Coinbase Prime to End Custody Support for 49 Altcoins by April’s End

Coinbase Prime, the institutional arm of the popular cryptocurrency exchange, has announced it will end custody support for 49 altcoins by the end of this month.

The move will affect a range of lesser-known tokens. These include assets associated with niche blockchain projects and even real estate-related tokens.

49 Altcoins Lose Custody Support on Coinbase Prime

The decision was made public in an April 14 post on X (formerly Twitter).

“We regularly evaluate the assets we support to ensure they continue to meet our standards. Based on recent reviews, Coinbase Prime will end custody support for 49 assets, effective the end of the month,” the post read.

The impacted tokens include BOSAGORA (BOA), 0chain (ZCN), pNetwork (PNT), Telcoin (TEL), and Oraichain Token (ORAI). The list also mentioned Sentinel Protocol (UPP), Cellframe (CELL), Ideaology (IDEA), and RioDeFi (RFUEL), which cater to different use cases within the blockchain ecosystem.

Even real estate and investment-related assets were impacted. 1717 Bissonnet (1717), The Edison (EDSN), Draper Garland Apartments (GFDG), Forest Crossing Apartments (GFFC), Hello Albemarle (HLAB), etc were some of the mentioned tokens.

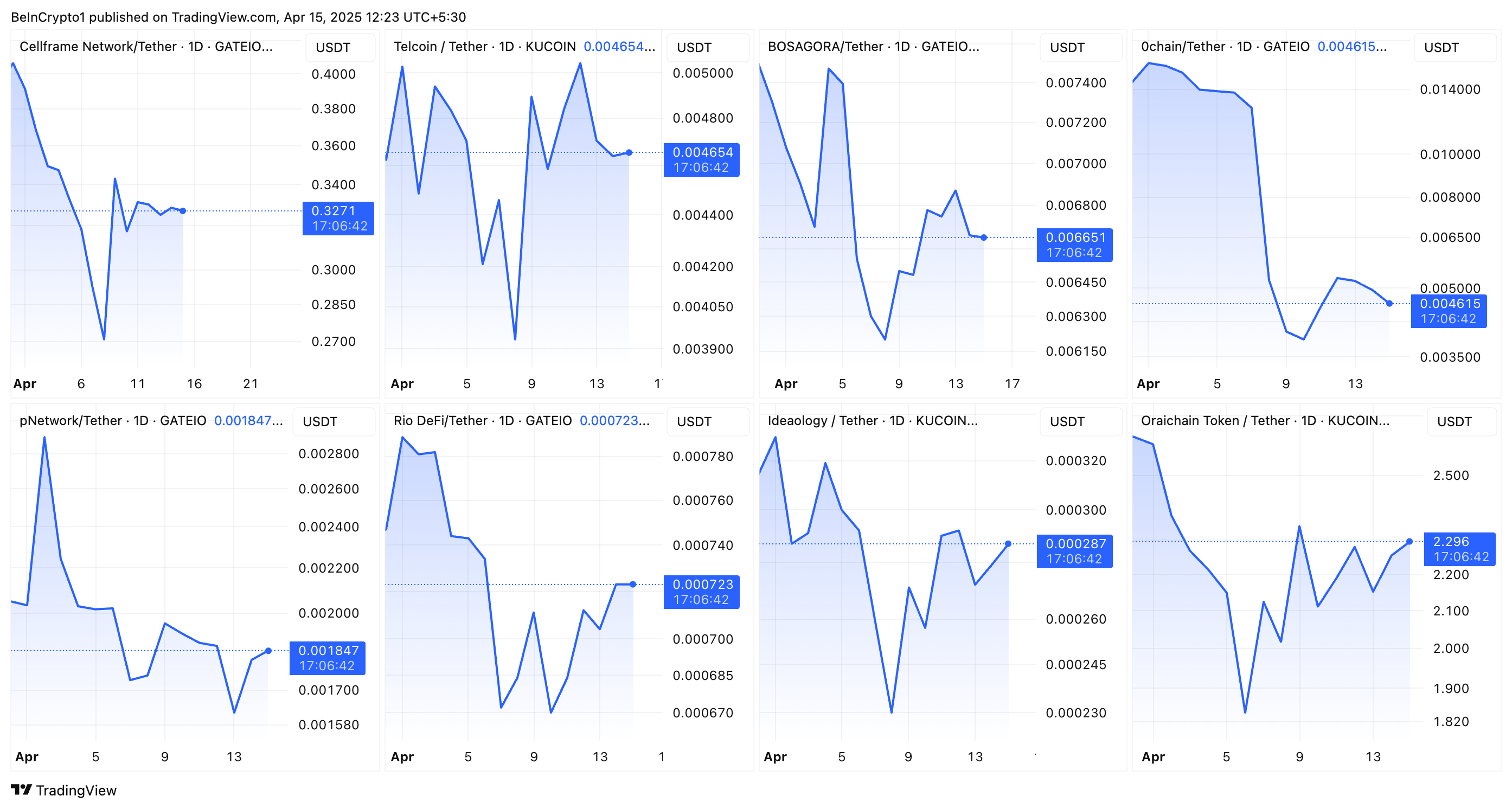

While some of the featured tokens saw modest declines, others remained unaffected. In addition, PNT, ORAI, IDEA, and TEL have apprecaited in price over the past day.

CELL, TEL, BOA, ZCN, PNT, RFUEL, IDEA, ORAI Price Performance. Source: TradingView

CELL, TEL, BOA, ZCN, PNT, RFUEL, IDEA, ORAI Price Performance. Source: TradingView

For context, Coinbase Prime offers a suite of services designed to meet the needs of institutional investors. The platform provides custody, trading, and financing solutions. The former allows institutions to securely store digital assets, ensuring compliance and protection for large-scale investments.

Nevertheless, the latest decision to remove these assets suggests that the platform is reassessing its offerings. Coinbase has not disclosed specific reasons for removing these particular assets.

Still, the move could be linked to factors such as low liquidity, market activity, or failure to meet institutional-grade compliance standards. For institutional clients using Coinbase Prime, this change means they will need to transfer or liquidate their holdings before the end of April 2025.

According to its website, Coinbase Prime currently supports over 430 assets. Thus, the shift represents a relatively small adjustment in the broader offering.

The announcement comes as the exchange Coinbase continues to expand its portfolio. A few weeks ago, the exchange listed Doginme (DOGINME), Keyboard Cat (KEYCAT), and then Definitive (EDGE). The move led to notable price upticks for the tokens.

However, broader market conditions have negatively impacted the exchange. BeInCrypto reported that Coinbase’s stock experienced a 30% dip in Q1 2025. Moreover, the period marked the company’s worst quarter since the defunct cryptocurrency exchange FTX collapsed.

As Coinbase moves forward in a volatile cryptocurrency market, this decision to delist certain assets seems to be part of a larger strategy to concentrate on more liquid tokens and better serve the needs of institutional clients.