How to Retire Early with Bitcoin (BTC): Experts Reveal Key Strategies

Cryptocurrency, particularly Bitcoin (BTC), has often been touted as having the potential to deliver massive gains for investors. However, many now believe Bitcoin could also be the key to retiring early.

With its impressive growth and the promise of long-term value, Bitcoin offers a unique opportunity for those seeking financial independence. Thus, some experts have outlined several strategies for achieving retirement through Bitcoin investments.

How Much Bitcoin Do You Need to Retire with $100,000 Annually?

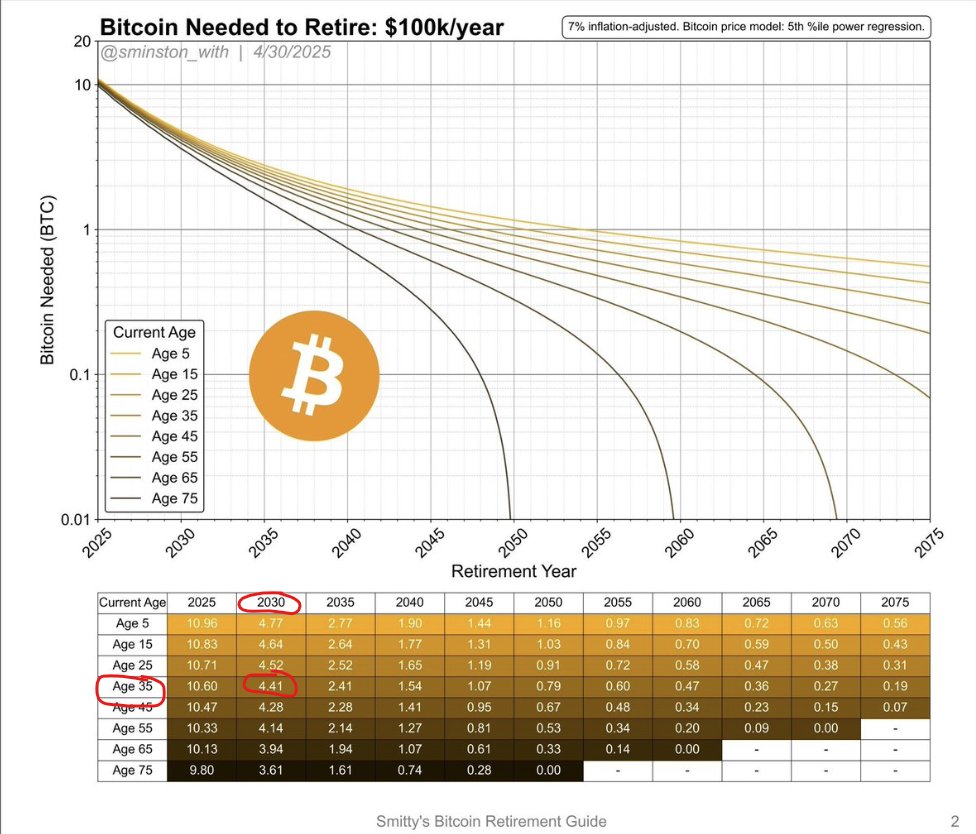

David Battaglia, a cryptocurrency analyst, recently shared a detailed analysis on X. He presented a model that estimates the amount of Bitcoin required to retire with $100,000 per year by factoring in two key elements.

First, a 7% annual inflation rate is considered, which adjusts for the increasing cost of living and the decreasing value of money over time. Second, the model uses a Bitcoin price model based on a 5th percentile power regression. This provides a conservative estimate of Bitcoin’s future value.

Bitcoin Retirement Strategy. Source: X/DavidBattaglia

Bitcoin Retirement Strategy. Source: X/DavidBattaglia

The data shows that the number of BTC needed for retirement is influenced by the year in which retirement begins and the individual’s age. The earlier the retirement date, the more BTC is required.

For example, someone aged 35 and planning to retire in 2030 would require approximately 4.41 BTC ($460,000 at current prices).

“This implies that the price of Bitcoin in 2030 would be high enough for 4 BTC to be worth an amount that, when invested or spent gradually, would provide you with $100,000 annually,” Battaglia said.

Battaglia explained that if investors withdraw 4% or its inflation-adjusted equivalent annually (common in Financial Independence, Retire Early), those 4 BTC should be worth at least $2,500,000 in 2030. That means each BTC should be worth $584,112 in 2030.

“The key is inflation and Bitcoin’s price growth: The model adjusts the value of $100,000 for a 7% annual inflation, meaning that the purchasing power of $100,000 in 2030 will be lower than in 2025. Additionally, the price of Bitcoin grows according to the regression model, which reduces the amount of BTC needed over time (the descending lines),” he added.

He suggested two primary methods to access this income: selling Bitcoin gradually over time or entrusting the assets to an institution for a fixed annual payout.

However, he cautioned against the risks of third-party custody. Battaglia also emphasized the importance of tax strategy, recommending residency in a zero-tax jurisdiction like Paraguay to maximize returns.

“What is clear is that we are getting closer to the point where the price of Bitcoin will provide financial independence for holders for the rest of their lives. The bad news is that there isn’t enough Bitcoin for those who don’t take action in the coming years. We also assume a very modest Bitcoin price for 2030,” he remarked.

Complementing Battaglia’s approach, an analyst who goes by the pseudonym Hornet Hodl has developed a Bitcoin calculator inspired by the FIRE model used in traditional finance.

This tool incorporates various Compound Annual Growth Rate (CAGR) models tailored to Bitcoin’s unique market cycles. The calculator allows users to project Bitcoin’s future value and determine sustainable withdrawal rates based on different growth scenarios.

“This is a great retirement planning tool for Bitcoiners. Choose a model, choose when you are going to retire, estimate the amount,” Fred Krueger stated.

For instance, Model 6, which uses a conservative median line of the Power Law, balances early-stage price growth with diminishing returns in later years, ensuring realistic projections for retirement planning.

Retirement Planning With Bitcoin. Source: Bitcoin FIRE Calculator

Retirement Planning With Bitcoin. Source: Bitcoin FIRE Calculator

This tool helps investors estimate how much Bitcoin they need and how to withdraw funds without depleting their portfolio. By smoothing out yearly returns with CAGR, Hodl’s calculator provides a practical framework for long-term retirement planning with crypto.

Could Bitcoin Lead to Early Retirement? Mark Moss Explains His 5-Year Plan

Meanwhile, Mark Moss offers a distinct strategy focused on tax efficiency and asset preservation. In a YouTube video, Moss outlined a “5-year retirement plan.”

It involves accumulating Bitcoin, leveraging it for tax-free loans, and using the asset’s growth to generate wealth without depleting the principal.

“The rich use debt to leverage investments and create additional income streams. While the average person uses debt to buy things that make rich people richer. Don’t do it that way. We want to be able to buy assets that make us more wealthy. Okay, let’s talk about the cheat code. Now, the cheat code is Bitcoin,” Moss said.

Moss argues that this method allows the Bitcoin portfolio to continue appreciating while providing a steady income stream. He claims this approach can lead to retirement in as little as five years, as the borrowed funds can cover living expenses while the underlying asset grows in value, potentially leaving a legacy for future generations.

“We believe that by the end of that runup in about 5 years, Bitcoin will be about the same size of global store value assets as gold. Bitcoin and gold will be about on par, about 20 trillion each,” he claimed.

Nonetheless, not everyone agrees with crypto’s retirement potential. Sibel, a crypto trader, argued that it’s nearly impossible to “retire” from crypto.

“You can’t ‘retire’ from crypto. Have you ever seen someone from our industry that made it and left? Except people that had to ran away. Even these people turned back with newly created accounts. You became too attached to gambling at some point that it’s impossible to leave,” she noted.

She highlighted how even high-profile figures who made millions briefly left the industry, only to return seeking more wealth and clout. Sibel suggests that the crypto space functions like an endless casino, where individuals can never fully break free from the trading cycle, no matter how much they’ve earned. The lure of profit and recognition keeps people tethered to the industry, regardless of their initial intentions to retire.

In conclusion, Bitcoin offers a unique opportunity for early retirement through various strategies, from David Battaglia’s inflation-adjusted model to Mark Moss’s tax-efficient approach.

Tools like the Bitcoin FIRE calculator also help investors plan their retirement. However, as Sibel points out, the crypto market’s addictive nature may make it difficult for some to step away fully. While Bitcoin can provide a path to financial independence, it requires careful planning, market understanding, and discipline.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The strategies discussed are speculative and may not materialize as expected. Cryptocurrency investments are highly volatile and involve significant risks. Always conduct thorough research and consult with a financial advisor before making any investment decisions.