Bitcoin & Ethereum Diverge: Longs Dominate BTC, While ETH Shorts Rise

Data shows Bitcoin and Ethereum have formed a divergence in the Funding Rate indicator, with traders going long on BTC, short on ETH.

Bitcoin & Ethereum Funding Rates Are Showing Opposite Values

In a new post on X, on-chain analytics firm Santiment has talked about how the Funding Rate has developed for Bitcoin and Ethereum amid the latest market volatility.

Bitcoin and other cryptocurrencies saw some sudden price swings during the past day, with BTC’s price first rallying to $90,300 in a blink, but then crashing back toward $86,000 just as quickly. The coin’s decline later extended to $85,300.

While BTC returned to about the same levels as before the flash surge, the same wasn’t true about Ethereum. After its rally to $3,000, ETH plummeted to $2,830, before another leg down to about $2,790. Before the volatility storm, the cryptocurrency was trading around $2,920.

The difference in price action could be a potential factor behind the divergence that has formed in the derivatives market sentiment as gauged by the Funding Rate.

The Funding Rate keeps track of the periodic amount of fees that derivatives traders are paying on all centralized exchanges. A positive value on the indicator is a sign that long investors are paying the short ones, while a negative one implies bearish positions outweigh the bullish ones.

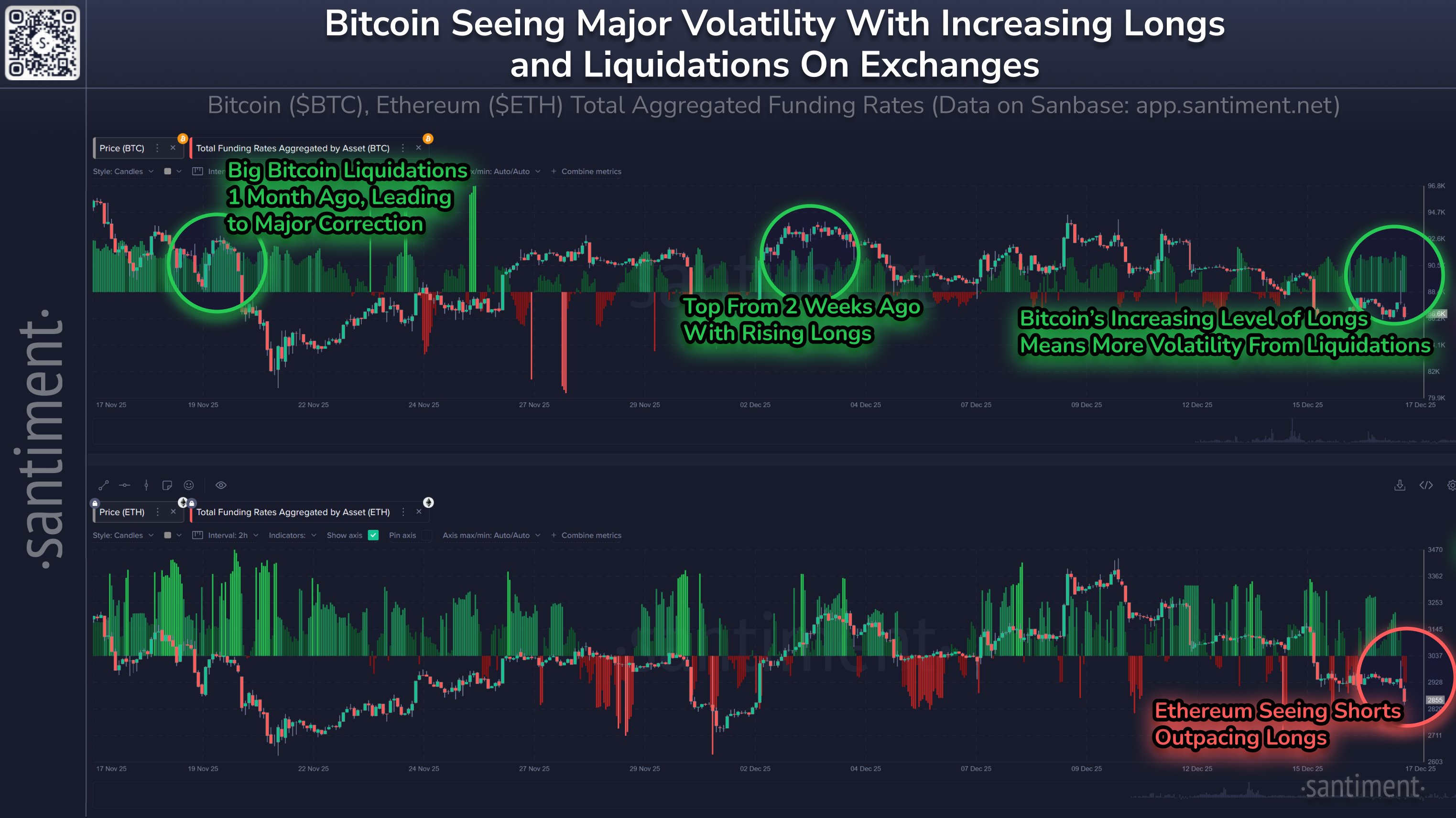

Now, here is the chart shared by Santiment that shows how the Funding Rate has changed for Bitcoin and Ethereum over the past month:

As displayed in the above graph, the Bitcoin Funding Rate has been positive for the last few days, indicating that a bullish mentality has been dominant among the traders. This sentiment has been maintained even after the price volatility.

Ethereum was also observing a positive value on the Funding Rate prior to the volatility, but unlike for BTC, the trend didn’t last. Since ETH has gone through its quick surge and flash crash, the indicator has turned red, a sign that shorts have started outpacing longs.

The fact that bullish sentiment around ETH has weakened, however, may not actually be negative. According to Santiment, highly leveraged long positions have historically led to sharp liquidation events and volatility. This trend was also seen during some recent tops and pullbacks.

Thus, considering that the Funding Rate is negative for Ethereum now, the risk of volatility may be lower. That said, Bitcoin’s long-heavy market could still be relevant for the cryptocurrency.

As Santiment explains, “all assets will still move with Bitcoin, meaning Bitcoin’s funding rates must stay neutral or go negative in order to justify a clear path back to $100K and for altcoins to rebound.”

BTC Price

Bitcoin has recovered back to $87,100 following its plunge on Wednesday.