Analyst Says MicroStrategy Could Trigger a Bitcoin Cascade Worse Than Mt. Gox or 3AC

Analysts voice concerns that MicroStrategy, the largest corporate holder of Bitcoin (BTC), may be sitting on a financial time bomb that could ripple through the entire crypto market.

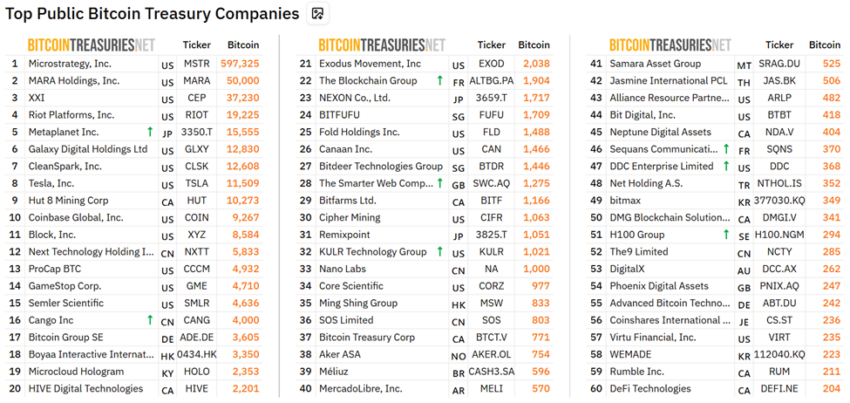

With over 597,000 BTC, equivalent to 3% of Bitcoin’s total supply, the business intelligence company-turned-Bitcoin proxy now poses what some call “crypto’s biggest liquidation risk.”

MicroStrategy’s $71 Billion Bitcoin Bet Raises Systemic Risk Concerns

Bitcoin hit another all-time high (ATH) on Sunday, steadily edging towards the $120,000 threshold. This time, however, the surge comes amid institutional interest rather than retail buying momentum.

Chief among them is MicroStrategy (now Strategy), which holds 597,325 BTC, worth over $71 billion as of this writing.

Top Public Bitcoin Treasury Companies. Source: Bitcoin Treasuries.

Top Public Bitcoin Treasury Companies. Source: Bitcoin Treasuries.

Leshka.eth, a KOL and investment strategist, laid out the scale and fragility of MicroStrategy’s Bitcoin play.

“Everyone’s celebrating while this creates crypto’s biggest liquidation risk,” Leshka wrote.

The analyst notes that MicroStrategy’s $71 billion position in Bitcoin has been built on top of $7.2 billion in convertible debt raised since 2020. Its average BTC purchase price sits around $70,982.

If Bitcoin were to fall below that mark, the paper losses could start applying real pressure on its balance sheet.

Unlike spot ETFs (exchange-traded funds), MicroStrategy lacks cash buffers or redemption mechanisms.

This means any downturn in Bitcoin’s price would directly hit the company’s valuation and could, in an extreme case, force asset sales to cover liabilities.

“This is not just a high-beta Bitcoin play—it’s a leveraged bet with very little margin for error,” Leshka warned.

The Fragile Feedback Loop Behind MicroStrategy’s Bitcoin Strategy

While many retail and institutional investors treat MicroStrategy stock (MSTR) as a liquid way to gain Bitcoin exposure, it carries risks far beyond those of regulated ETFs.

Leshka explained that MSTR trades at a premium over its net asset value (NAV), sometimes up to 100%. This “premium feedback loop”—where rising share prices fund more BTC buys—can collapse quickly in a downturn.

If investor sentiment shifts and MSTR’s NAV premium evaporates, the company’s access to fresh capital would dry up.

Such an outcome could compel difficult decisions about MicroStrategy’s Bitcoin holdings.

The post references the 2022 Terra-LUNA collapse, where a $40 billion market cap evaporated due to a similar leverage spiral. This comparison highlights a real precedent for systemic risk.

The collapse of MicroStrategy’s core business adds to the fragility. Software revenue fell to a 15-year low of $463 million in 2024, and headcount has dropped by over 20% since 2020.

The company is now effectively a Bitcoin fund with minimal diversification, meaning its fortunes rise and fall with the crypto market.

Elsewhere, critics say this level of centralization poses a threat to Bitcoin’s decentralized ethos.

Leshka agrees, noting that Bitcoin was built to avoid central control, which makes MicroStrategy holding 3% of all BTC a single point of failure.

Still, not all analysts see the setup as apocalyptic. Convertible bond maturities stretch from 2027 to 2031, with minimal near-term interest obligations. If Bitcoin avoids a collapse below $30,000, forced liquidations are unlikely.

Additionally, in the event of financial stress, MicroStrategy could dilute equity rather than sell BTC directly, giving it optionality.

Notwithstanding, the core concern remains that a system dependent on relentless optimism and premium-driven capital raises is inherently fragile.