Gold and Silver surge to record highs as Bitcoin and Ethereum slide lower

- Gold and Silver have climbed to new highs as safe-haven trades gain momentum amid geopolitical tensions.

- Bitcoin and Ethereum crashed below $90,000 and $3,000, respectively, sparking heavy liquidations.

- Despite its recent underperformance, Bitcoin maintains stronger gains against Gold on longer timeframes.

Following geopolitical tensions surrounding the US proposed acquisition of Greenland, Gold and Silver have surged to record highs while Bitcoin and Ethereum — often considered digital alternatives to the two traditional metals — are crashing alongside US equities.

Gold (XAU/USD) surged to a record high above $4,750 on Tuesday, adding $15 trillion in market cap over the past twelve months. Silver (XAG/USD) also posted a fresh all-time high above $95, extending its run over the past year to about 210%. The two metals have been riding the demand for safe-haven assets amid the unpredictability of Trump's actions.

Meanwhile, Bitcoin has declined 3.5% over the past 24 hours, sliding below $90,000. The top crypto has lost 6% of its value since the start of the week, sending its performance in the past year to -13%. In the same period, ETH has suffered a 10% downturn, falling below $3,000.

The decline has wiped out $1.6 billion in leveraged positions in the crypto market over the past three days, according to Coinglass data.

A similar decline is evident across the US equity market, where the S&P 500 fell over 2% on Tuesday, wiping out $1.2 trillion in market cap, its largest decline since October. The Nasdaq also fell 2.3%.

Once considered a safe-haven asset, Bitcoin has been behaving more like equities in recent times. Moreover, over the past year, it underperformed the Nasdaq during uptrends but reclaimed its high beta during downtrends.

Bitcoin holds a good record against Gold over a longer time frame

Despite its underperformance over the past year, Bloomberg analyst, Eric Balchunas, noted that Bitcoin is only taking a "breather."

"...Bitcoin was up 122% in 2024, $GLD and $SLV were up 20%. It got ahead of itself, needed breather, other assets just playing catch up," wrote Balchunas in an X post on Tuesday.

Bitcoin Magazine highlighted a similar trend, stating that Bitcoin outperformed Gold over a three-year period when dollar-cost averaging is considered.

BTC vs. Gold vs. AAPL vs. DJI. Source: Bitcoin Magazine

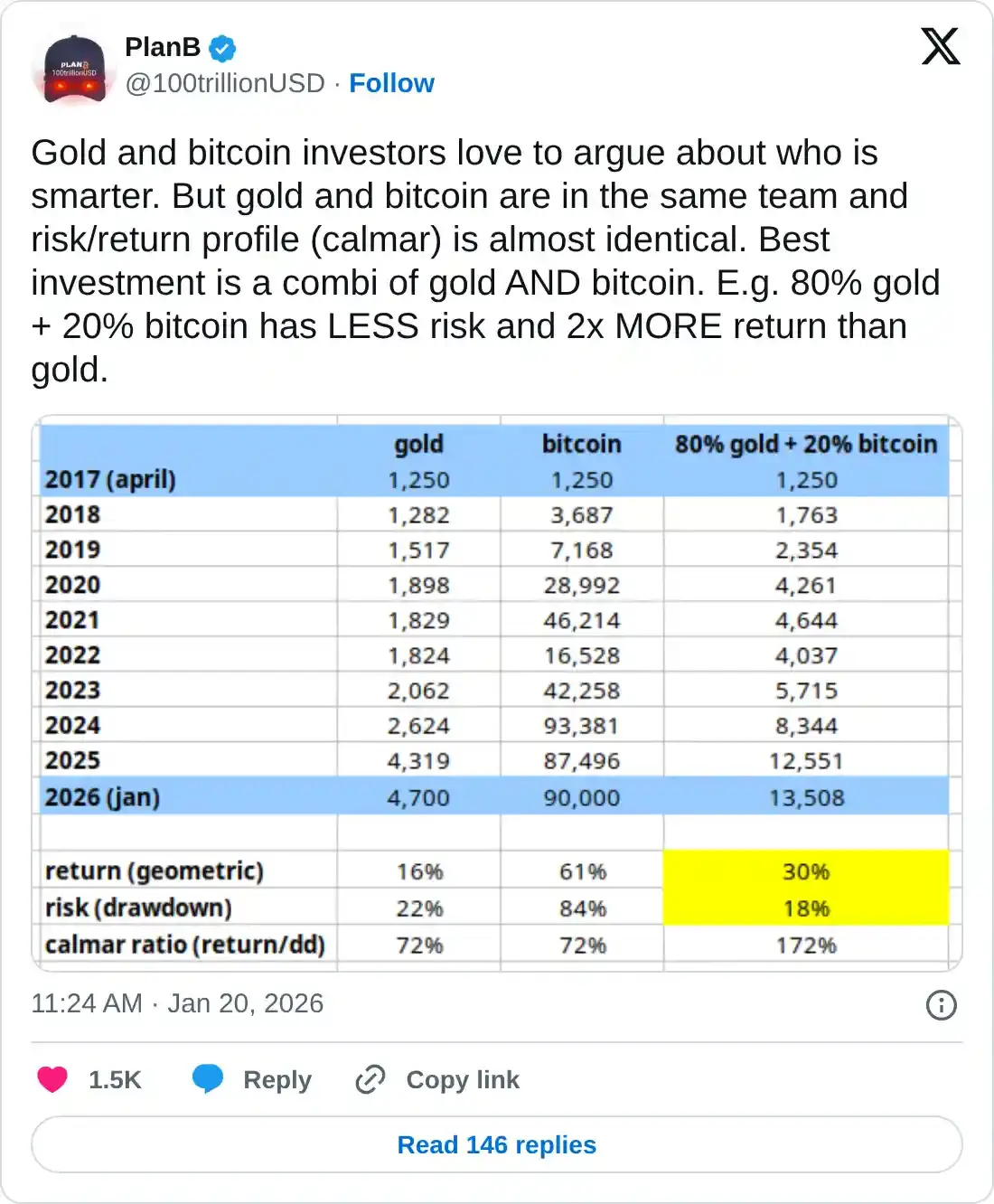

In contrast, Bitcoin analyst PlanB said a combination of both assets — an 80% Gold and 20% BTC allocation — will deliver higher returns while reducing risk.

Meanwhile, some analysts predict that investors will rotate some of the gains seen in Gold and Silver into Bitcoin over the coming months.