Ethereum Nears $3,000 as Bitmine Expands Holdings to 4 Million ETH

Ethereum is once again attempting to reclaim the $3,000 level after several failed efforts this month. ETH briefly pushed higher during early trading but continues facing resistance amid fragile broader market conditions.

Despite muted momentum, on-chain data suggests investors may be positioning to support a potential recovery.

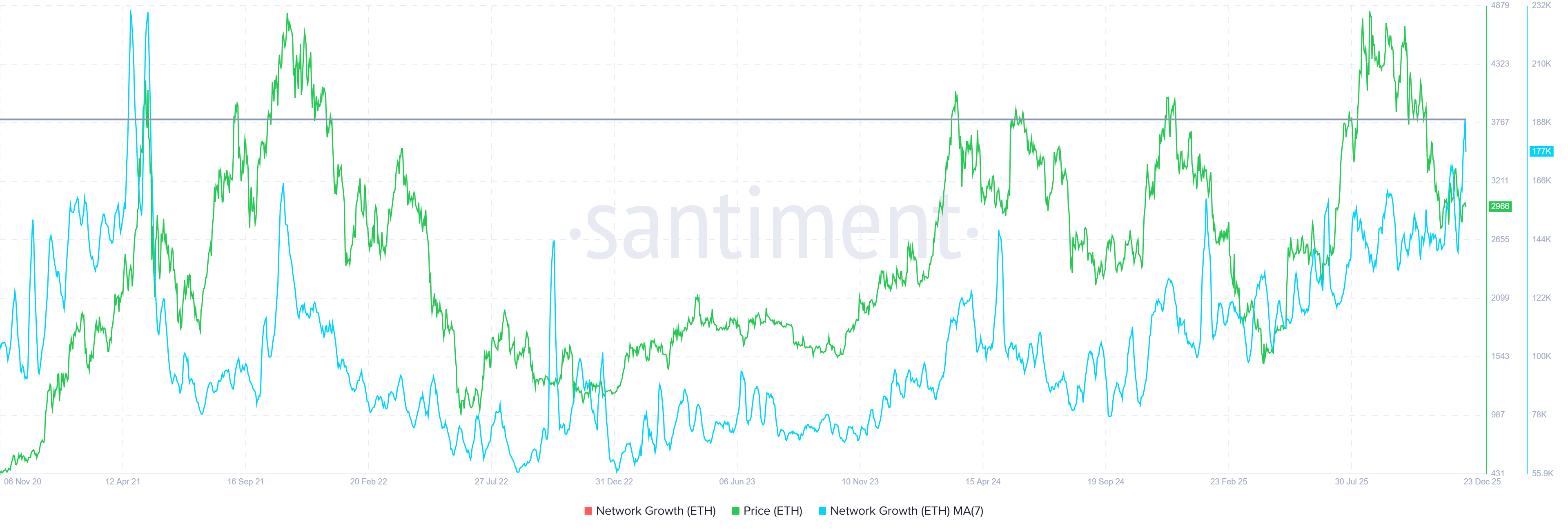

Ethereum Holders Continue To Grow

Ethereum’s network growth has surged to a four-year and seven-month high. This metric reflects the pace at which new addresses are joining the network. The increase signals renewed interest at current price levels, even as ETH struggles to break higher.

Rising network growth often introduces fresh capital. New participants expand liquidity and strengthen demand foundations. For Ethereum, this trend is particularly important as price recovery depends on sustained inflows rather than short-term speculative trading. Strong address growth suggests long-term confidence remains intact.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Network Growth. Source: Santiment

Ethereum Network Growth. Source: Santiment

Bitmine Could Be Aiding Price Recovery

A major contributor to this growth is Bitmine. The firm has quickly accumulated Ethereum through its treasury strategy. Bitmine now holds approximately 4.066 million ETH, representing 3.37% of the total supply within six months.

The company has publicly targeted ownership of 5% of all ETH, a move that could further tighten circulating supply and support price appreciation.

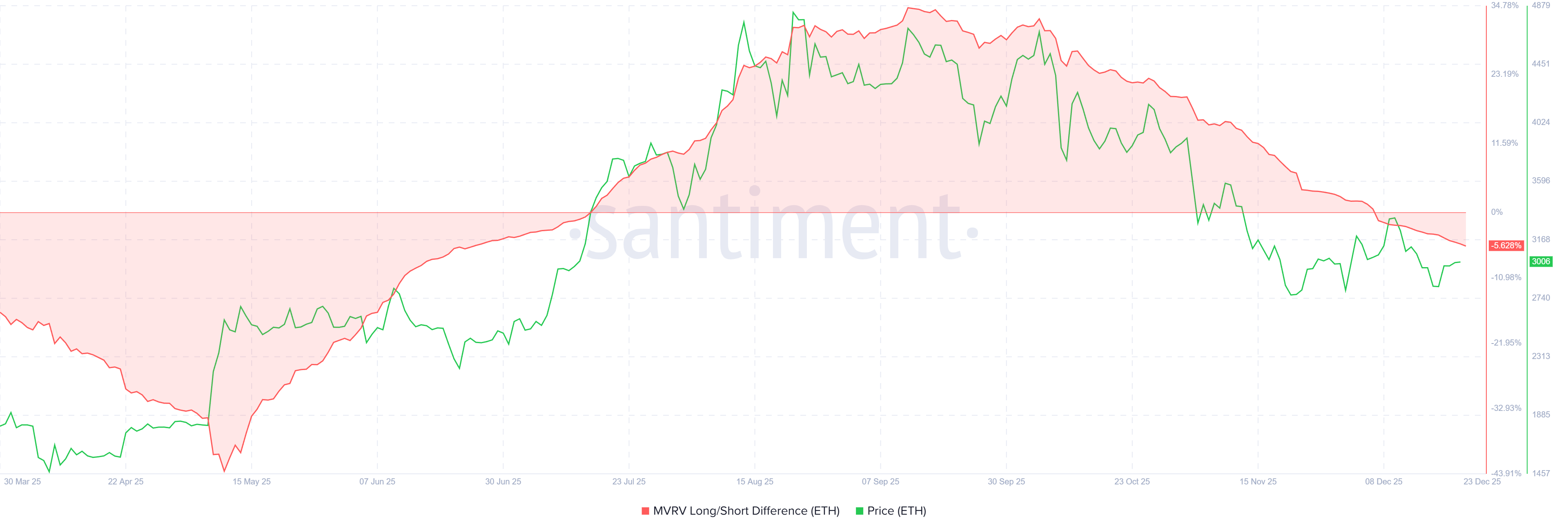

Macro indicators present a mixed backdrop. The MVRV Long/Short Difference remains at low negative levels, indicating neither long-term holders nor short-term traders are currently in profit. This lack of profitability often slows transaction activity, as participants hesitate to move assets at a loss.

Low profit conditions can suppress velocity across the network. However, such environments also reduce sales pressure. If broader macro conditions improve, long-term holders typically act as stabilizers. Their reluctance to sell at unfavorable prices can provide a base for recovery when demand returns.

Ethereum’s current setup reflects this balance. Weak profitability limits enthusiasm, yet it also prevents aggressive distribution. A positive external catalyst could shift sentiment quickly, allowing stronger hands to absorb supply and push ETH higher.

Ethereum MVRV Long/Short Difference. Source: Santiment

Ethereum MVRV Long/Short Difference. Source: Santiment

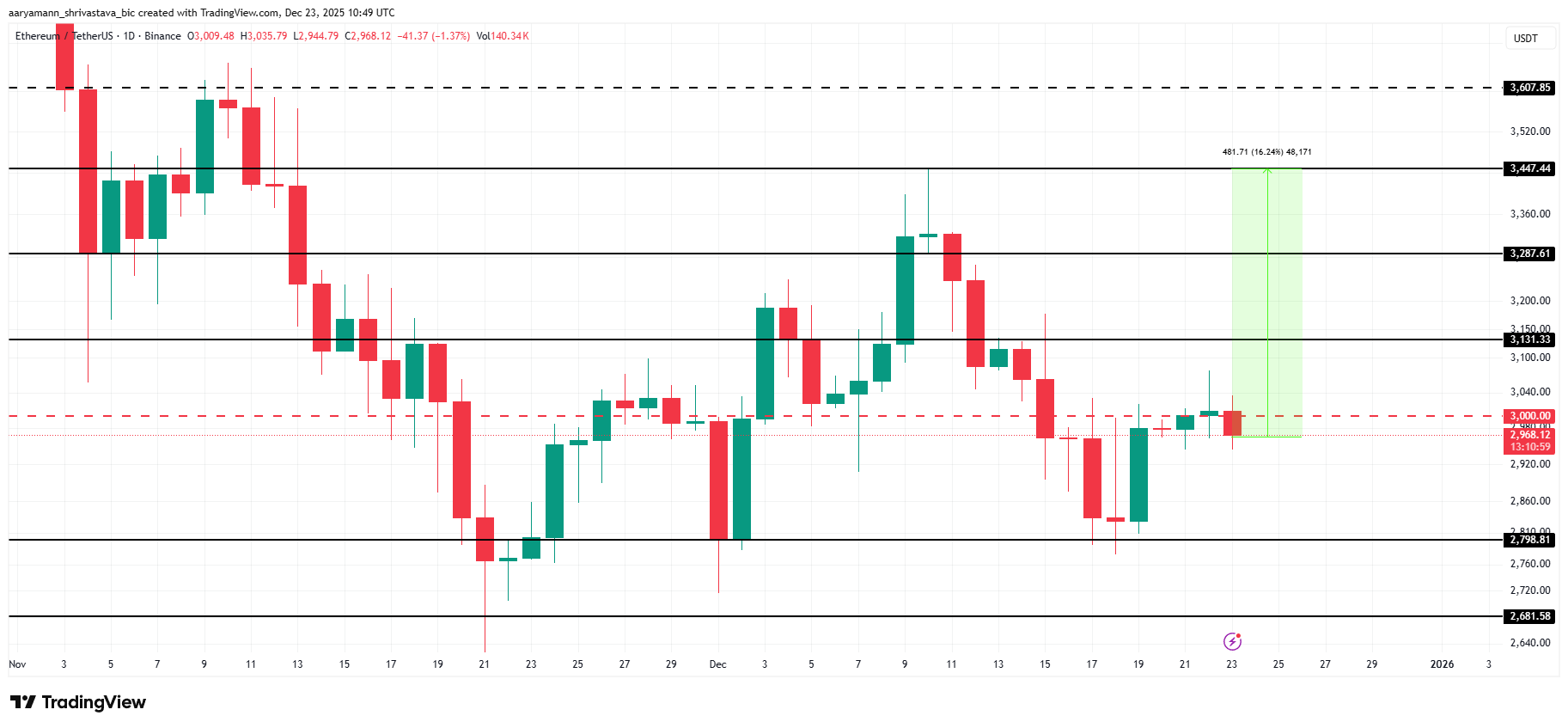

ETH Price Faces Its Challenge

Ethereum trades near $2,968 at the time of writing, sitting just below the $3,000 resistance. The level has capped price action repeatedly in recent weeks. Continued failure to reclaim it keeps ETH vulnerable to volatility and short-term pullbacks.

To revisit December’s high of $3,447, ETH requires a recovery of roughly 16%. The first hurdle remains $3,131, a key resistance zone. Sustained network growth and continued accumulation by large entities like Bitmine could provide the buying pressure needed to reach this level.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

Downside risks persist if Ethereum fails to secure $3,000 as support. A rejection could send the price back toward $2,798, a level previously tested. Given ETH’s tendency for sharp moves in this range, a breakdown could accelerate losses before stability returns.