Crypto markets dip as traders book profits ahead of US CPI

- Crypto market faces a broad pullback on Tuesday as traders lock in profits following a strong rally last week.

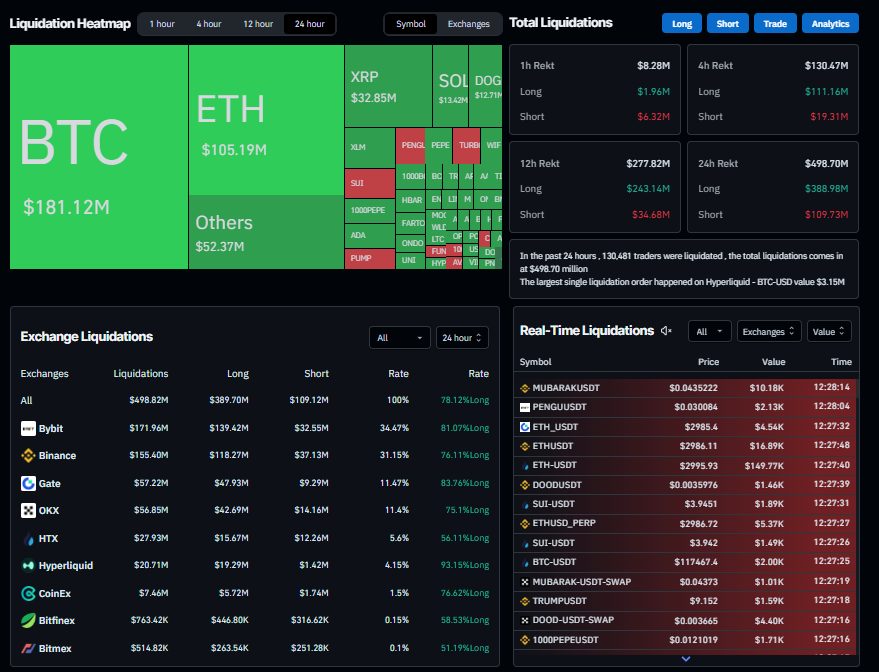

- Nearly $500 million in leveraged positions were liquidated across crypto markets in the past 24 hours, 78% of which were long positions.

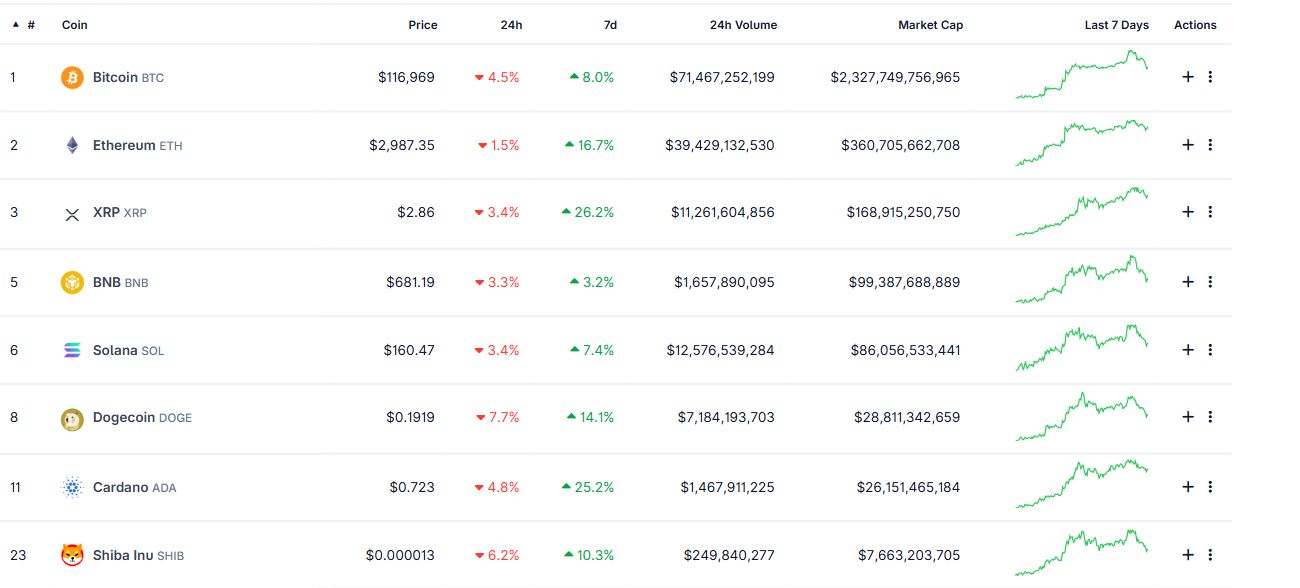

- Major cryptos such as ETH, SOL, XRP, and ADA, along with meme coins DOGE and SHIB, follow the market-wide decline.

Crypto market trades in red on Tuesday as traders lock in profits ahead of the US Consumer Price Index (CPI) release. The correction follows a strong rally last week, with Coinglass data showing that nearly $500 million in leveraged positions were liquidated in the past 24 hours, out of which 78% were long positions. Major cryptocurrencies like Ethereum (ETH), Solana (SOL), Ripple (XRP), and Cardano (ADA), along with meme coins such as Dogecoin (DOGE) and Shiba Inu (SHIB), all post losses amid growing investor caution.

Crypto market dips, as holders book profits

Bitcoin and major altcoins are facing a correction during the European session on Tuesday, with BTC falling 2% and reaching a low of $116,250 after hitting an all-time high of $123,218 the previous day.

Major cryptocurrencies like ETH, SOL, XRP, and ADA, along with top meme coins such as DOGE and SHIB, all follow BTC’s lead and trade in red, as shown in the CoinGecko chart below.

This correction follows a strong rally in the crypto markets last week, as investors begin to realize profit and increase selling pressure. CryptoQuant data shows that BTC’s Exchange Netflow (the difference between BTC flowing into and out of the exchange) is positive and reaches levels not seen since February 25. An increase in inflows indicates investors are likely sending BTC to sell and could contribute to the short-term pullback in major altcoins and meme coins.

- All Exchanges (5)-1752567157433.png)

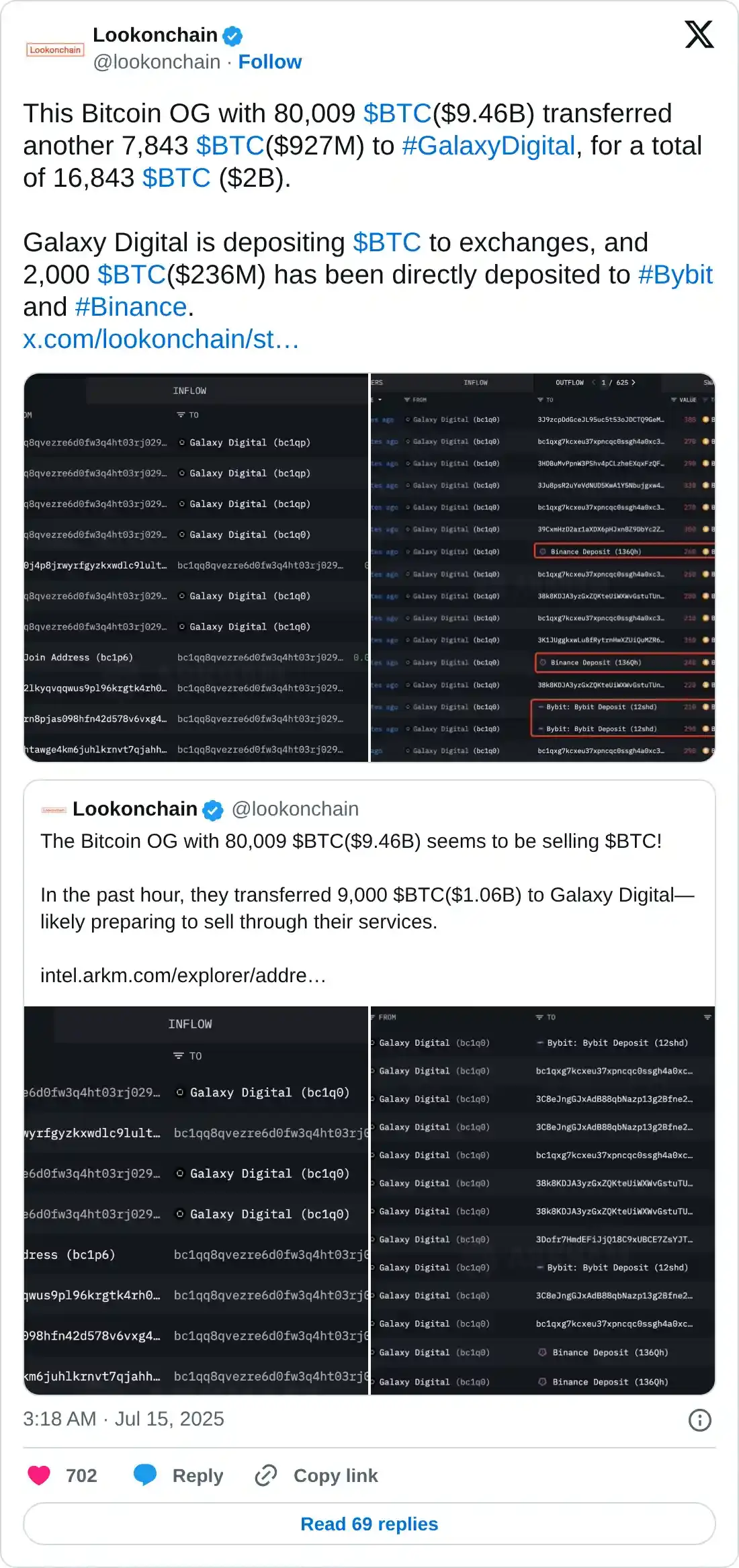

Additionally, Lookonchain data shows that BTC’s dormant wallet holding 80,009 BTC worth $9.46 billion has transferred another 7,843 BTC worth $927 million to Galaxy Digital, making a total transfer of 16,843 BTC, nearly $2 billion. Galaxy Digital is depositing BTC to exchanges, with 2,000 BTC worth $236 million directly deposited to Bybit and Binance exchanges on Tuesday, increasing the selling pressure.

This rising selling pressure in cryptocurrencies has triggered a wave of liquidation in the crypto markets. According to the CoinGlass Liquidation Map chart, a total of 130,735 traders were liquidated in the last 24 hours, resulting in a total liquidation value of nearly $500 million, with 78% of the positions being long.

These massive liquidations and holders realizing profits come as investors turn cautious ahead of the upcoming US Consumer Price Index (CPI) report to be released during the late American session on Tuesday.

FXStreet reported on Tuesday that inflation in the US is expected to rise at an annual rate of 2.7% in June, having recorded a 2.4% increase in May and core CPI, which excludes food and energy, is forecast to rise 3% YoY compared to the 2.8% acceleration reported in the previous month. Overall, inflation is expected to tick up further away from the Fed’s 2% target.

This increase is being partly driven by new tariffs imposed by US President Donald Trump, which are beginning to push up the cost of goods.

If the CPI reading comes in higher than expected, it could strengthen the US Dollar (USD), reduce risk appetite, and pressure cryptos. Conversely, if inflation data came in softer than expected, markets may regain confidence in interest rate cuts by the Federal Reserve (Fed), which could support risk-on sentiment and riskier assets like cryptocurrencies.