Top Crypto Gainers: Audiera, Midnight, MemeCore sustain weekend gains

- Audiera is up 7% on Monday, extending the nearly 50% gains from Sunday on its revenue-based flywheel.

- Midnight takes a breather of 8% on Monday after a 42% rise on Sunday amid network growth.

- MemeCore holds above $1.50, with bulls aiming for the 50-day EMA at $1.70.

Audiera (BEAT), Midnight (NIGHT), and MemeCore (M) recorded double-digit gains on Sunday and remain top performers over the last 24 hours. Audiera extends the rally while Midnight takes a breather, and MemeCore struggles at a crucial moving average.

Audiera’s rally on weekly burns aims for a fresh high

Audiera, a web3 music platform, launched AI payments on December 1, allowing users to pay in BEAT for AI-powered creation tools. This revenue supports the weekly on-chain burn for a deflationary economy.

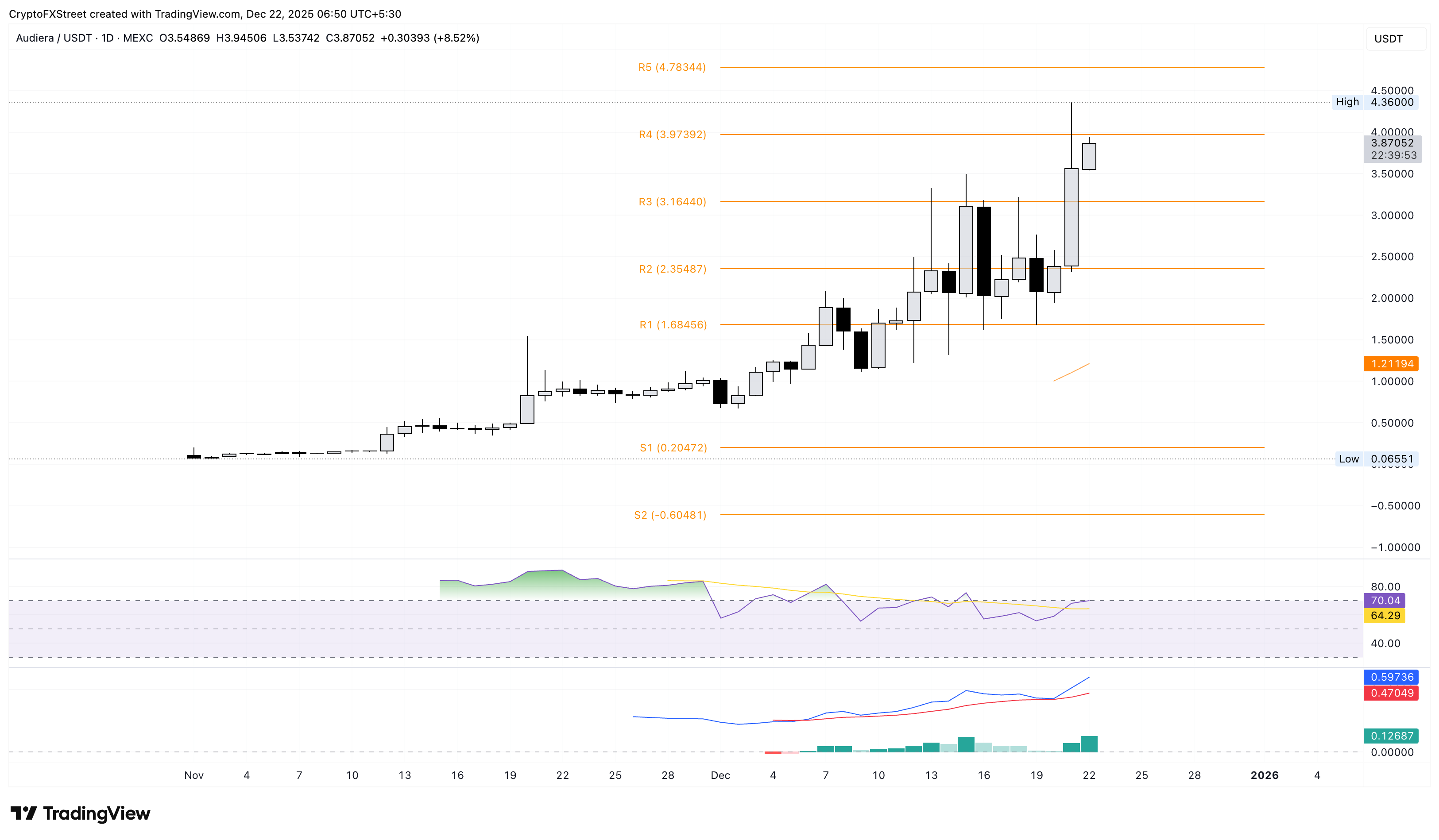

At the time of writing, Audiera is up 7% on Monday, building on the 50% gains from the previous day. BEAT is aiming to surpass the R4 Pivot Point at $3.97 to reclaim the $4 mark after reaching an all-time high of $4.36 on Sunday.

A potential daily close above $3.97 could extend the Audiera rally to the R5 Pivot Point at $4.78.

The momentum indicators on the daily chart indicate a bullish bias as the Relative Strength Index (RSI) at 70 shows intense buying pressure. Still, a mainly descending RSI trend compared to the BEAT rally reflects a bearish divergence, signaling underlying weakness.

Additionally, the Moving Average Convergence Divergence (MACD) bounces off its signal line, indicating a rise in bullish momentum.

On the flip side, the R3 Pivot Point at $3.16 could serve as the immediate support.

Midnight could extend recovery amid network growth

Cardano’s privacy-focused sidechain, Midnight, is down 6% at press time on Monday, after a 42% jump on the previous day. The NIGHT token rallies on network growth as the testnet produces over 3 million blocks.

The NIGHT token holds above $0.1000 psychological support but could revisit the $0.0930 support, marked by the December 9 high.

The RSI at 78 remains overbought, indicating intense buying pressure, while a steady rise in the MACD suggests increasing momentum.

On the upside, the R1 Pivot Point at $0.1367 could serve as the primary target.

MemeCore holds weekend gains

MemeCore trades at $1.50 at press time on Monday, targeting the 50-day Exponential Moving Average (EMA) at $1.70. The M token surged 10% on Sunday, avoiding a bearish extension to the $1.00 psychological mark.

If MemeCore clears the $1.70 resistance, it could face further opposition at the $2.00 round figure, followed by the R1 Pivot Point at $2.56.

However, the technical indicators suggest a lack of bullish drive to fuel MemeCore’s reversal. The RSI at 46 remains below the halfway line while the MACD is on the verge of crossing below the signal line.

If MemeCore reverses to the downside, it could find support at $1.00, followed by the S1 Pivot Point at $0.73.