Investors Rotate Into DUSK After Missing XMR and DASH Rallies, but Data Raises Warnings

Capital from investors interested in privacy coins shows signs of rotating toward lower-market-cap altcoins. This shift occurs as many believe billion-dollar projects such as XMR and DASH have become saturated. One candidate drawing attention is Dusk (DUSK).

What advantages make DUSK attractive to investors? What do on-chain data signals warn about? The following article explores these questions in detail.

Dusk (DUSK) Defies the Market, Rallies More Than 4x in January

On January 19, while Bitcoin fell nearly 3% to below $93,000 and many altcoins dropped 5–10%, DUSK surged 40% to a high above $0.22. This marked its highest level since January 2025.

DUSK Price Performance Over The Past Year. Source: BeInCrypto Price

DUSK Price Performance Over The Past Year. Source: BeInCrypto Price

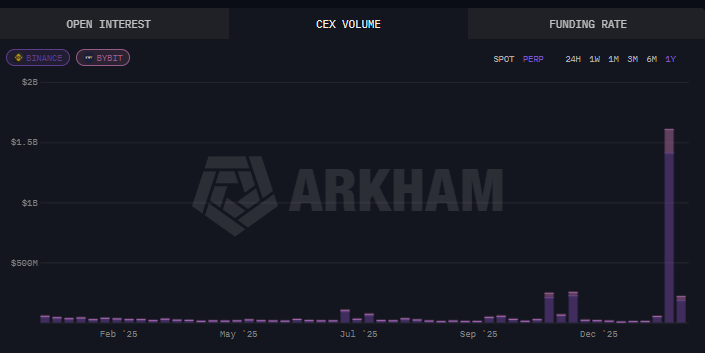

DUSK has risen more than fourfold since the beginning of the year. Arkham data on DUSK trading volume across centralized exchanges (CEXs) shows that volume exceeded $1.4 billion over the past week. This was the highest level in the past year.

DUSK Trading Volume on CEXs. Source: Arkham

DUSK Trading Volume on CEXs. Source: Arkham

At the time of writing, the altcoin ranked in the Top 4 by 24-hour trading volume, trailing only ZEC, XMR, and DASH, according to CoinGecko. The sharp spike in trading volume suggests that DUSK is attracting strong retail interest.

Two Key Factors Driving DUSK’s Price Surge

The first factor lies in DUSK’s intrinsic value. Its key strength comes from advanced encryption technology. DUSK integrates zero-knowledge proofs (ZK proofs) and zk-SNARKs to conceal transaction details while still allowing regulators to access necessary data.

While altcoins such as XMR may face legal challenges due to full anonymity, even toward regulators, DUSK takes a different approach. This path does not necessarily satisfy privacy maximalists, but it aims for balance.

Investor Paxton explained that businesses require privacy, while regulators require transparency. Dusk positions itself in the middle.

“Private by default, accountable when required. DUSK shielded transfers hide sender and amount from the public, while the receiver can still verify—and cryptographically prove—who paid them. That missing piece makes privacy on Dusk much more travel-rule-friendly and compliant.” — Hein Dauven, CTO of the Dusk Foundation, said.

The second factor is more external. Investors increasingly believe that large-cap privacy coins offer limited upside after strong rallies. As a result, capital flows toward smaller-cap privacy projects. DUSK’s current market capitalization stands at just over $100 million.

On-Chain Data Signals Potential Risks

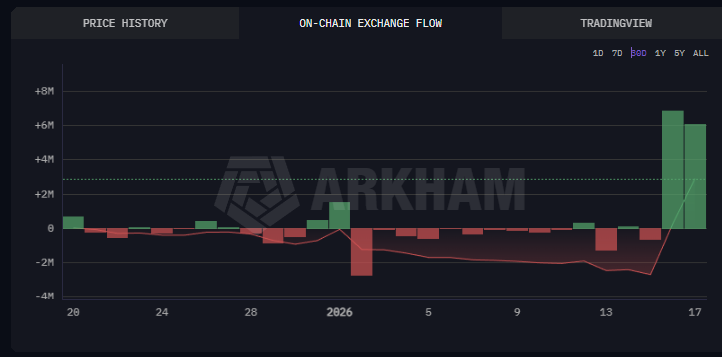

Despite the strong rally, the price surge may face risks after a fourfold increase. On-chain exchange flow data from Arkham provides a warning signal.

Dusk On-chain Exchange Flow. Source: Arkham

Dusk On-chain Exchange Flow. Source: Arkham

This data reflects the amount of DUSK flowing into and out of exchanges. On January 16–17, exchange inflows spiked to more than 6 million DUSK per day. This marked the highest level in the past 30 days. The data suggests that early investors may be taking profits after the recent rally.

In addition, capital rotating into lower-market-cap altcoins within the same narrative often signals that a cycle is nearing its end. Combined with the return of fear sentiment in the third week of January, this trend may increase risks for investors chasing DUSK at current levels.