Bitwise files for 11 new crypto ETFs tracking altcoins like Aave, Zcash, and Ethena

- Bitwise files for 11 crypto ETFs applications with the SEC, reflecting increasing institutional confidence in altcoins.

- The ETFs would offer exposure to tokens such as Aave, Zcash, Ethena, and others.

- Bitcoin dominance lingers around 60%, lowering the odds of an altcoin season in the short term.

Bitwise filed for 11 crypto Exchange Traded Funds (ETFs) with the US Securities and Exchange Commission (SEC) on Tuesday, with the aim to offer exposure to Aave (AAVE), Zcash (ZEC), Ethena (ENA), and other altcoins. Despite the shift in institutional interest from Bitcoin (BTC) to altcoins, Bitcoin's dominance remains around 60%, suggesting the chances of an altcoin season are low.

Bitwise files for 11 new crypto ETFs

Bitwise, a crypto asset management fund, filed for 11 new crypto ETFs with the US SEC on Tuesday, expanding its offering to include niche altcoins such as Aave, Uniswap, Zcash, Canton, Ethena, Hyperliquid, Near Protocol, Starknet, Sui, Bittensor, and Tron. While the ticker code and fees are yet to be determined, the effective date is expected to be March 16, 2026, if approved by the SEC.

Bitwise will invest 60% of the funds directly in the targeted altcoins, and the remaining funds will be directed to other crypto-focused Exchange Traded Products (ETPs) and, possibly, to the derivatives market.

Could Bitwise move catalyze an altcoin season?

Bitcoin dominance, the share of BTC market capitalization of the total crypto market, is at 59.70% at press time on Wednesday. This indicates that Bitcoin dominates the entire crypto market, outpacing the altcoins.

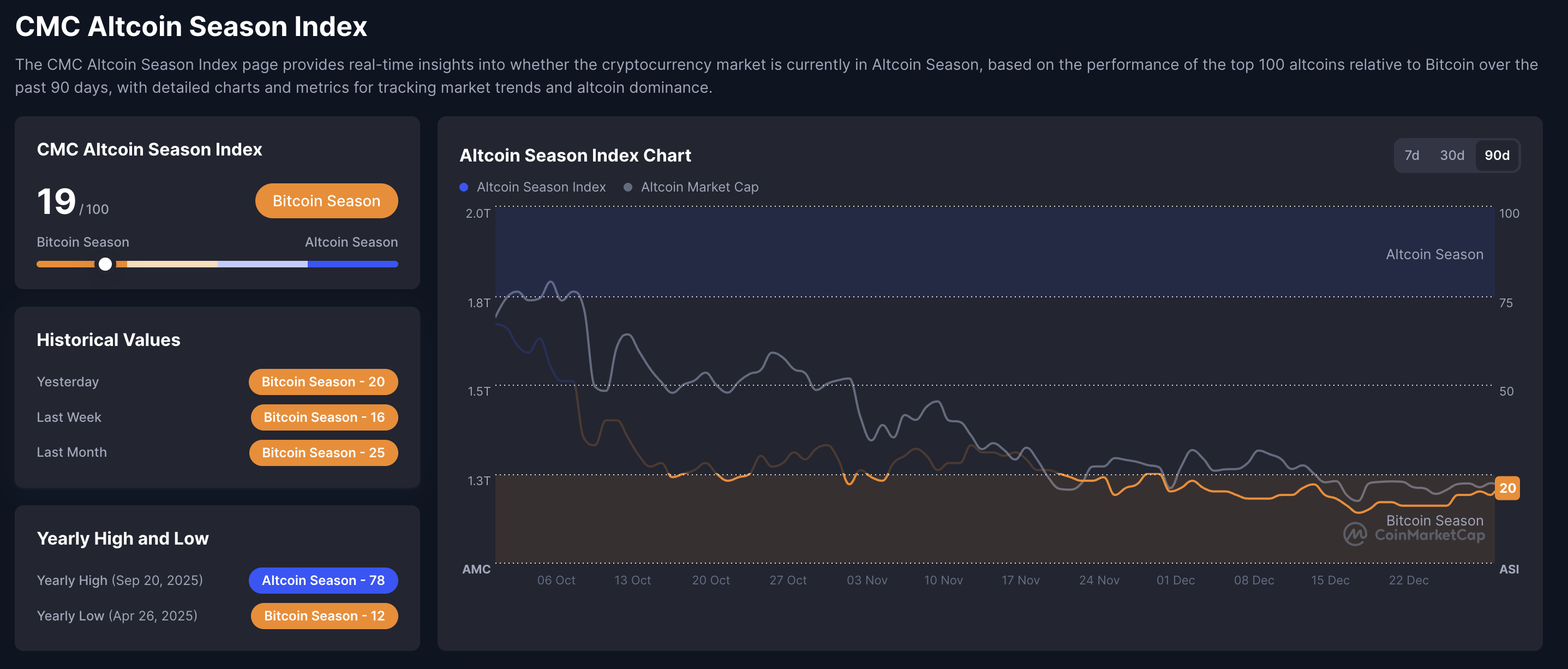

Ethereum’s struggle to gain strength against Bitcoin remains a headwind to an altcoin season. At the time of writing, Ethereum trades at 0.03358 BTC, stabilizing above 0.03000 BTC after a decline from mid-August to early November. At the same time, CoinMarketCap’s Altcoin Season Index at 19 indicates a Bitcoin Season, aligning with the BTC-dominant market sentiment.

The total cryptocurrency market capitalization excluding Bitcoin (TOTAL2), at $1.19 trillion, approaches the apex of a descending triangle pattern on the daily chart — the November 21 low at $1.13 trillion as the base, with a resistance trendline connecting the highs of November 10 and December 9.

Typically, such patterns extend the decline, but the recovery in the Relative Strength Index (RSI) at 45 on the same chart reflects an underlying increase in buying pressure.

If TOTAL2 exceeds the overhead trendline near $1.22 trillion, it could reverse the bearish trend and target the R1 Pivot Point at $1.98 trillion.

In short, Bitcoin continues to dominate the crypto market, and the status quo could persist into early 2026.