Gold price plunges almost 2% on risk rally spurred by tariff delay

- XAU/USD drops below $3,300 as Trump's EU tariff pause boosts sentiment and US Dollar.

- Trump delays 50% EU tariffs to July 9, improving market mood and weighing on safe-haven demand.

- DXY surges 0.62% to 99.54, driven by four-year high in US Consumer Confidence.

Gold prices posted losses of nearly 2%, falling below the $3,300 figure, as market participants cheered US President Donald Trump's decision to delay tariffs on European Union goods. Consequently, an improvement in risk appetite and the Greenback trimming some of last week’s losses weighed on the non-yielding metal.

Over the weekend, a call between Trump and the EU chief, Ursula von der Leyen, ended with Washington's decision to postpone 50% tariffs on EU goods until July 9. This shift in investors' mood triggered outflows from haven assets, except for the US Dollar, and pushed global equities higher.

The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, rises over 0.62% to 99.54, fueled by an improvement in Consumer Confidence, which according to the Conference Board (CB) rose the most in four years.

News that Washington could be on the brink of securing additional trade deals in the near term added to the positive sentiment among traders. Fox Business News Gasparino, in a post on X, revealed that a framework between the US and India is close to being announced.

Other economic data in the US revealed that Durable Goods Orders fell in April the most since October, with business equipment diving sharply due to uncertainty about tariffs and US tax policy.

Bullion’s faith for the remainder of the week rests on the upcoming US economic docket. They will eye the Federal Reserve’s (Fed) last meeting minutes, the second estimate for Gross Domestic Product (GDP) in Q1 2025, and the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Gold daily market movers: Bullion plummets on strong US Dollar and solid US Consumer Confidence

- US Treasury bond yields remain steady. The 10-year Treasury note yield falls six basis points (bps) down to 4.446%. Meanwhile, US real yields also declined by six basis points to 2.116%.

- US Consumer Confidence in May improved from 85.7 to 98.0, with the recovery attributed to the truce on tariffs. Stephanie Guichard, senior economist at The Conference Board, said, “The rebound was already visible before the May 12 US-China trade deal but gained momentum afterward.”

- US Durable Goods Orders disappointed investors, plunged -6.3% MoM in April, down from March's 7.6% increase but exceeded forecasts of -7.8% contraction.

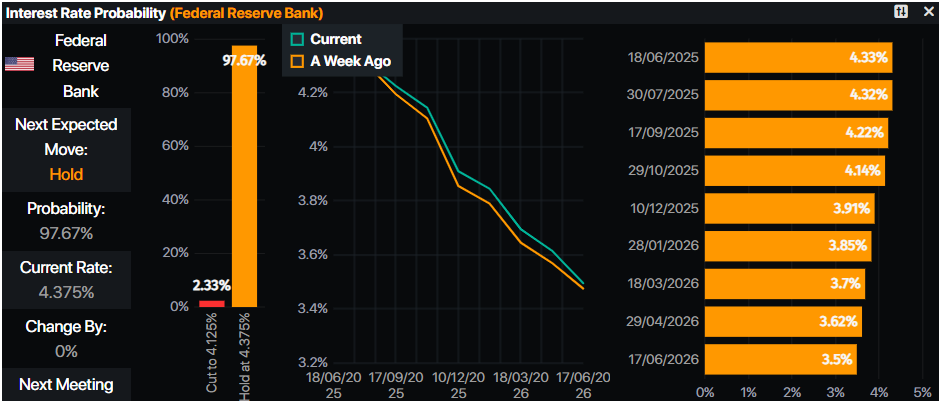

- Minneapolis Fed President Neel Kashkari said that interest rates should remain on hold until there is clarity on how higher duties affect price stability.

- Despite the backdrop, the Gold price outlook remains optimistic due to the still fragile market mood on US assets, ignited by the growing fiscal deficit in the United States, which prompted Moody’s to downgrade US government debt from AAA to AA1.

- Besides this, Reuters revealed that “China's net gold imports via Hong Kong more than doubled in April from March, and were the highest since March 2024, data showed.”

- Money markets suggest that traders are pricing in 46.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price pullback to challenge $3,250

Gold price remains steady, hovering on the bottom of the $3,300 figure but set to consolidate within the $3,250-$3,300 range ahead. Nevertheless, the uptrend remains intact, with buyers eyeing a decisive break above $3,300, which could pave the way for testing last week’s peak of $3,365 ahead of a challenging $3,400. Further upside lies above the May 7 high of $3,438.

On the bearish side, if Gold drops below $3,250, expect a move to the confluence of the May 20 daily low and the 50-day Simple Moving Average (SMA) near $3,204/05.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.