Ripple Price Forecast: XRP bulls tighten grip as Ripple selects BNY for RLUSD stablecoin reserves

- XRP extends recovery to $2.38, backed by a technical breakout from an inverse Head-and-Shoulders pattern.

- Ripple has settled on the Bank of New York Mellon as the primary custodian of RLUSD stablecoin reserves.

- The RLUSD stablecoin focuses on providing purpose-built enterprise utility for cross-border payments.

Ripple’s (XRP) price is bullish, rising over 2% to exchange hands at around $2.35 at the time of writing. This increase in the price of XRP comes amid growing macroeconomic uncertainty, triggered by United States (US) President Donald Trump expanding the scope of his potential tariffs to include copper and pharmaceuticals.

Ripple selects Bank of New York to custody RLUSD stablecoin reserves

Ripple, the issuer of XRP, has announced the selection of the Bank of New York (BNY), a renowned global service institution, as the primary custodian for its enterprise-grade Ripple USD (RLUSD) stablecoin reserves.

According to the announcement via a blog post, RLUSD stands out from other stablecoins for being regulatory-compliant, transparent, and fostering institutional-oriented utility. The token, pegged to the US Dollar (USD), is issued under a New York Department of Financial Services (NYDFS) Trust Company Charter.

“Ripple USD addresses a critical gap in the market as a stablecoin developed for enterprise-grade financial use cases, designed to meet the rigorous standards of leading financial institutions,” SVP of Stablecoins at Ripple, Jack McDonald, said.

Ripple has, in recent weeks, committed to expanding its stablecoin infrastructure by building strategic partnerships beyond the US, particularly in the European and Asian regions. The company aims to be the bridge between traditional finance and the digital currency ecosystem, potentially capturing a significant portion of the SWIFT system’s global volume.

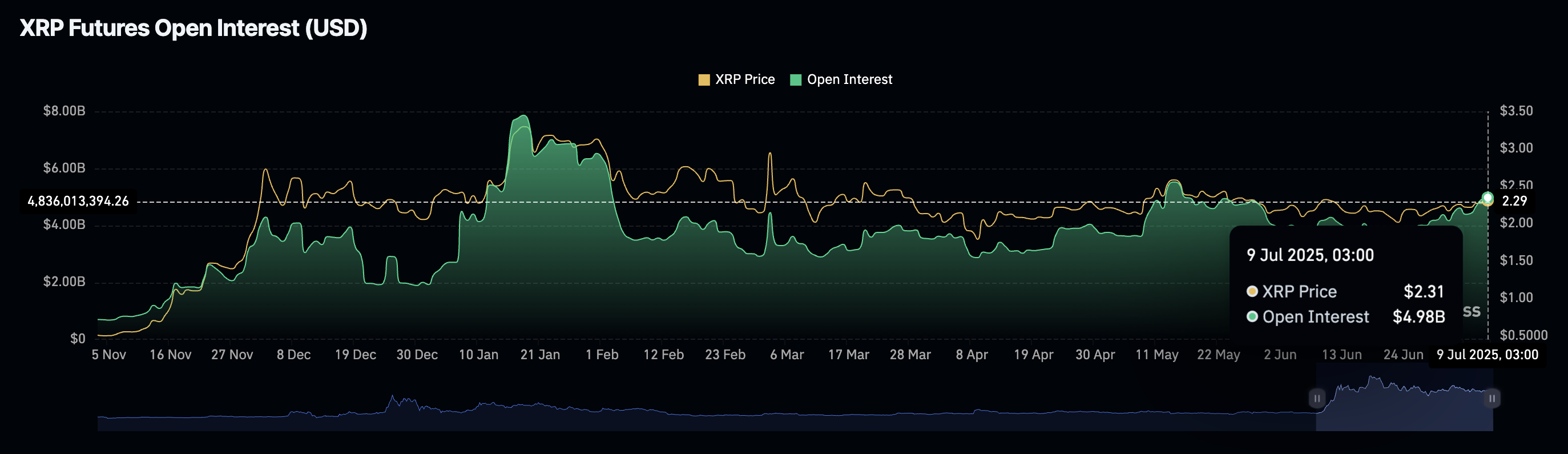

Interest in the token has also continued to improve over the past two weeks, with XRP futures Open Interest (OI) rising to $4.98 billion from the $3.54 billion recorded on June 23. OI represents the value of all futures and options contracts that have not been settled or closed. The nearly 30% increase indicates trader confidence in the token, with bets on futures price increases buoying risk-on sentiment.

XRP futures Open Interest | Source: CoinGlass

Technical outlook: XRP breaks out, targets $2.76

XRP’s price is back in a short-term bullish phase, backed by growing interest in the derivatives market. The token has offered multiple technical bullish signals on the 8-hour chart below, starting with a Golden Cross pattern.

A Golden Cross is a bullish formation characterized by a shorter-term moving average crossing above a longer-term moving average. For instance, the 50-period Exponential Moving Average (EMA) currently holds above the 200-period EMA, reinforcing the bullish structure.

Traders will likely seek exposure, considering the Moving Average Convergence Divergence (MACD) indicator has sustained a buy signal since Sunday. The green histogram bars expanding above the mean line signal that the bullish outlook may have the potential to sustain recovery in upcoming sessions.

A recently confirmed breakout from an inverse Head-and-Shoulders (H&S) pattern estimates an 18% move to $2.76. This target, as discussed in the previous price forecast, is determined by measuring the height of the pattern and then extrapolating above the breakout point.

XRP/USDT 8-hour chart

Still, XRP could face resistance at $2.40, a level that capped price action around June 20. A trend reversal from this level or slightly higher could be motivated by potential pressure from profit-taking activities and the possibility of changing market dynamics, especially with tariff shockwaves on the horizon.

Key levels to keep in mind as tentative support are the confluence formed by the 50-period EMA and the 200-period EMA at $2.22, the 100-period EMA at $2.21, and the area around $2.20, which was tested on July 5.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.