AI tokens AWE Network, OlaXBT extend gains as crypto sell-off intensifies

- Investors count losses as liquidation of leveraged crypto assets hit $1 billion over the past 24 hours.

- AWE Network gains over 5% intraday as the RSI and MACD indicators reinforce bullish grip.

- OlaXBT rises for a second consecutive day, supported by a strengthening technical outlook.

The crypto market is in turmoil as aggressive selling continues across the board, triggering liquidations and leaving investors counting losses. Bitcoin (BTC) tumbled below the $70,000 mark on Thursday, after erasing the post United States (US) election surge.

In stark contrast to the extensive sell-off, some Artificial Intelligence (AI) crypto tokens, including AWE Network (AWE) and OlaXBT (AIO), are defying headwinds and extending their uptrends.

Crypto liquidations hit $1 billion

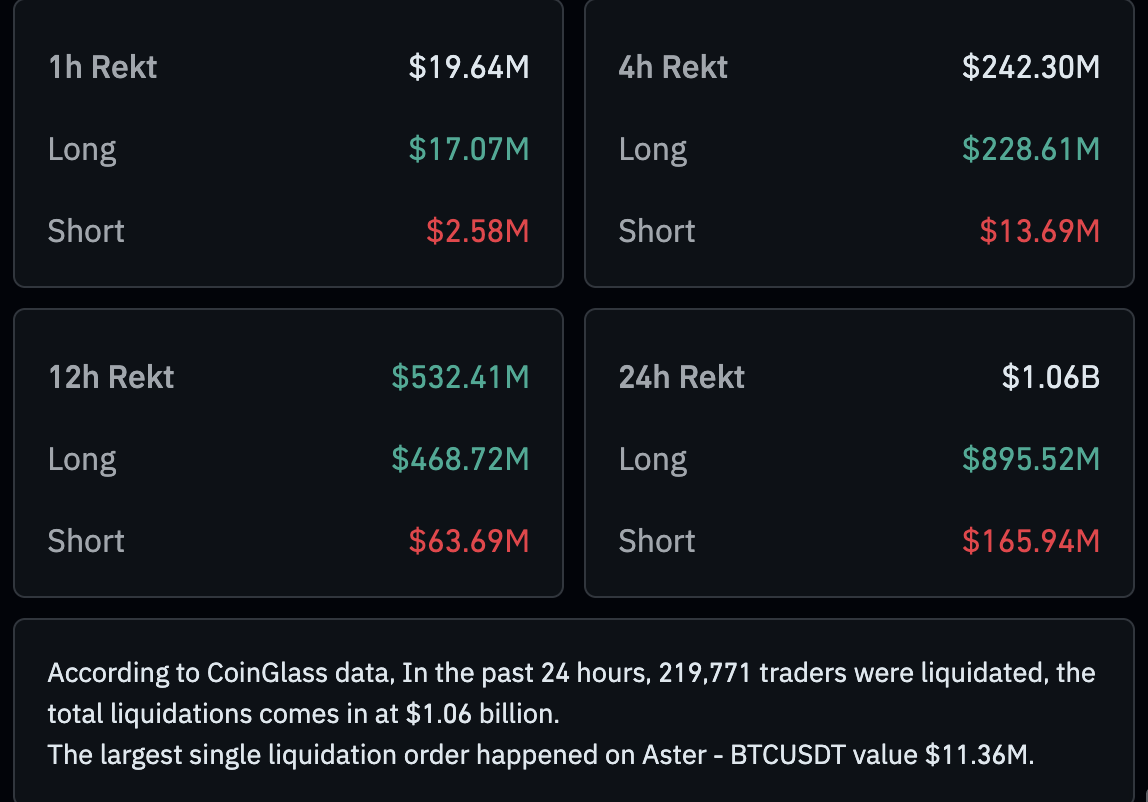

Bitcoin’s slump below $70,000 has dragged the majority of crypto assets down with it, as leveraged positions are liquidated, exceeding $1 billion over 24 hours.

Long position traders bore the biggest brunt of the correction, with approximately $896 million wiped out. Short position holders, on the other hand, lost nearly $166 million in the same period 24-hour period.

AWE Network tests breakout strength

AWE Network is largely in bullish hands, trading above $0.066 while the 200-day Exponential Moving Average (EMA) at $0.060, the 100-day EMA at $0.059 and the 50-day EMA at $0.056 reinforce a short-term bullish outlook.

The AI token also holds above a descending trendline, poised to serve as support if profit-taking and broader market sentiment cap the upside, leading to a correction.

Meanwhile, the Relative Strength Index (RSI) at 72 on the daily chart supports the bullish thesis. A further increase in the RSI would accelerate the price by 15% to the next resistance at $0.077.

The Moving Average Convergence Divergence (MACD) indicator remains above its signal line on the same chart, as the red histogram bars expand, prompting investors to increase their risk exposure.

Closing below the immediate hurdle at $0.067 could lead to instability amid aggressive profit-taking. A correction from this level is likely to test the 200-day EMA support at $0.060.

OlaXBT also edges up, trading above $0.16 at the time of writing on Thursday, reflecting increased interest from traders seeking opportunities in newly launched AI tokens. AIO holds well above the 50-day EMA, providing support at $0.14 and the 100-day EMA at $0.13. The accelerated trendline (dotted) is poised to absorb selling pressure if the trend reverses, while the slow trendline is positioned below the 100-day EMA.

The RSI is at 56 as it rises on the daily chart, indicating that bullish momentum is building. A continued uptrend would bring AIO to the next resistance level at $0.18.

Still, traders should be cautious and temper their expectations given that the MACD indicator remains below its signal line on the same chart. If the price trims intraday gains, the AI token may drop to test support provided by the 50-day EMA at $0.14.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.