This Is How Aster Whales Can Save Price From Its First Bearish Crossover

Aster’s steady three-week uptrend has been abruptly interrupted as broader market conditions weakened, dragging the altcoin lower. The shift reflects rising bearish pressure across the crypto market, putting Aster at risk of deeper losses.

However, whale behavior suggests that a full breakdown may still be avoided if their support continues.

Aster Whales Stand Firm

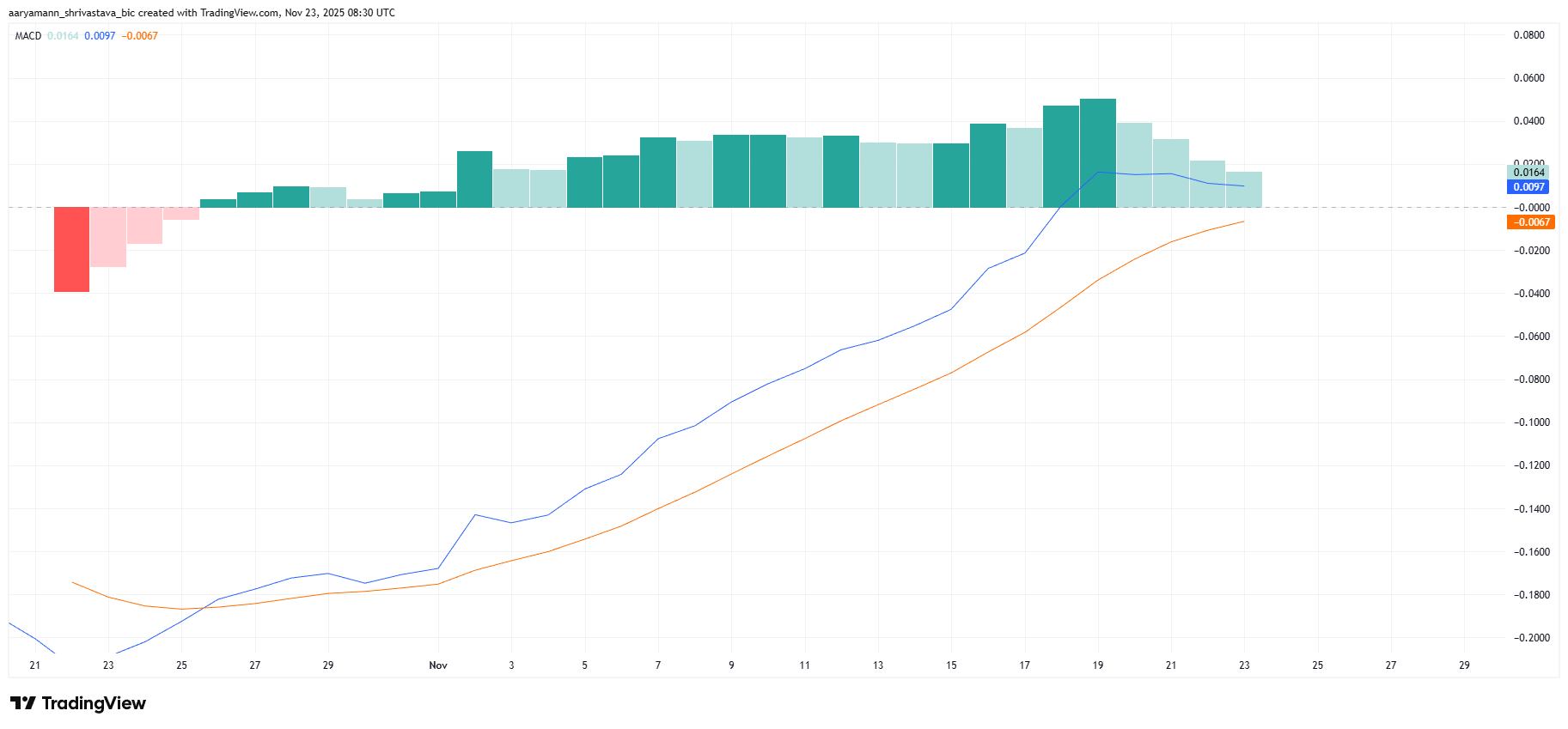

Aster’s MACD indicator is signaling a potential shift in momentum.

For the first time, the altcoin is nearing a bearish crossover as the signal line edges closer to moving above the MACD line. This alignment typically marks a transition from bullish to bearish momentum and raises caution among traders.

The histogram reinforces this warning with shrinking bars that indicate fading bullish strength.

As momentum recedes, investor sentiment may shift, making Aster more vulnerable to additional declines. The potential crossover could be Aster’s first major momentum reversal since the uptrend began.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ASTER MACD. Source: TradingView

ASTER MACD. Source: TradingView

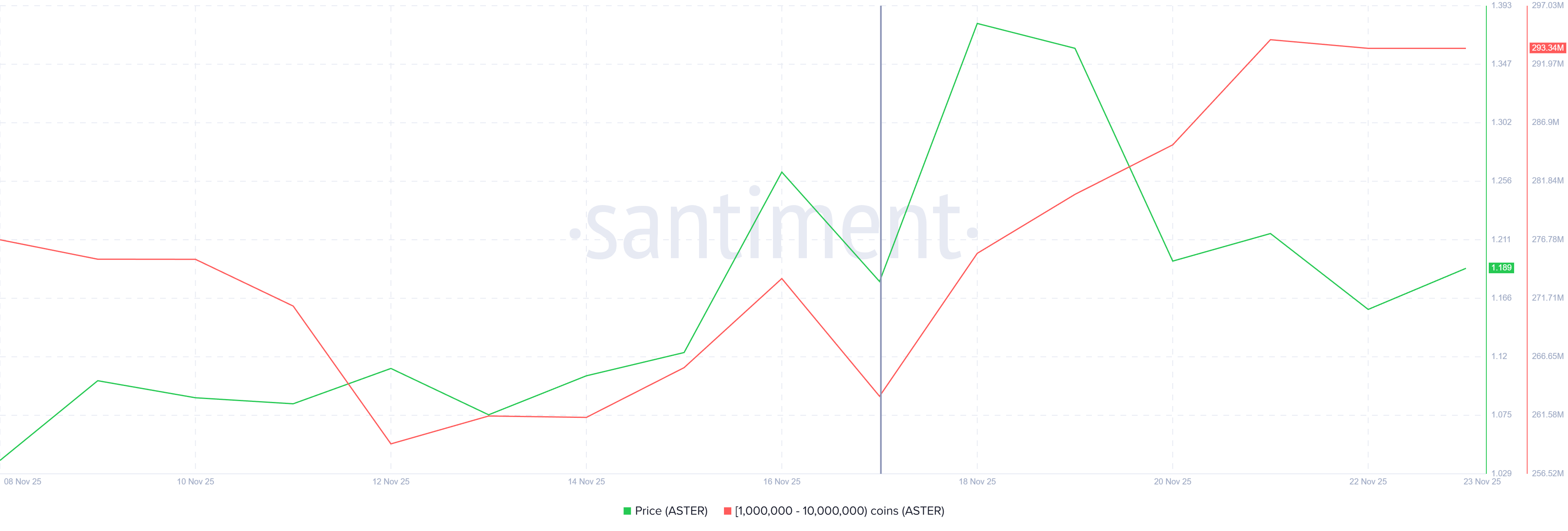

Despite weakening indicators, whale activity has remained surprisingly supportive. Over the past week, addresses holding between 1 million and 10 million ASTER accumulated 30 million tokens, worth more than $35 million. This consistent buying helped stabilize price action during earlier volatility.

Although whale accumulation has paused, these holders have not shifted to selling. Their willingness to hold despite market turbulence provides a critical cushion against sharper losses.

If whales maintain their positions, Aster may avoid a deeper decline, even if market conditions deteriorate further.

Aster Whale Holding. Source: Santiment

Aster Whale Holding. Source: Santiment

ASTER Price Could Recover

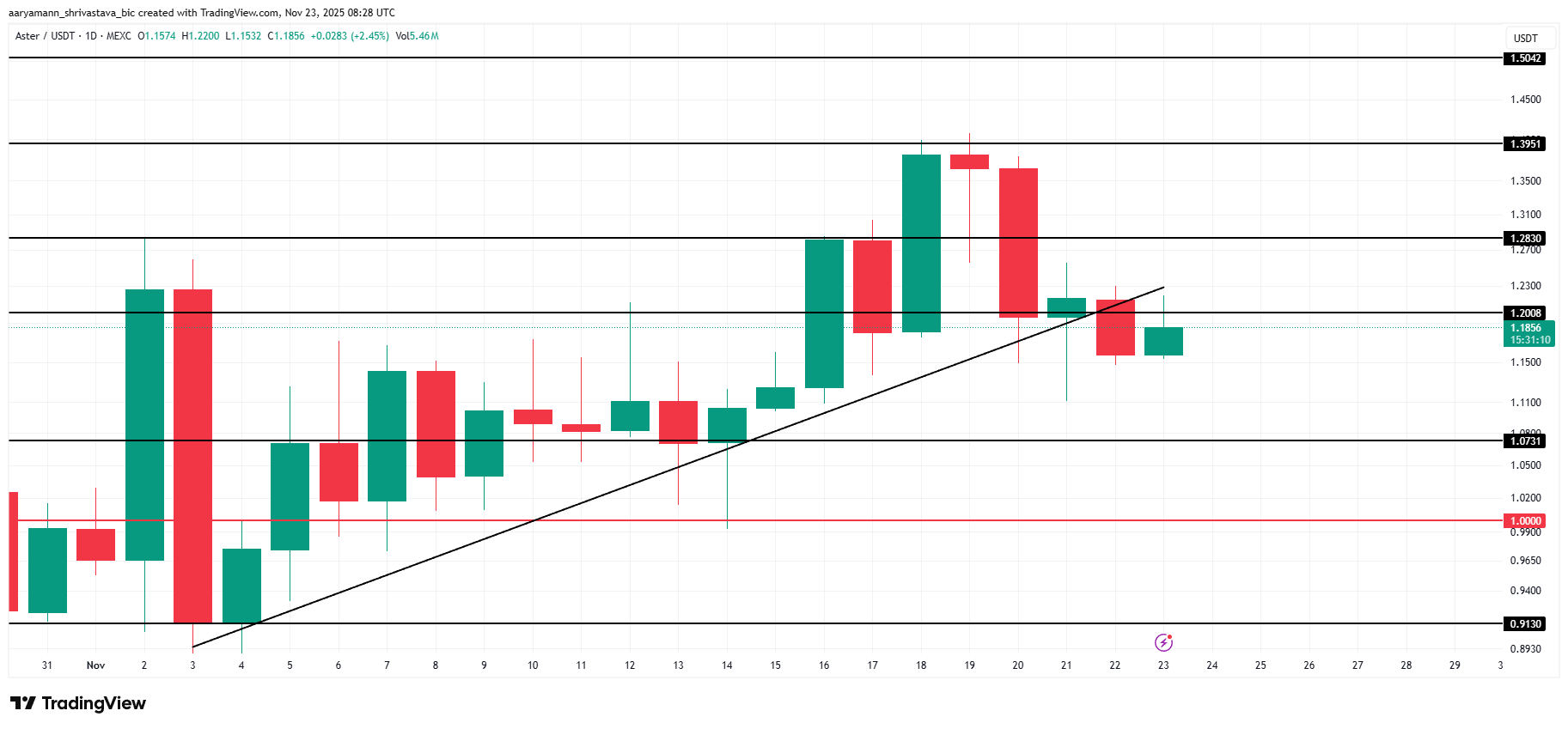

Aster trades at $1.18, sitting just below the $1.20 resistance level. The altcoin’s nearly three-week uptrend broke in the last 24 hours, creating uncertainity about the trajectory ahead.

Given the current indicators, Aster could reclaim $1.20 as support and either consolidate below $1.28 or climb toward $1.39. This outlook relies heavily on bullish stability and continued backing from accumulation-heavy investors.

ASTER Price Analysis. Source: TradingView

ASTER Price Analysis. Source: TradingView

However, if whales reverse course and begin to sell, Aster’s price could fall to $1.07. Losing that level would invalidate the bullish thesis.

This would confirm that bearish momentum has taken control, potentially leading to a deeper correction.