Crypto Today: Market sentiment weakens amid Russia-Ukraine tensions; Bitcoin ETFs see first weekly outflow since mid-April

- Crypto market sentiment shifts to a risk-off stance as the Russia-Ukraine war escalates, weighing on digital assets.

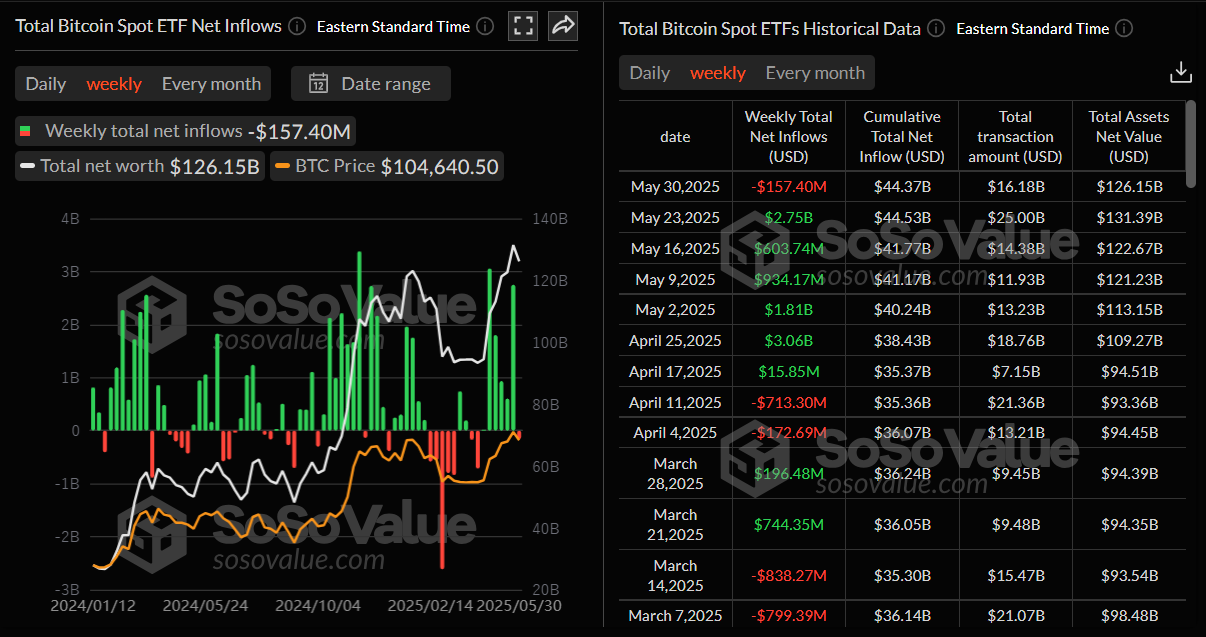

- Spot Bitcoin ETFs recorded an outflow of $157.40 million last week, ending their consistent weekly inflow streak since mid-April.

- Altcoins ENA, TAIKO, and NEON are set to unlock over $5 million each in token releases this week, potentially adding sell-side pressure.

The cryptocurrency market is showing early signs of weakness at the start of this week on Monday as risk-off sentiment escalates amid rising tensions in the Russia-Ukraine war.

Bitcoin (BTC) spot Exchange Traded Funds (ETFs) recorded their first weekly outflow since mid-April, signaling a pause in institutional inflows. Traders should keep a watch on three altcoins: Ethena (ENA), Taiko (TAIKO), and Neon (NEON), which are set to undergo upcoming token unlocks worth over $5 million each, potentially adding sell-side pressure.

Market Overview: Russia-Ukraine war sparks risk-off sentiment

BBC reports on Monday that Ukraine completed its biggest long-range attack of the war with Russia on Sunday, targeting four airbases and damaging 40 Russian warplanes.

The covert operation, the so-called “Spider’s Web,” used 117 drones, striking 34% of Russia’s strategic cruise missile carriers, said Ukraine’s President Volodymyr Zelensky.

Russia confirmed these attacks in five regions, calling them a “terrorist act,” reports BBC.

The peace talks between the two countries are set to resume in Istanbul on Monday. Still, the likelihood of negotiations yielding meaningful progress toward ending the Russia-Ukraine war is slim.

These rising war tensions and geopolitical uncertainties are driving investors toward safe-haven assets, such as Gold (XAU), which brings a risk-off sentiment to the market, not boding well for the prices of risky assets.

Data spotlight: BTC institutional investors show early signs of weakness

Institutional demand for Bitcoin weakened last week. According to SoSoValue data, Bitcoin spot ETFs experienced a mild outflow of $157.40 million last week, marking a break in their long-standing weekly streak of inflows since mid-April. This outflow is weak as compared to the flow seen during February. However, if this outflow intensifies, then the Bitcoin price could see a sharp decline in the upcoming days.

Total Bitcoin Spot ETFs weekly chart. Source: SoSoValue

Despite signs of weakness in Bitcoin ETFs, Japanese investment firm Metaplanet announced on Monday that it had purchased an additional 1,088 BTC. The firm currently holds a total of 8,888 BTC. Meanwhile, Meta, formerly known as Facebook, shareholders voted against adding Bitcoin to the company’s balance sheet.

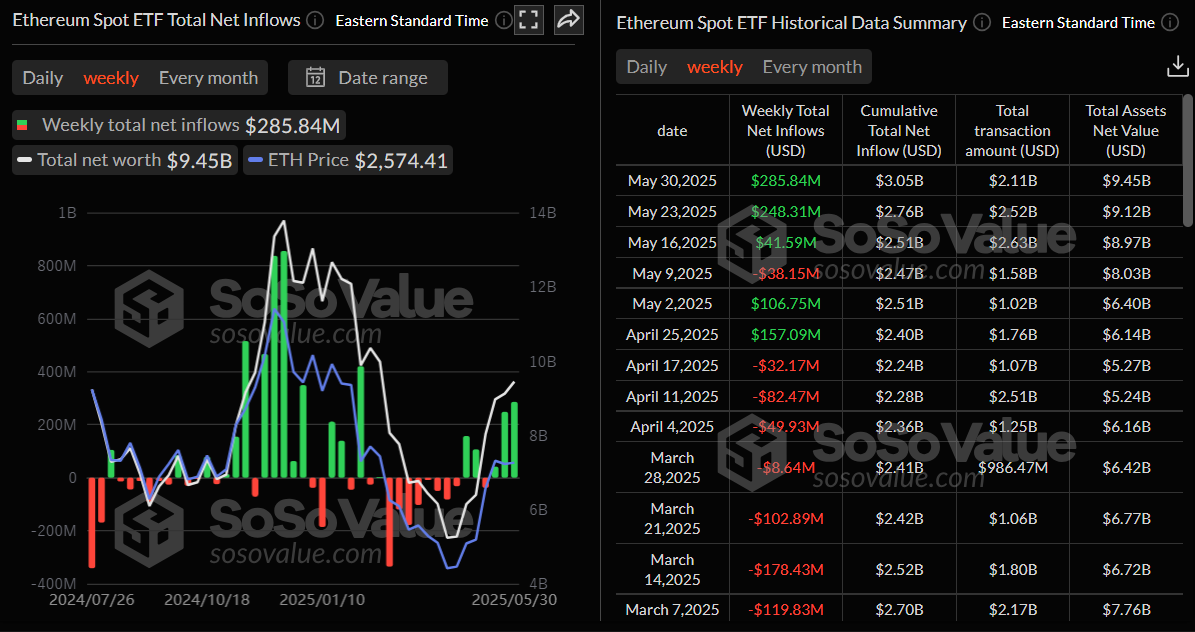

However, according to SoSoValue data, Ethereum spot ETFs experienced a weekly inflow of $285.84 million last week, the highest since mid-February, marking three consecutive weeks of inflows since mid-May. If this inflow continues and intensifies, the Ethereum price is likely to see a recovery in the upcoming days.

Total Ethereum Spot ETFs weekly chart. Source: SoSoValue

Chart of the day: Bitcoin bears heading toward $100k mark

Bitcoin price closed below the daily support level of $106,406 on Thursday and declined by 1.50% the following day. However, it recovered slightly during the weekend. At the time of writing on Monday, BTC trades below $105,000.

If BTC faces resistance around the $106,406 daily level and continues its correction, it could extend the decline to revisit the psychologically important level of $100,000.

The Relative Strength Index (RSI) on the daily chart reads 51, pointing downward toward its neutral level of 50, indicating fading bullish momentum. The Moving Average Convergence Divergence (MACD) also showed a bearish crossover last week. It also shows rising red histogram bars below its neutral level, indicating increasing bearish momentum and suggesting a correction ahead.

BTC/USDT daily chart

However, if BTC recovers and closes above $106,406, it could extend the rally toward its all-time high of $111,980.

Altcoin markets: Token unlock this week

According to Wu Blockchain, three altcoins are set to cliff unlock over $5 million each in token releases this week, potentially adding sell-side pressure. The cliff unlock allows a certain number of tokens to be unlocked immediately after a certain period.

The list includes Ethena (ENA), Taiko (TAIKO), and Neon (NEON), which are unlocking tokens at 3.72%, 71.23%, and 6.48% of their circulating supply, respectively. Typically, when a token unlocks accounts for over 1% of the cryptocurrency’s circulating supply, it will likely have a negative impact on the price as more tokens enter into circulation. Therefore, traders should monitor these three assets for increased volatility this week.

Apart from these altcoins, the large token linear (daily unlock amounts over $7 million) unlocks this week include Solana (SOL), Worldcoin (WLD), Bittensor(TAO), Dogecoin (DOGE), Celestia (TIA), Avalanche (AVAX), Sui (SUI), Morpho (MORPHO), Ether.fi (ETHFI), Polkadot (DOT), Story (IP), NEAR Protocol (NEAR) and Jito (JTO).

These linear token releases are planned to unlock schedules and may have a less significant impact, as it is already anticipated by the trading community, which is likely to position itself accordingly.

However, traders should remain cautious as the increased supply from token unlocks frequently generates negative sentiment among investors, which can weigh down prices.