Bitcoin Price Forecast: BTC steadies above $90,000 as Fed rate-cut optimism lifts market sentiment

- Bitcoin price holds above $90,000 on Tuesday after finding support around this key level.

- Firm expectations that the Fed will cut interest rates on Wednesday boosts investors' appetite for riskier assets such as BTC.

- Institutional activity remains mixed, with Strategy adding more BTC to its holdings while US-listed spot ETFs seeing a modest outflow.

Bitcoin (BTC) began the week on a stable footing, holding firmly above $90,000 at the time of writing on Tuesday after finding support around the key level. Easing macroeconomic conditions and renewed expectations of a December Federal Reserve rate cut boost investors' appetite for riskier assets such as BTC. However, institutional demand remained mixed, with Strategy Inc. adding more BTC to its holdings even as US-listed spot Bitcoin Exchange Traded Funds (ETFs) recorded a mild outflow.

Fed rate cut expectation boosts risk-off sentiment

Bitcoin started the week on a positive note, extending its weekend recovery, rising slightly and holding above $90,000 when writing on Tuesday. This price rebound was supported by the US Personal Consumption Expenditures (PCE) Price Index, released last Friday, which did little to influence expectations for further policy easing by the Federal Reserve (Fed).

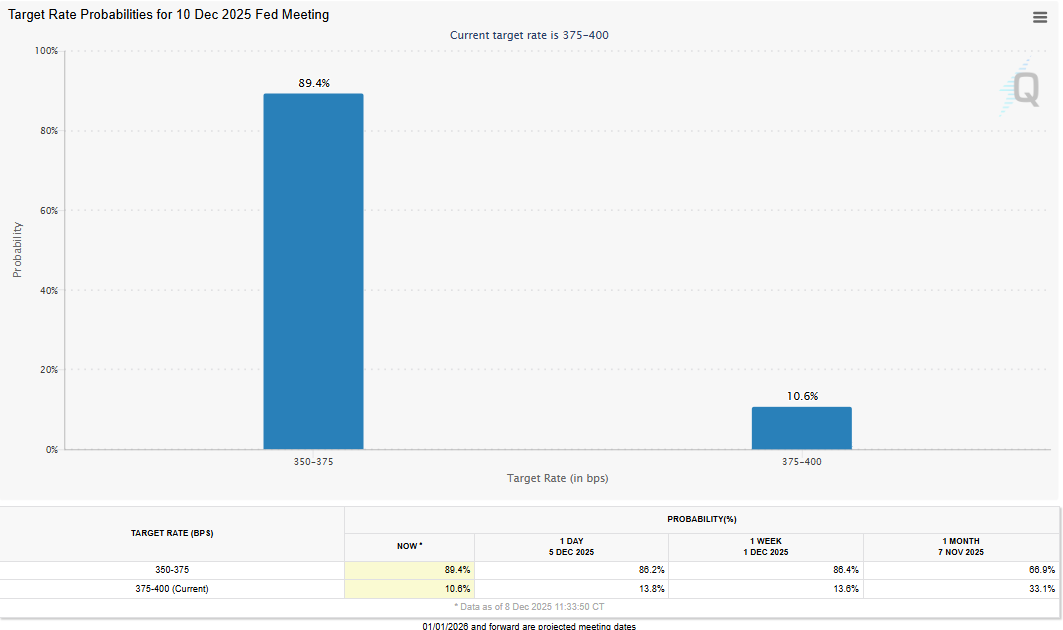

Market participants are currently pricing in an over 89% chance that the US central bank will cut interest rates by 25 basis points at the end of a two-day policy meeting on Wednesday, according to the CME FedWatch tool shown in the chart below.

Moreover, the yield on the benchmark 10-year US government bond rose to a 2-1/2-month high on Monday amid speculation that Fed Chair Jerome Powell's comments during the post-meeting press conference might signal a higher bar for further rate reductions. This renewed optimism that the US central bank will cut interest rates again in December boosts investors' appetite for riskier assets such as Bitcoin.

Mix sentiment among institutional demand

Institutional demand for Bitcoin shows a reduction in selling pressure compared to previous weeks. According to SoSoValue data, US-listed spot Bitcoin ETFs recorded a mild outflow of $60.48 million on Monday, after a streak of outflows last week. For BTC to continue its recovery, the ETF flows should turn positive and intensify.

On the corporate side, Strategy Inc. (MSTR) announced on Monday that it purchased 10,624 bitcoin for $962.7 million between December 1–7 at an average price of $90,615. The firm currently holds 660,624 BTC, valued at $49.35 billion. According to Walter Bloomberg X post, Strategy still has several securities available for issuance under its At-The-Market (ATM) program, including $1.64 billion in STRF, $4.04 billion in Stretch (STRC), $20.34 billion in Strike (STRK), and $13.45 billion in MSTR stock. This indicates that the firm retains substantial capacity to raise additional capital, potentially allowing for further large-scale Bitcoin accumulation.

Bitcoin Price Forecast: BTC hovers around $90,000

Bitcoin price faced rejection from the 61.80% Fibonacci retracement level at $94,253 (drawn from the April low of $74,508 to the all-time high of $126,199 set in October) on Thursday and declined 4.49% the next day. However, BTC recovered slightly during the weekend and has been consolidating around the $90,000 key psychological level. As of Tuesday, it continues to hover around $90,000.

If BTC rallies and closes above the $94,253 resistance level, it could extend its rally toward the next key resistance at $100,000.

The Relative Strength Index (RSI) on the daily chart is 44, near the neutral 50 level, suggesting fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above the neutral level. However, the Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which still holds, supporting the bullish thesis.

However, if BTC faces a correction, it could extend the decline toward the next key support at $85,569, its 78.60% Fibonacci retracement level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.