Bitcoin Price Forecast: Analyst expects BTC to extend its consolidation between the $75,000 to $88,000 range

- Bitcoin price faces slight rejection around the $85,000 resistance level on Wednesday after recovering 3.16% the previous day.

- A K33 report highlights that Cryptocurrencies and Equities have largely de-risked going into Trump’s “Liberation Day.”

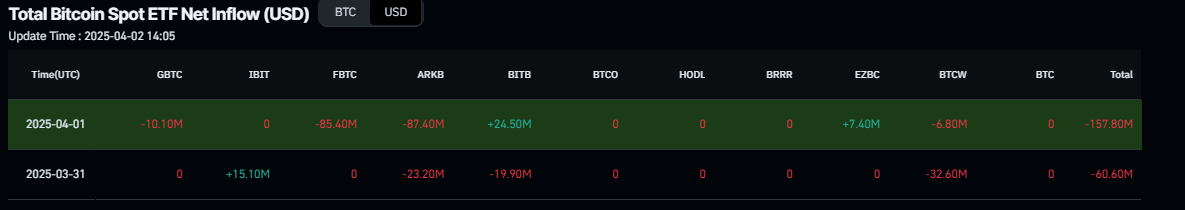

- US spot Bitcoin ETFs’ demand continues to weaken amid $157.80 million outflow on Tuesday.

Bitcoin (BTC) price faces a slight rejection around the $85,000 resistance level on Wednesday after recovering 3.16% the previous day. A K33 report highlights that Cryptocurrencies and Equities have largely de-risked going into Donald Trump’s “Liberation Day” on Wednesday. Meanwhile, the US spot Bitcoin spot Exchange Traded Funds’ (ETFs) demand continues to weaken as it recorded an outflow of $157.80 million on Tuesday.

Bitcoin de-risking going into Trump’s “Liberation Day”

A K33 Research report, ‘The Forgotten Reserve’, highlights that tariffs remain the primary market-moving factor with “Liberation Day” looming, while US jobs data this week may bring more volatility. Moreover, the Crypto and Equities have largely de-risked going into Trump’s so-called “Liberation Day” on Wednesday, a highly anticipated tariff announcement.

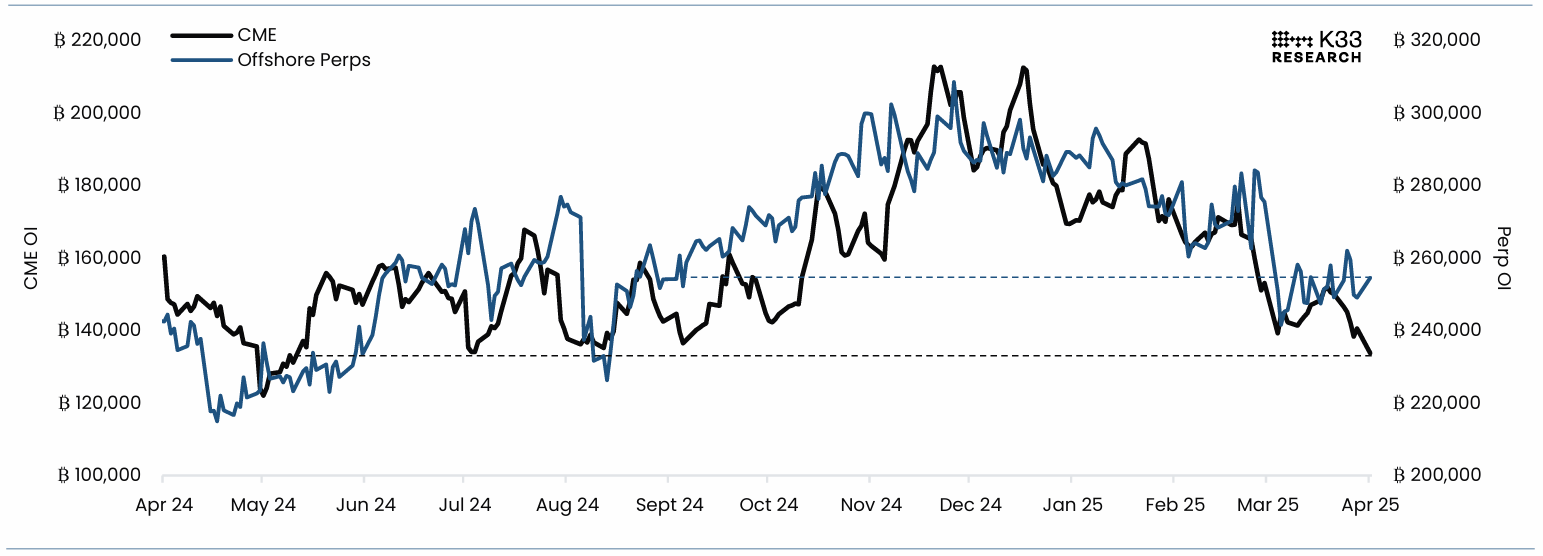

The report explains that expectations of tariff-induced volatility on Wednesday have rendered CME traders defensive. The graph below shows that the traders refuse to take on risk as futures premiums fell back to 5%, alongside CME open interest plummeting to 11-month lows of 133,790 BTC.

“Contango steepened post-expiry, but the spike - similar to February's - does not reflect renewed long interest and sentiment remains risk-off,” says Vetle Lunde, Head of Research at K33 Research.

Bitcoin Futures – Open Interest chart. Source: K33 Research

The report further explains that lost somewhere underneath tariff headlines, federal agencies are scheduled to submit reports by Saturday outlining their authority to transfer digital assets to the Strategic Bitcoin Reserve (SBR). This brings a clear and closer clarification of the reserve’s initial composition and value.

“We expect the Bitfinex funds (94,636 BTC) to be transferred to the exchange following this deadline,” says a K33 Research analyst.

The analyst continued, “Volatility may follow such a transfer, especially since headlines still reference the total US Gov. BTC holdings of ~200K BTC in relation to the SBR.” The analyst expects BTC to extend its consolidation and hover in the $75,000 to $88,000 range.

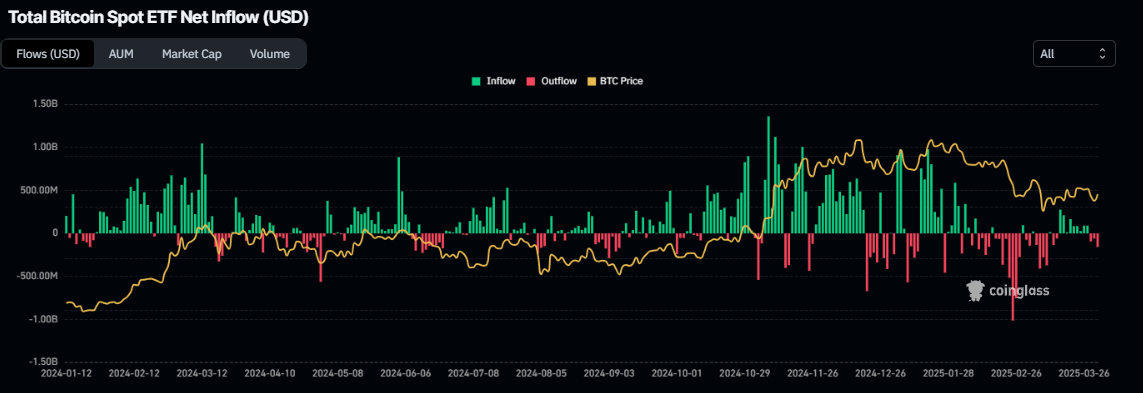

Bitcoin institutional demand weakens while public companies show rising interest

Bitcoin’s institutional demand continues to weaken as the week proceeds. According to Coinglass, Bitcoin spot ETF data recorded an outflow of $157.80 million on Tuesday after a mild outflow of $60.60 million the previous day. If these outflows continue and intensify, the Bitcoin price could decline further.

Total Bitcoin spot ETF netflow chart. Source: Coinglass

Despite the weakening institutional demand, public companies increasingly convert their balance sheets into Bitcoin reserves.

As explained in the earlier report, Gamestop (GME) has raised $1.5 billion in capital, with potential plans to allocate part of the funds toward expanding its Bitcoin treasury. Metaplanet (MTPLF) added 160 BTC to its holdings on Tuesday, bringing its total to 4,206 BTC. Meanwhile, Bitcoin mining firm MARA Holdings (MARA) is preparing a $2 billion stock offering to acquire more Bitcoin, signaling growing institutional interest in crypto assets.

This trend is generally bullish for Bitcoin’s price due to increased demand, reduced circulating supply, and positive market sentiment. If this trend continues, Bitcoin could see more stable price growth over the long term, but short-term fluctuations are likely to persist as the market adjusts to this new wave of institutional involvement.

Bitcoin Price Forecast: BTC approaches key resistance at $85,000

Bitcoin price stabilized around $82,500 to start the week on Monday and recovered 3.16% the next day. At the time of writing on Wednesday, it faces a slight rejection from the daily resistance level of $85,000. This daily level coincides with the 200-day Exponential Moving Average (EMA) and a descending trendline, making it a key resistance zone.

The Relative Strength Index (RSI) indicator on the daily chart reads 48 and points downward after being rejected from its neutral level of 50, indicating slight bearish momentum. If the RSI continues to slide downwards, the bearish momentum will increase, leading to a sharp fall in the BTC price. The Moving Average Convergence Divergence (MACD) lines coil against each other, indicating indecisiveness among traders.

If BTC continues to find rejection from the daily resistance at $85,000, it could extend the decline to retest its next support level at $78,258.

BTC/USDT daily chart

However, if BTC recovers and closes above its daily resistance at $85,000, it could extend the recovery rally to the key psychological level of $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.