LayerZero rallies as demand absorbs 25 million token unlock, futures interest spikes

- LayerZero is up over 8% on Wednesday, recording nearly 60% gains so far this month.

- Consistent high demand for ZRO smoothly absorbs over 25 million fresh tokens unlocked on Tuesday.

- Derivatives data suggests increased retail strength as ZRO futures Open Interest jumps over 30% in the last 24 hours.

LayerZero (ZRO) extends its recovery toward the $2 mark on Wednesday, as the broader cryptocurrency market remains under pressure from the US-EU trade war. The cross-chain messaging token’s recovery remains steady, absorbing the fresh supply release of over 25 million ZRO tokens on Tuesday. A bullish bias in the retail sentiment pumps the ZRO futures Open Interest by over 30% in the last 24 hours, approaching $55 million.

LayerZero’s short-term demand outweighs 25 million token unlock

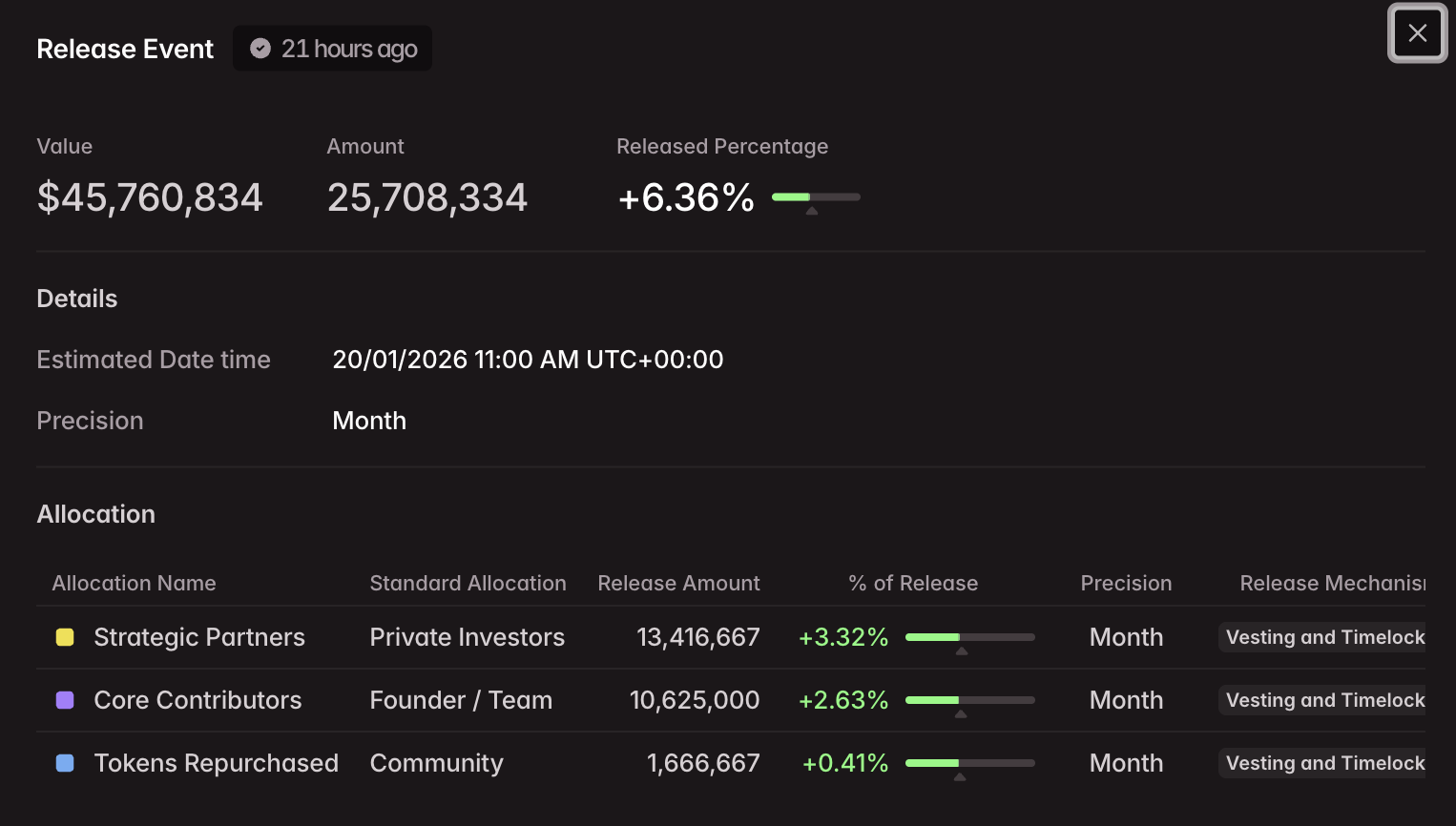

Data shows that 25.71 million ZRO tokens (6.36% of the total supply) were unlocked on Tuesday, vested mainly by private investors and the core team. Despite the surge in circulation supply, the steady recovery in ZRO confirms the presence of intense buying pressure.

Meanwhile, on the derivatives side, ZRO futures Open Interest (OI) has surged by 32% over the last 24 hours to $54.38 million, suggesting a reduction in the total value of outstanding contracts. Additionally, the funding rate stands at -0.0060%, up from -0.0353% earlier on the day, indicating reduced selling intent among new positions.

LayerZero extends recovery above the 200-day EMA

LayerZero extends the recovery by 8% at press time on Wednesday above the 200-day Exponential Moving Average (EMA) at $1.784. The upward slope in the 50-day EMA approaches the 100-day EMA, hinting at a potential Golden Cross pattern in the coming days if the bullish momentum persists.

The Moving Average Convergence Divergence (MACD) line rises above the signal line on the daily chart as the positive histogram widens, indicating steady bullish momentum. On the same chart, the Relative Strength Index (RSI) is at 80, rising deeper into the overbought zone, suggesting that intense buying pressure is at dangerously high levels and risking a potential reversal.

If ZRO extends its consistent upward trend, the October 13 close at $2.036 could serve as crucial resistance near a psychological level.

Looking down, the 200-day EMA at $1.784 could serve as the immediate support if the momentum flips bearish. This remains a real possibility as token unlock has increased the circulating supply, increasing the risk of profit-taking. In such a case, deeper support remains at the 100-day EMA at $1.557.