Stablecoin Cap Sets $228 Billion Record—What’s Behind The 2025 Boom?

Data shows the stablecoin market cap has been enjoying a sharp surge in 2025 and has reached a new record. Here’s what’s driving the growth.

Stablecoin Market Cap Has Gone Up By 17% In 2025 So Far

In a new post on X, the on-chain analytics firm CryptoQuant has talked about the latest trend in the market cap of the stablecoins. A “stablecoin” is a cryptocurrency that has its price pegged to a fiat currency (with the US Dollar being the most popular one).

Investors use the stables for a variety of purposes, like as a mode of payments or a sort of safe-haven away from the volatility that comes with other digital assets like Bitcoin.

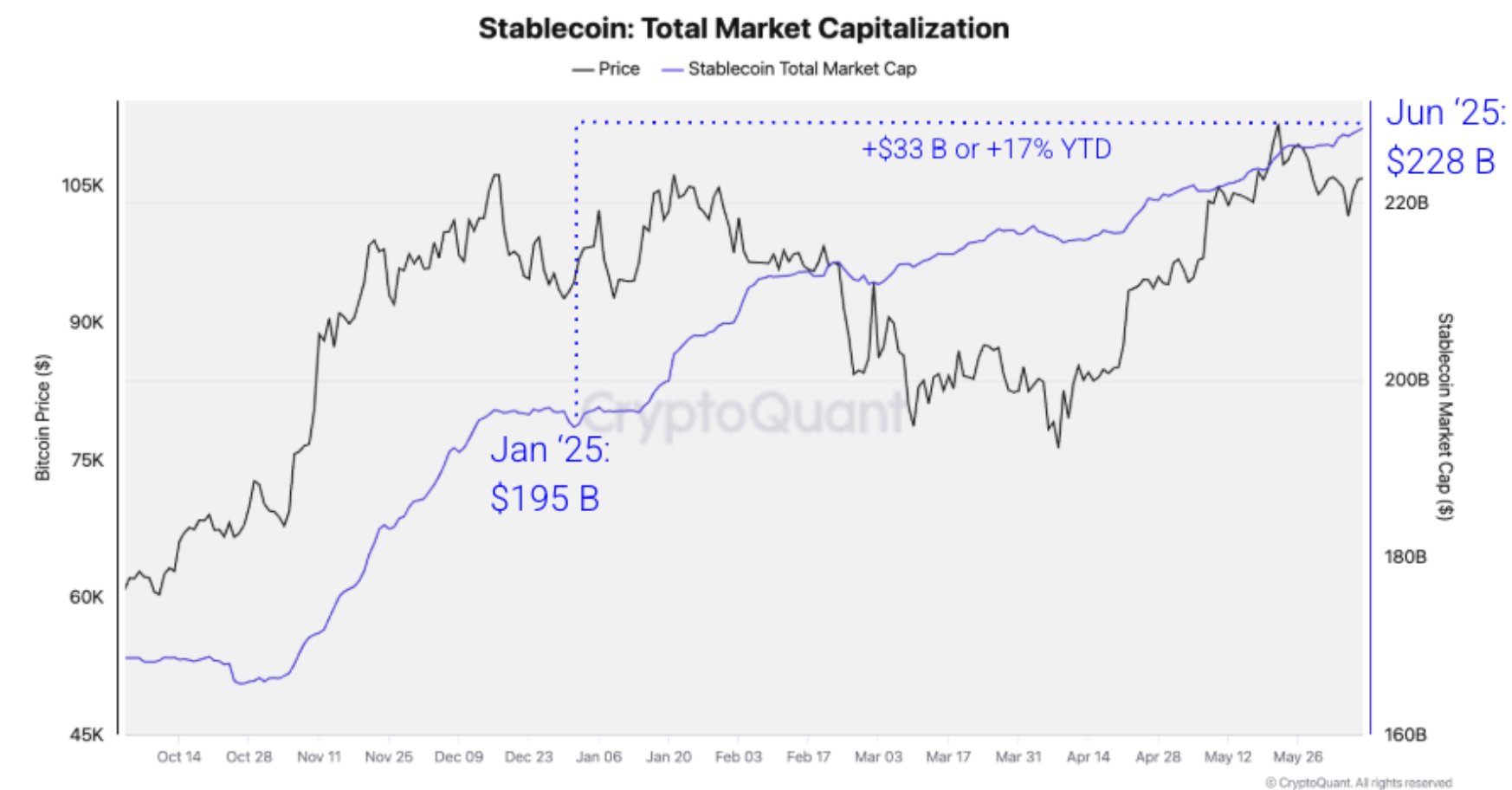

Below is the chart shared by CryptoQuant that shows how the market cap of the stablecoins has grown during the past few months.

From the graph, it’s visible that the stablecoin market was valued at $195 billion in January, but today it has risen to $228 billion. This represents an increase of $33 billion or 17% year-to-date.

As for what’s behind the metric’s growth, the analytics firm says it’s driven by “rising trading activity, growing payment use, and clearer U.S. regulation under Trump.”

Speaking of US regulation, a bipartisan bill aimed at regulating stablecoins is gaining momentum in the Senate and could pass as early as next week, according to a report.

As mentioned earlier, investors can choose to invest in these fiat-tied tokens as a means of avoiding the risk associated with Bitcoin and other volatile cryptocurrencies.

Some of these holders plan to re-invest into the other side of the market in the future, so a chunk of the capital stored in the form of stablecoins can be looked at as potential dry powder for BTC and company. As such, growth in the market cap of these assets may prove to be a constructive sign for the sector as a whole.

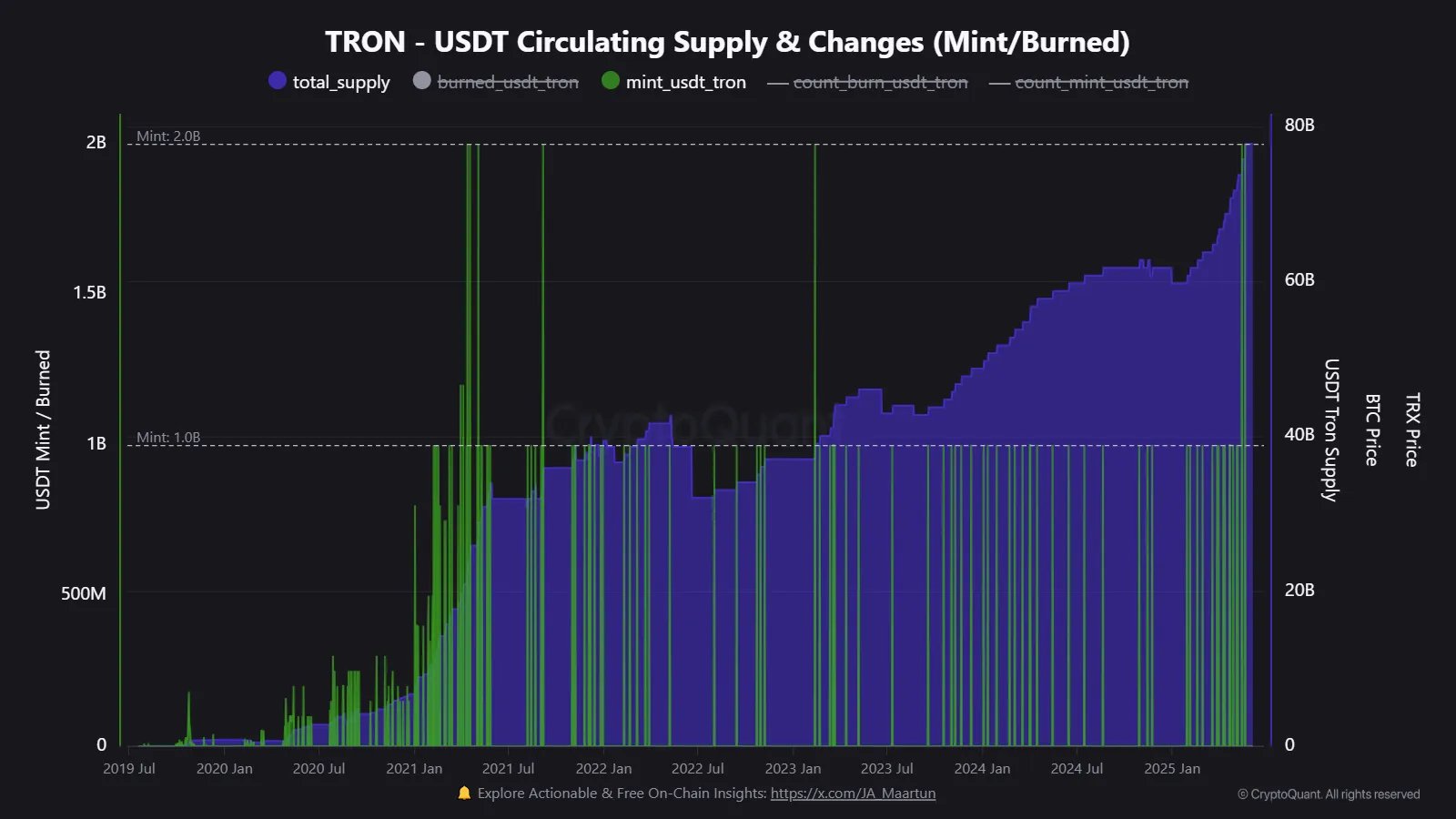

A digital asset network that stands out in relation to the stables is Tron. As pointed out by CryptoQuant author Maartunn in a new thread on X, the TRX network hosts the most amount of stables across all chains.

According to the analyst, Tron holds $75.7 billion worth of USDT, the largest stablecoin. In comparison, the Ethereum network occupies $71.4 billion of the coin’s market cap.

Lately, USDT mints of more than $1 billion have been becoming more common on the TRX chain. In 2025, there have been 17 mints exceeding this value so far.

BTC Price

At the time of writing, Bitcoin is floating around $108,300, up almost 5% in the last seven days.