Top Crypto Gainers: Monero rises toward $600 record high as Story and Render extend gains

- Monero is up 5% on Monday after Sunday’s 18% rise, approaching the $600 record high.

- Story edges higher by 9% from the 50-day EMA, extending the 13% gains from Sunday.

- Render steadies near the 200-day EMA with roughly 100% gains so far this month.

Monero (XMR) leads the crypto market recovery, posting roughly 23% gains over the last 24 hours, suggesting renewed interest in privacy coins. Additionally, Story (IP) and Render (RENDER) with double-digit gains sustain bullish momentum. Technically, Monero at record high levels could further extend gains, while Story and Render should sustain above key moving averages.

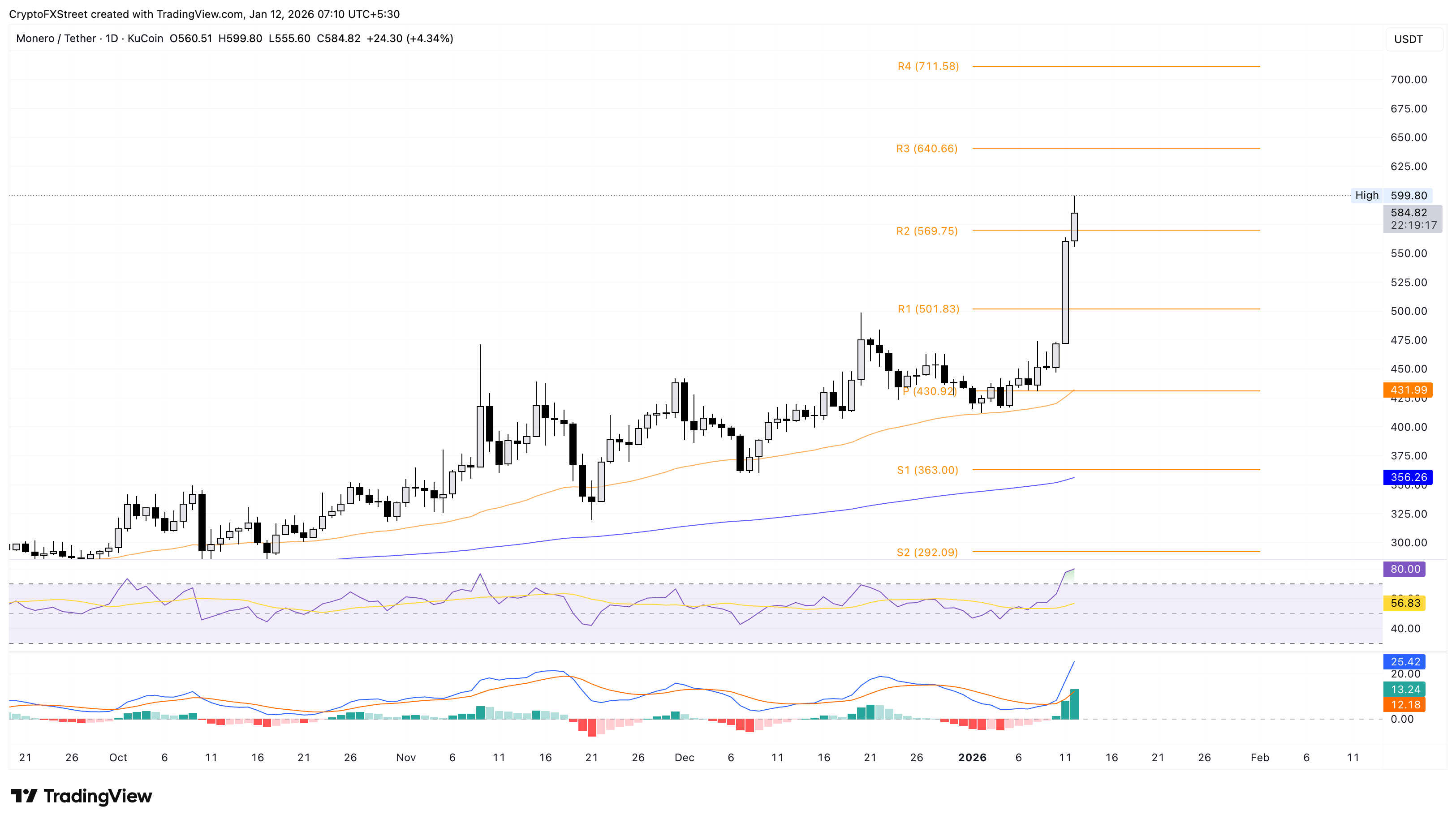

Monero at record high levels gains bullish momentum

Monero approaches the $600 mark, extending the rally in price-discovery mode. At the time of writing, XMR is up 5% on Monday, building on the 18% gains from the previous day. Overall, XMR has gained nearly 35% so far this month as the Zcash developers' crisis boosts capital rotation to Monero.

If Monero clears the $600 mark, it could extend the rally toward the R3 Pivot Point at $640.

The technical indicators on the daily chart flash intense bullish momentum. The Relative Strength Index (RSI) is at 80, signaling intense overbought conditions with an underlying risk of unsustainable buying pressure. Still, the Moving Average Convergence Divergence (MACD) extends the upward trend, joined by rising green histogram bars, suggesting heightened trend momentum.

Looking down, the R2 Pivot Point at $569 remains the immediate support level for Monero.

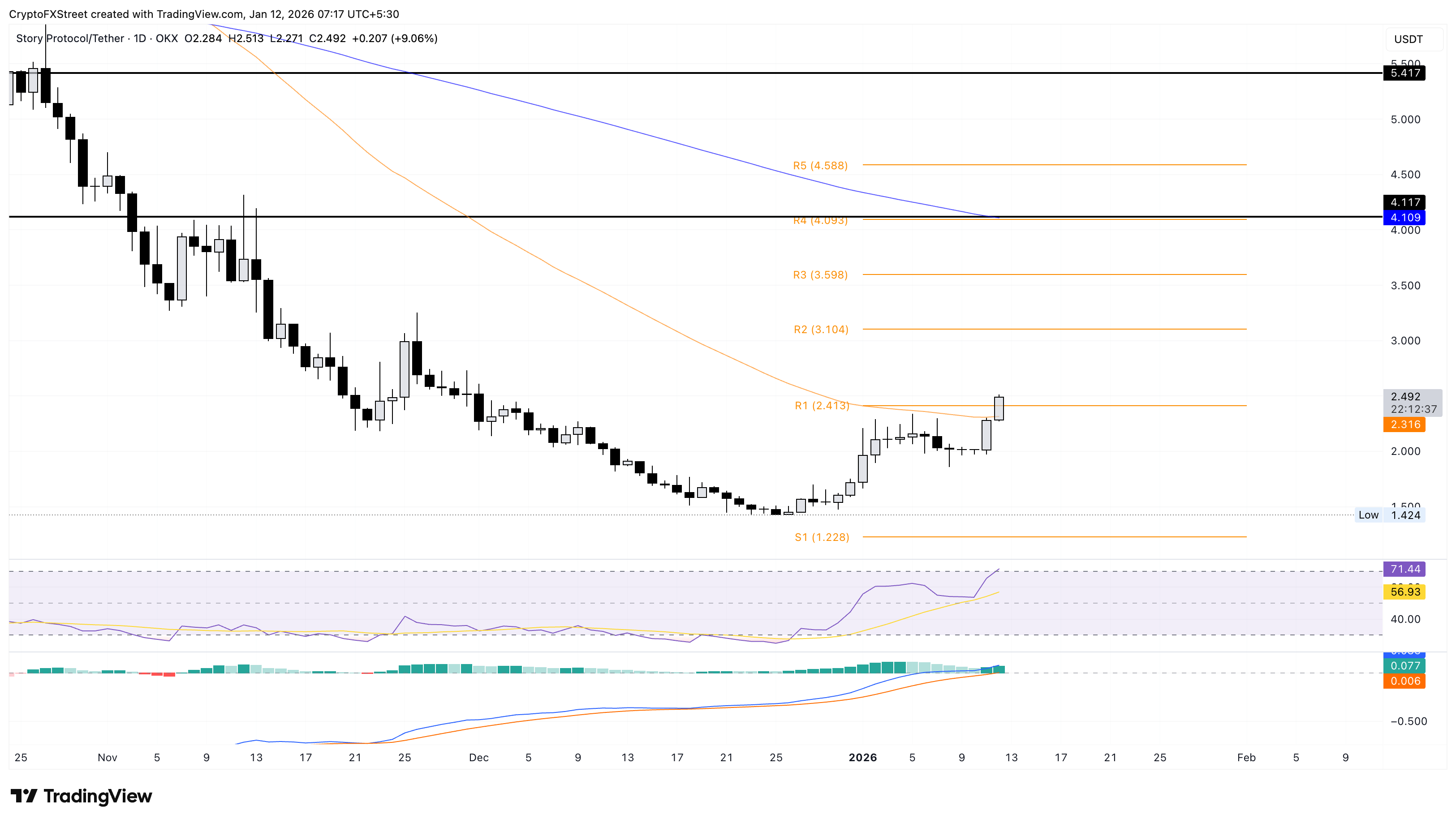

Story crosses above the 50-day EMA, targeting $3

Story gains 9% at press time on Monday, extending above the 50-day Exponential Moving Average (EMA) at $2.31 after Sunday’s 13% jump. The meme coin has exceeded the R1 Pivot Point at $2.41 and is approaching $2.50.

If IP holds a successful close above $2.41, it could extend the rally toward the R2 Pivot Point at $3.10.

The RSI is at 71 on the daily chart, entering the overbought zone from the halfway line and reflecting a spike in buying pressure. At the same time, the MACD and signal line rise above the zero line, indicating renewed bullish momentum.

If Story slips below the 50-day EMA at $2.31, it could threaten the $2.00 psychological support level.

Render’s January rally hits the 200-day EMA resistance

Render hovers slightly below the 200-day EMA at $2.71 following a roughly 30% rise last week, which amounts to over 100% gains so far this month. At the time of writing, RENDER holds steady above $2.50 on Monday.

If the AI token clears this moving average on a daily close, it could rise toward the $3.00 round figure, followed by the $3.34 level, which served as crucial support between August and early October of 2025.

The RSI at 75 hovers in the overbought zone, suggesting strong and sustained buying pressure, while the rising MACD signals growing bullish momentum.

However, if RENDER reverses from the 200-day EMA at $2.71, it could revisit the January 8 low at $2.06, close to the $2.00 round figure.