growing adoption of Bitcoin by institutional investors and government reserves.

Charles also highlights the growing role of Bitcoin in Decentralized Finance (DeFi) and Cardano’s potential to become its yield layer, offering access to staking, yield farming, and other DeFi services.

Hoskinson shared the possibility that Cardano partner chains might bring annual airdrops for ADA holders, starting with the launch of Midnight (NIGHT) tokens. It is worth noting that 50% of NIGHT tokens from the 24 billion supply will be reserved for ADA holders.

Bullish bets, open interest declines in ADA derivatives

CoinGlass’ data shows the ADA Open Interest (OI) at $1.51 billion, down from the all-time high of $1.74 billion last week. The $230 million drop in a week reflects a significant capital outflow, suggesting a declining interest among traders.

Cardano Open Interest. Source: Coinglass

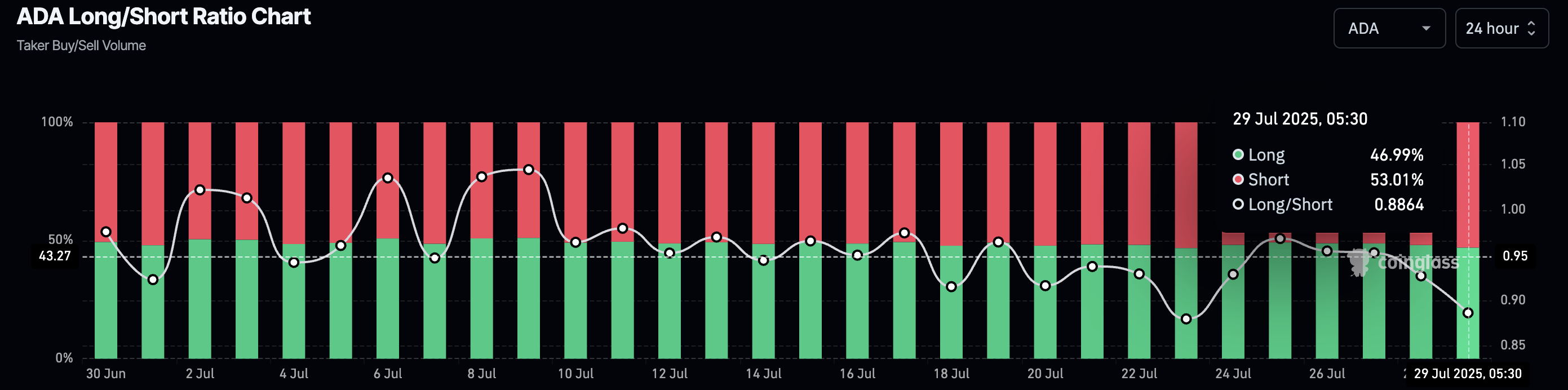

The long/short ratio chart declines to 0.8864, from 0.9272 over the last 24 hours, suggesting an increase in short positions. The sell-side dominance grows as short positions surge to 53.01%, up from 51.89%.

ADA long/short ratio. Source: Coinglass

A decrease in OI and long positions in ADA derivatives translates to a dimmed optimism amid a broader market pullback.

Cardano’s declining trend targets the 50-day EMA

Cardano edges lower by 1% at press time on Tuesday after the nearly 5% drop from the previous day. The altcoin forms a multi-month resistance trendline formed by connecting the December 3 and March 3 peaks.

ADA’s recent rejection from the trendline on July 21 also marked the failure to surpass the 50% retracement level at $0.9187, drawn from $1.3264 on December 3 to $0.5110 on April 7. Cardano’s declining trend projects a path of least resistance to the 50-day EMA at $0.7228.

The Moving Average Convergence Divergence (MACD) crossed below its signal line on Sunday, flashing a sell signal with the resurgence of red histogram bars. The Relative Strength Index (RSI) reads 54 on the daily chart as it declines towards the halfway line, suggesting decreasing buying pressure.

ADA/USDT daily price chart.

On the flip side, a reversal in Cardano could test the overhead resistance trendline near the 50% retracement level at $0.9187.