BNB Price Forecast: BNB Foundation completes a $1.3 billion token burn as price consolidates

- BNB trades sideways above $900 amid an overall cooldown across the crypto market on Thursday.

- BNB Foundation has completed the 34th quarterly burn worth $1.3 billion, driving the total supply down to 136.36 million BNB.

- The network’s Auto-Burn system was implemented to reduce the total supply to 100 million BNB.

BNB is trading sideways above support at $900 at the time of writing on Thursday, after a correction from the previous day’s high of $954. Retain interest in the exchange native token has also narrowed, suggesting that investors have been quick to book profits.

BNB Foundation finalizes 34th token burn

The BNB Foundation has announced the completion of the 34th quarterly token burn on the BNB Chain. According to the announcement, approximately 1.37 million BNB tokens have effectively been removed from circulation, valued at $1.3 billion. This includes 1.37 million BNB from the Auto-Burn and 100.1 BNB from the Pioneer Burn. Following the burn, the total supply now stands at approximately 136.36 million BNB.

The Foundation utilizes an Auto-Burn system to gradually reduce the total supply to 100 million BNB.

“The burn amount is adjusted based on BNB's price and the number of blocks generated on BSC during a quarter, ensuring transparency and predictability,” the Foundation stated.

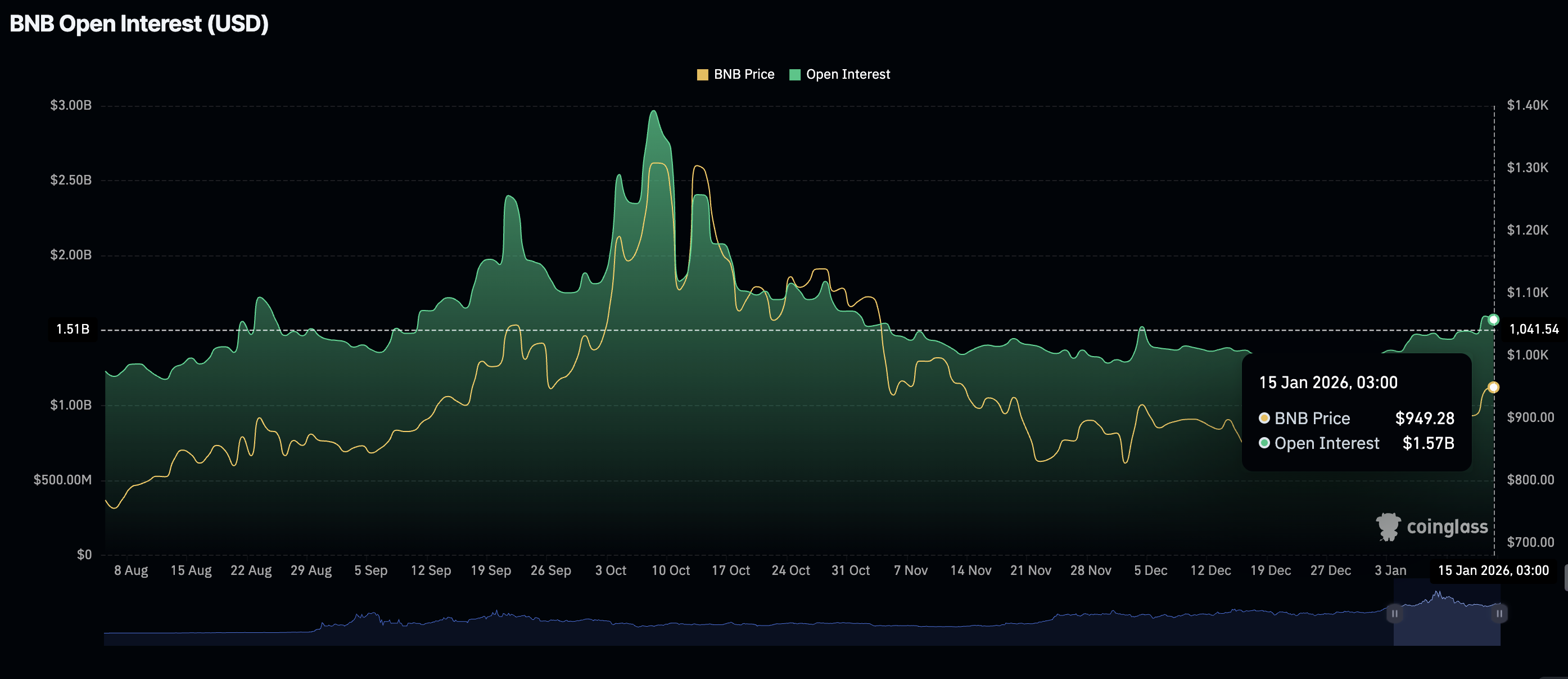

Meanwhile, BNB faces a relatively weak derivatives market, with futures Open Interest (OI) falling to $1.57 billion on Thursday, from $1.6 billion the previous day. The OI average reached a record high of $2.97 billion on October 8, before BNB hit a new record high of $1,375 on October 13.

Technical outlook: BNB extends consolidation

BNB price remains above key moving averages, including the 200-day Exponential Moving Average (EMA) at $881, the 50-day EMA at $881 and the 100-day EMA at $991 at the time of writing on Thursday.

The previous day’s high at $945 caps the upside, with more resistance anticipated at $1,022, last tested on November 10.

The Relative Strength Index (RSI) has retraced to 65 from near overbought conditions, indicating that bullish momentum is gradually faltering and increasing the odds of the next down leg toward the 100-day EMA.

Still, the Moving Average Convergence Divergence (MACD) indicator holds above the signal line, supporting a short-term bullish outlook for BNB. However, the histogram bars should continue to rise above the zero line as traders increase risk exposure, adding to the tailwind likely to support a bullish continuation toward the $1,022 resistance level.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.