Ripple Price Forecast: XRP rally runs into headwinds as liquidations surge amid falling network growth

- XRP price peaked at $2.65 on Wednesday, stalling the uptrend amidst a market-wide slowdown.

- Long liquidations reach $8.44 million over the past 24 hours as the uptrend targeting $3.00 falters.

- Declining network growth signals reduced demand and engagement as fewer new addresses are created on the XRP Ledger.

Ripple (XRP) price slides slightly on Thursday to $2.51 after peaking at $2.65 on Wednesday. The two-week streak from support around $2.12 mirrored bullish sentiment in the wider crypto market, supported by strong fundamentals as the United States (US) eased trade tensions with China. However, a slump in XRP's network growth points to declining user engagement, which could inhibit the uptrend eyeing the $3.00 psychological resistance in the mid-term.

Progressive talks between the US and the United Kingdom (UK) yielded positive results as the two nations struck a bilateral trade agreement last week. Global markets, including crypto, continue to rebound from the tariff-triggered crash in early April, buoyed by favourable inflation data.

XRP rally slows as network activity shrinks

The XRP Ledger showcases mixed signals with Sentiment's Network Activity metric consistently falling from nearly 16,000 addresses in January to approximately 3,400 addresses on May 7.

Declining network growth for XRP indicates fewer new addresses and reduced user engagement, signaling weaker demand. The 78.7% figure could undermine the rally, as observed with the XRP price (green line) on the chart below. Since its peak of $3.40 in January, XRP tumbled to $1.61 before reversing the trend in the second week of April.

[07-1747287474330.12.55, 15 May, 2025].png)

Network Activity metric | Source: Santiment

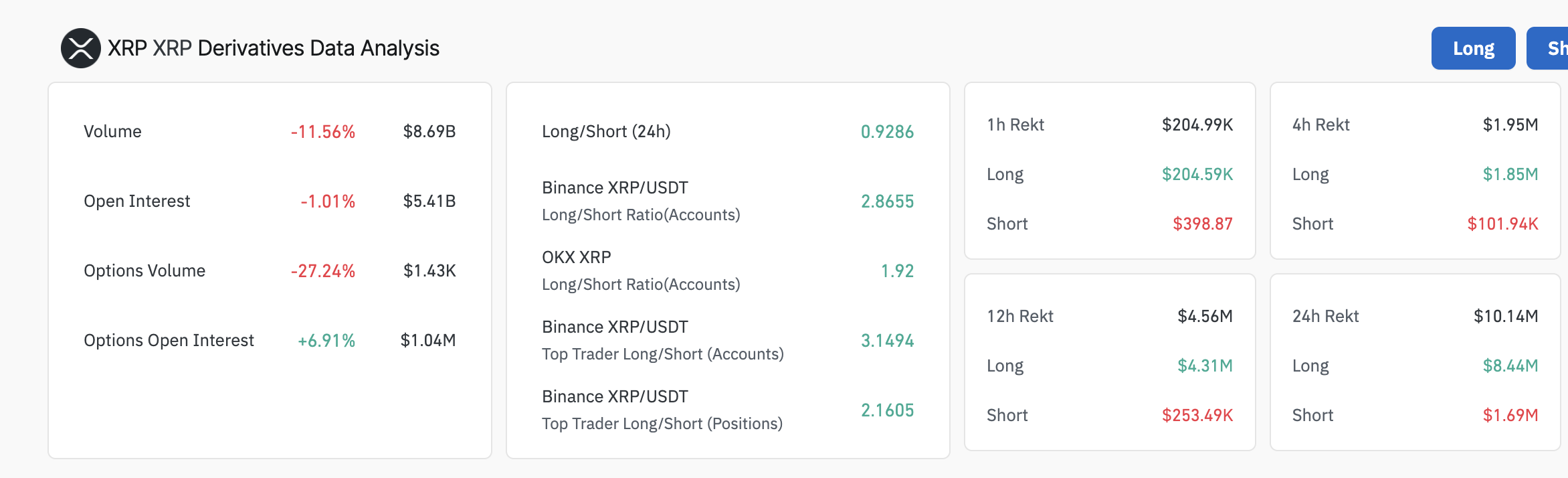

Meanwhile, XRP's price hovers at $2.53, as liquidations in the derivatives market surge. CoinGlass highlights $10.14 million in liquidations over the past 24 hours. Long positions accounted for the lion's share of the liquidations at $8.44 million compared to $1.69 million in shorts.

XRP derivatives market data | Source: CoinGlass

The increase in long position liquidations, as well as the drop in open interest (OI) and trading volume, hints at cooling speculative activity. Lower trading volume at $8.69 million from approximately $19.5 million on Monday implies crunching liquidity, potentially augmenting volatility, especially if traders adjust positions, increasing sell-side pressure. The slight decline in OI by 1% to $5.41 billion indicates the unwinding of leveraged positions, potentially from profit-taking or liquidations.

Looking ahead: Can XRP re-ignite the rally eyeing $3?

XRP's price sits significantly above key moving averages, including the 50-day, the 100-day and the 200-day Exponential Moving Averages (EMA), signifying a relatively strong tailwind despite the minor pullback from $2.65 reached on Wednesday.

The Moving Average Convergence Divergence (MACD) indicator upholds a buy signal above the centre line, buoyed by green histograms. This highlights a sustained bullish momentum for XRP and shows that interest in XRP is still elevated, with the uptrend likely to resume towards $3.00.

XRP/USD daily chart

Traders should consider the possibility of the down leg extending in upcoming sessions, especially with the Relative Strength Index (RSI) indicator at 63.34 and sliding toward the midline of 50, highlighting weakness in the uptrend.

If declines persist, accentuated by potential profit-taking, tentative support levels would come into play, ranging from the 50-day EMA at $2.27, the 100-day EMA at $2.25 and the 200-day EMA at $2.00.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.